Texas Instruments 2009 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2009 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TEXAS INSTRUMENTS 2009 ANNUAL REPORT

PAGE 10

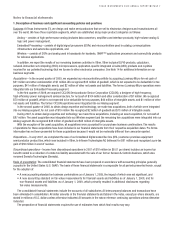

Impairments of long-lived assets: We regularly review whether facts or circumstances exist that indicate the carrying values of

property, plant and equipment or other long-lived assets, including intangible assets, are impaired. We assess the recoverability of

assets by comparing the projected undiscounted net cash flows associated with those assets to their respective carrying amounts.

Any impairment charge is based on the excess of the carrying amount over the fair value of those assets. Fair value is determined by

available market valuations, if applicable, or by discounted cash flows (DCF).

Goodwill: Goodwill is not amortized but is reviewed for impairment annually, or more frequently if certain impairment indicators arise.

We complete our annual goodwill impairment tests as of October 1 for our reporting units. The test compares the fair value for each

reporting unit to its associated carrying value including goodwill.

Foreign currency: The functional currency for our non-U.S. subsidiaries is the U.S. dollar. Accounts recorded in currencies other than

the U.S. dollar are remeasured into the functional currency. Current assets (except inventories), deferred income taxes, other assets,

current liabilities and long-term liabilities are remeasured at exchange rates in effect at the end of each reporting period. Inventories,

and property, plant and equipment and depreciation thereon, are remeasured at historic exchange rates. Revenue and expense accounts

other than depreciation for each month are remeasured at the appropriate daily rate of exchange. Currency exchange gains and losses

from remeasurement are credited or charged to other income (expense) net (OI&E).

Derivatives and hedging: We use derivative financial instruments to manage exposure to foreign exchange risk. These instruments are

primarily forward foreign currency exchange contracts that are used as economic hedges to reduce the earnings impact exchange rate

fluctuations may have on our non-U.S. dollar net balance sheet exposures or for specified non-U.S. dollar forecasted transactions. Gains

and losses from changes in the fair value of these forward foreign currency exchange contracts are credited or charged to OI&E. We do

not use derivatives for speculative or trading purposes. We do not apply hedge accounting to our foreign currency derivative instruments.

Changes in accounting standards: In June 2009, the FASB Accounting Standards Codification™ (Codification) became the single source

of authoritative U.S. GAAP. The Codification did not create any new GAAP standards, but incorporated existing accounting and reporting

standards into a new topical structure with a new referencing system to identify authoritative accounting standards, replacing the

prior references to Statement of Financial Accounting Standards (SFAS), Emerging Issues Task Force (EITF), FASB Staff Position (FSP),

etc. Authoritative standards included in the Codification are designated by their ASC topical reference, and new standards issued after

July 1, 2009, are designated as Accounting Standards Updates (ASUs), with a year and assigned sequence number. References to prior

standards have been updated to reflect the new system.

In October 2009, the FASB concurrently issued the following ASUs:

•ASUNo.2009–14-Software (Topic 985): Certain Revenue Arrangements That Include Software Elements. This standard

removes tangible products from the scope of software revenue recognition guidance and also provides guidance on determining

whether software deliverables in an arrangement that includes a tangible product, such as embedded software, are within the

scope of the software revenue guidance.

•ASUNo.2009–13-Revenue Recognition (Topic 605): Multiple-Deliverable Revenue Arrangements. This standard modifies the

revenue recognition guidance for arrangements that involve the delivery of multiple elements, such as product, software, services

and support, to a customer at different times as part of a single revenue generating transaction. This standard provides principles

and application guidance to determine whether multiple deliverables exist, how the individual deliverables should be separated

and how to allocate the revenue in the arrangement among those separate deliverables. The standard also expands the disclosure

requirements for multiple deliverable revenue arrangements.

We expect to apply these standards on a prospective basis for revenue arrangements entered into or materially modified beginning

January 1, 2011. We have evaluated the potential impact of these standards and expect they will have no significant impact on our

financial position and results of operations.

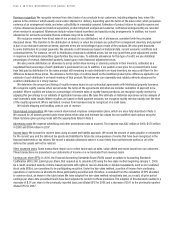

2. Restructuring activities

Costs incurred with restructuring activities generally consist of voluntary and involuntary severance-related expenses, asset

impairments and other costs to exit activities. We recognize voluntary termination benefits when the employee accepts the offered

benefit arrangement. We recognize involuntary severance-related expenses depending on whether the termination benefits are

provided under an ongoing benefit arrangement or under a one-time benefit arrangement. We recognize involuntary severance-related

expenses associated with an ongoing benefit arrangement once they are probable and the amounts are estimable. We recognize

involuntary severance-related expenses associated with a one-time benefit arrangement once the benefits have been communicated

to employees.