Texas Instruments 2009 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2009 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 11

Restructuring activities have also resulted in asset impairments, which are included in restructuring expense and are recorded as an

adjustment to the basis of the asset, not as a liability relating to a restructuring charge. When we commit to a plan to abandon a long-lived

asset before the end of its previously estimated useful life, we accelerate the recognition of depreciation to reflect the use of the asset

over its shortened useful life. When an asset is held to be sold, we write down the carrying value to its net realizable value and cease

depreciation.

2008 and 2009 actions

In October 2008, we announced actions to reduce expenses in our Wireless segment, especially our baseband operation. In

January 2009, we announced actions that included broad-based employment reductions to align our spending with weakened

demand. Combined, these actions eliminated about 3,900 jobs; they were completed in 2009.

2007 actions

In January 2007, we announced plans to change how we develop advanced digital manufacturing process technology. Instead of

separately creating our own core process technology, we now work collaboratively with our foundry partners to specify and drive the

next generations of digital process technology. Additionally, we stopped production at an older digital factory. These actions eliminated

about 300 jobs and were completed in 2007.

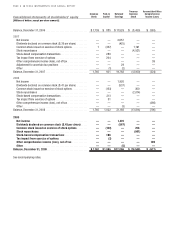

The table below reflects the changes in accrued restructuring balances associated with these actions:

2008 and 2009 Actions 2007 Action

Severance

and Benefits

Impairments

and Other

Charges

Impairments

and Other

Charges Total

Accrual at December 31, 2007. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ 17 $17

Restructuring expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 218 12 24 254

Non-cash charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (30)* (7)(28)(65)

Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2) — (8)(10)

Remaining accrual at December 31, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . 186 5 5 196

Restructuring expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 201 11 —212

Non-cash (charges) credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (26)* 1(4)(29)

Payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (277)(7) — (284)

Remaining accrual at December 31, 2009. . . . . . . . . . . . . . . . . . . . . . . . . . $84 $10 $ 1 $ 95

* Reflects charges and credits for postretirement benefit plan settlement, curtailment and special termination benefits.

The accrual balances above are a component of Accrued expenses and other liabilities or Deferred credits and other liabilities on our

balance sheets, depending on the expected timing of payment.

Restructuring expense recognized by segment from the actions above are as follows:

2009 2008 2007

Analog . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $87 $60 $18

Embedded Processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43 24 4

Wireless . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59 130 20

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 40 10

Total restructuring expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $212 $254 $ 52