Texas Instruments 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

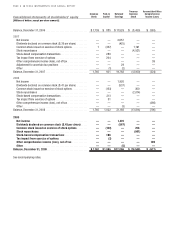

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 3

Consolidated statements of comprehensive income

[Millions of dollars]

For Years Ended

December 31,

2009 2008 2007

Income from continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,470 $1,920 $2,641

Other comprehensive income (loss):

Available-for-sale investments:

Unrealized gains (losses), net of tax benefit (expense) of ($9), $20 and ($3) . . . . . . . . . . . 17 (38) 8

Reclassification of recognized transactions, net of tax benefit (expense)

of ($3), $0 and $0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6— (1)

Net actuarial loss of defined benefit plans:

Annual adjustment, net of tax benefit (expense) of ($38), $282 and ($19) . . . . . . . . . . . . . 91 (476) 5

Reclassification of recognized transactions, net of tax benefit (expense)

of ($27), ($17) and ($12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62 32 28

Prior service cost of defined benefit plans:

Annual adjustment, net of tax benefit (expense) of $1, $1 and $2 . . . . . . . . . . . . . . . . . . . . . (1)14 (2)

Reclassification of recognized transactions, net of tax benefit (expense)

of $3, ($1) and $1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (6)2 1

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 169 (466)39

Total comprehensive income from continuing operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,639 1,454 2,680

Income from discontinued operations, net of income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——16

Total comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,639 $1,454 $2,696

See accompanying notes.