Texas Instruments 2009 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2009 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2009 ANNUAL REPORT

PAGE 14

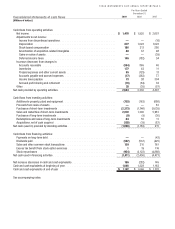

Summarized information as of December 31, 2009, about outstanding stock options that are vested and expected to vest, as well as

stock options that are currently exercisable, is as follows:

Outstanding Stock Options (Fully

Vested and Expected to Vest) (a)

Options

Exercisable

Number of outstanding (shares) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 173,539,877 145,197,386

Weighted average remaining contractual life . . . . . . . . . . . . . . . . . . . 3.9 yrs 3.0 yrs

Weighted average exercise price per share. . . . . . . . . . . . . . . . . . . . . $30.60 $32.18

Intrinsic value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $475 $316

(a) Includes effects of expected forfeitures. Excluding the effects of expected forfeitures, the aggregate intrinsic value of stock options

outstanding was $483 million.

As of December 31, 2009, the total future compensation cost related to unvested stock options and RSUs not yet recognized in the

statements of income was $117 million and $139 million. Of that total, $118 million, $85 million, $48 million and $5 million will be

recognized in 2010, 2011, 2012 and 2013.

Employee stock purchase plan

Under the TI Employees 2005 Stock Purchase Plan, options are offered to all eligible employees in amounts based on a percentage of

the employee’s compensation. Under the plan, the option price per share is 85 percent of the fair market value on the exercise date, and

options have a three-month term.

Options outstanding under the plan at December 31, 2009, had an exercise price of $22.11 per share (85 percent of the fair market

value of TI common stock on the date of automatic exercise). Of the total outstanding options, none were exercisable at year-end 2009.

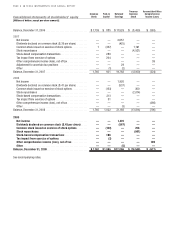

Employee stock purchase plan transactions during 2009 were as follows:

Employee Stock

Purchase Plan

(shares) (a) Exercise Price

Outstanding grants, December 31, 2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,039,543 $13.64

Granted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,009,785 17.75

Exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,469,647)15.79

Outstanding grants, December 31, 2009. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 579,681 $22.11

(a) Excludes options offered but not granted.

The weighted average grant-date fair value of options granted under the employee stock purchase plans during the years 2009, 2008

and 2007 was $3.13, $3.37 and $5.10 per share. During the years ended December 31, 2009, 2008 and 2007, the total intrinsic value

of options exercised under these plans was $10 million, $11 million and $11 million.

Effect on shares outstanding and treasury shares

Our practice is to issue shares of common stock upon exercise of stock options generally from treasury shares and, on a limited basis,

from previously unissued shares. We settled stock option plan exercises using treasury shares of 6,695,583 in 2009; 11,217,809 in

2008 and 39,791,295 in 2007; and previously unissued common shares of 93,648 in 2009; 85,472 in 2008 and 511,907 in 2007.

Upon vesting of RSUs, we issued treasury shares of 977,728 in 2009; 544,404 in 2008 and 515,209 in 2007; and previously

unissued common shares of zero in 2009; zero in 2008 and 12,000 in 2007.

Shares available for future grant and reserved for issuance are summarized below:

As of December 31, 2009

Shares

Long-term Incentive

and Director

Compensation Plans

TI Employees 2005

Stock Purchase Plan

Available for future grant . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79,542,009 31,935,700

Reserved for issuance (a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 268,802,866 32,515,381

(a) Includes 138,633 shares credited to directors’ deferred compensation accounts that may settle in shares of TI common stock on a

one-for-one basis. These shares are not included as grants outstanding at December 31, 2009.