Texas Instruments 2009 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2009 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To our shareholders

For many, 2009 is a year best forgotten. But for TI, it’s a year to be

remembered.

In the face of an historic economy of whipsawing contraction and

growth, we accelerated our commitment to Analog and Embedded

Processing by investing in new products and redeploying resources

from less promising areas. The soundness of our strategy was

underscored as we improved our growth relative to our competitors

each quarter of the year. We have strong momentum going into 2010.

Through the downturn, we continued to increase investments

in areas that we believe will fuel future growth. For example, we

expanded our field sales and applications resources to serve

customers in fast-growing regions like China, India and Eastern

Europe. We made strategic acquisitions to bolster the portfolios of

our core businesses. Luminary Micro expanded our Embedded

Processing microcontroller offerings, while CICLON Semiconductor

strengthened our Analog power management portfolio.

We expanded Kilby Labs, which provides an environment where

TI technologists can innovate, collaborate and test their ideas. And we

established new product lines to penetrate important opportunities

in the LED lighting, smart metering and solar energy markets.

We were also one of the very few semiconductor companies

to expand our manufacturing capacity in the downturn to position

our company for future growth. We began to outfit the world’s first

300-millimeter analog manufacturing facility, RFAB, in Richardson,

Texas, which will let us ship $3 billion more in Analog products when

fully equipped. We also added 800,000 square feet of assembly/test

capacity with our new TI Clark facility located in the Philippines.

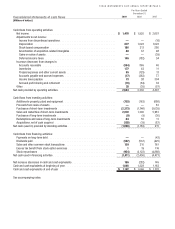

Our financial performance in 2009 offered a glimpse into the

power of a business model focused on Analog and Embedded

Processing. By the time the downturn troughed in the first quarter of

2009, TI revenue had declined 38 percent from six months earlier,

one of the steepest drops in our history. This decline was followed by

an unprecedented 44 percent snapback in cumulative growth in the

following three quarters. Yet, through it all, TI remained profitable,

demonstrating a resiliency that often eluded us in prior downturns.

For the year, revenue dropped 17 percent, but our operating margin

was virtually unchanged from 2008, and in the fourth quarter of 2009,

our operating margin set a new record high.

In this environment, our manufacturing operations demonstrated

their agility. As demand declined, we slowed and temporarily

suspended many of our operations to minimize costs, while being

careful not to impair our long-term ability to grow. When demand

unexpectedly turned back up in the second quarter, our operations

responded again, doubling production output inside of six months.

Even so, the rapid growth in demand for our products required

additional capital spending in the second half of the year as we work

to deliver the volume of products our customers need.

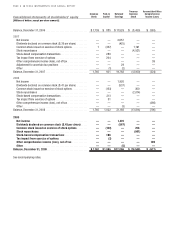

We also returned value directly to you, our shareholders, by

continuing to repurchase stock and paying higher dividends. While

many companies suspended their stock repurchases in the downturn,

TI bought back our stock in every quarter of 2009, repurchasing

almost $1 billion in total and reducing our outstanding shares another

3 percent. In addition, we paid over half a billion dollars in dividends

and raised our dividend for the sixth consecutive year. Even with our

capacity expansions, stock repurchases and dividends, our cash and

short-term investments increased by $385 million to more than

$2.9 billion.

The most important thing we learned in 2009 is that our work is

not yet done. Our positions in Analog and Embedded Processing are

strong, but we have the opportunity to make them much stronger.

That’s our mission for 2010.

Richard K. Templeton

Chairman, President and

Chief Executive Officer