Texas Instruments 2009 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2009 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 15

Effect on cash flows

Cash received from the exercise of options was $109 million in 2009, $210 million in 2008 and $761 million in 2007. The related net

tax impact realized was ($2) million, $31 million and $204 million (which includes excess tax benefits realized of $1 million, $19 million

and $116 million) in 2009, 2008 and 2007.

4. Profit sharing plans

Profit sharing benefits are generally formulaic and determined by one or more subsidiary or company-wide financial metrics. We pay

profit sharing benefits primarily under the company-wide TI Employee Profit Sharing Plan. This plan provides for profit sharing to be paid

based solely on TI’s operating margin for the full calendar year. Under this plan, TI must achieve a minimum threshold of 10 percent

operating margin before any profit sharing is paid. At 10 percent operating margin, profit sharing will be 2 percent of eligible payroll. The

maximum amount of profit sharing available under the plan is 20 percent of eligible payroll, which is paid only if TI’s operating margin is

at or above 35 percent for a full calendar year.

We recognized $102 million, $121 million and $180 million of profit sharing expense under the TI Employee Profit Sharing Plan in

2009, 2008 and 2007.

5. Income taxes

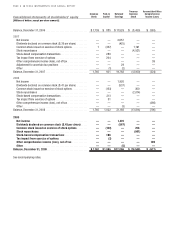

Income from continuing operations before income taxes U.S. Non-U.S. Total

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,375 $642 $2,017

2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,749 732 2,481

2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,738 954 3,692

Provision (benefit) for income taxes U.S. Federal Non-U.S. U.S. State Total

2009:

Current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $334 $63 $ 4 $ 401

Deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 117 30 (1)146

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $451 $93 $ 3 $ 547

2008:

Current. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $646 $89 $ 8 $ 743

Deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (214)43 (11)(182)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $432 $132 $(3) $ 561

2007:

Current. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $823 $198 $(4) $ 1,017

Deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3)37 —34

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $820 $235 $(4) $ 1,051

Principal reconciling items from income tax computed at the statutory federal rate follow:

2009 2008 2007

Computed tax at statutory rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $706 $868 $1,292

Effect of non-U.S. rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (101)(197)(94)

Research and development tax credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (28)(75)(69)

U.S. tax benefits for manufacturing and foreign sales . . . . . . . . . . . . . . . . . . . . . . . . . . (21)(18)(24)

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9)(17)(54)

Total provision for income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $547 $561 $1,051