Texas Instruments 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Texas Instruments annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009

Annual Report

Table of contents

-

Page 1

2009 Annual Report -

Page 2

... analog manufacturing facility, RFAB, in Richardson, Texas, which will let us ship $3 billion more in Analog products when fully equipped. We also added 800,000 square feet of assembly/test capacity with our new TI Clark facility located in the Philippines. Our ï¬nancial performance in 2009 offered... -

Page 3

...' equity ... . . . . . . . . . . . . . . . . . . . . . . Description of business and significant accounting policies and practices Restructuring activities Stock-based compensation Profit sharing plans Income taxes Financial instruments and risk concentration Valuation of debt... -

Page 4

PAGE 2 TEXAS INSTRUMENTS 2009 ANNUAL REPORT Consolidated statements of income [Millions of dollars, except share and per-share amounts] 2009 For Years Ended December 31, 2008 2007 Revenue ...Cost of revenue ...Gross profit ...Research and development ...Selling, general and administrative ...... -

Page 5

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 3 Consolidated statements of comprehensive income [Millions of dollars] 2009 For Years Ended December 31, 2008 2007 Income from continuing operations ...Other comprehensive income (loss): Available-for-sale investments: Unrealized gains (losses), net ... -

Page 6

PAGE 4 TEXAS INSTRUMENTS 2009 ANNUAL REPORT Consolidated balance sheets [Millions of dollars, except share amounts] December 31, 2009 2008 Assets Current assets: Cash and cash equivalents ...Short-term investments ...Accounts receivable, net of allowances ...Inventories ...Deferred income taxes ... -

Page 7

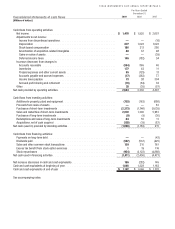

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 5 Consolidated statements of cash flows [Millions of dollars] 2009 For Years Ended December 31, 2008 2007 Cash flows from operating activities: Net income ...Adjustments to net income: Income from discontinued operations ...Depreciation ...Stock-based ... -

Page 8

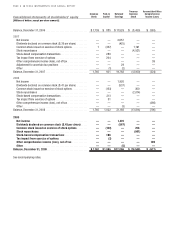

... 6 TEXAS INSTRUMENTS 2009 ANNUAL REPORT Consolidated statements of stockholders' equity [Millions of dollars, except per-share amounts] Common Stock Paid-in Capital Retained Earnings Treasury Common Stock Accumulated Other Comprehensive Income (Loss) Balance, December 31, 2006 ...2007 Net... -

Page 9

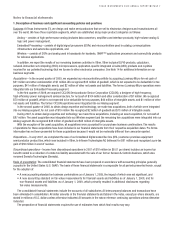

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 7 Notes to financial statements 1. Description of business and significant accounting policies and practices Business: At Texas Instruments (TI), we design and make semiconductors that we sell to electronics designers and manufacturers all over the world. ... -

Page 10

PAGE 8 TEXAS INSTRUMENTS 2009 ANNUAL REPORT Revenue recognition: We recognize revenue from direct sales of our products to our customers, including shipping fees, when title passes to the customer, which usually occurs upon shipment or delivery, depending upon the terms of the sales order; when ... -

Page 11

... capitalized costs: Property, plant and equipment are stated at cost and depreciated over their estimated useful lives using the straight-line method. Leasehold improvements are amortized using the straight-line method over the shorter of the remaining lease term or the estimated useful lives of the... -

Page 12

PAGE 10 TEXAS INSTRUMENTS 2009 ANNUAL REPORT Impairments of long-lived assets: We regularly review whether facts or circumstances exist that indicate the carrying values of property, plant and equipment or other long-lived assets, including intangible assets, are impaired. We assess the ... -

Page 13

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 11 Restructuring activities have also resulted in asset impairments, which are included in restructuring expense and are recorded as an adjustment to the basis of the asset, not as a liability relating to a restructuring charge. When we commit to a plan to... -

Page 14

... in the near term. The fair value per share of RSUs that we grant is determined based on the market price of our common stock on the date of grant. The TI Employees 2005 Stock Purchase Plan is a discount-purchase plan and consequently, the Black-Scholes option-pricing model is not used to determine... -

Page 15

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 13 We have RSUs outstanding under the 2000 Long-Term Incentive Plan, the 2003 Long-Term Incentive Plan and the 2009 Long-Term Incentive Plan. Each RSU represents the right to receive one share of TI common stock on the vesting date, which is generally four... -

Page 16

... TI Employees 2005 Stock Purchase Plan, options are offered to all eligible employees in amounts based on a percentage of the employee's compensation. Under the plan, the option price per share is 85 percent of the fair market value on the exercise date, and options have a three-month term. Options... -

Page 17

...million) in 2009, 2008 and 2007. 4. Profit sharing plans Profit sharing benefits are generally formulaic and determined by one or more subsidiary or company-wide financial metrics. We pay profit sharing benefits primarily under the company-wide TI Employee Profit Sharing Plan. This plan provides for... -

Page 18

...(104) (140) (31) (275) $ 1,626 Deferred income tax liabilities: Property, plant and equipment ...Accrued retirement costs (defined benefit and retiree health care) Other ...Net deferred income tax asset . ... ... As of December 31, 2009 and 2008, net deferred income tax assets of $1.41 billion and... -

Page 19

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 17 The following table summarizes the changes in the total amounts of uncertain tax positions for 2009 and 2008: 2009 2008 Balance, January 1 ...Additions based on tax positions related to the current year . Additions for tax positions of prior years ...... -

Page 20

PAGE 18 TEXAS INSTRUMENTS 2009 ANNUAL REPORT Details of these allowances are as follows: Balance at Beginning of Year Additions Charged to Operating Results Recoveries and Write-offs, Net Balance at End of Year Accounts receivable allowances 2009 . 2008 . 2007 ... $30 $26 $26 $ 1 $ 7 $- $ (8) $... -

Page 21

... that are classified as Level 3 assets. Auction-rate securities are debt instruments with variable interest rates that historically would periodically reset through an auction process. There is currently no active market for auction-rate securities, so we use a DCF model to determine the estimated... -

Page 22

...20 TEXAS INSTRUMENTS 2009 ANNUAL REPORT As of December 31, 2009, all of these securities had the highest possible long-term credit rating from at least one of the major rating agencies. One security (with a par value of $25 million) had a long-term credit rating below AAA/Aaa, and it was rated AAA... -

Page 23

...defined benefit, defined contribution and retiree health care benefit plans. For qualifying employees, we offer deferred compensation arrangements. U.S. retirement plans: Principal retirement plans in the U.S. are qualified and non-qualified defined benefit pension plans (all of which closed to new... -

Page 24

... the statements of income and balance sheets Expense related to defined benefit and retiree health care benefit plans was as follows: U.S. Defined Benefit 2009 2008 2007 U.S. Retiree Health Care 2009 2008 2007 Non-U.S. Defined Benefit 2009 2008 2007 Service cost ...Interest cost ...Expected return... -

Page 25

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 23 Changes in the benefit obligations and plan assets for the defined benefit and retiree health care benefit plans were as follows: U.S. Defined Benefit 2009 2008 U.S. Retiree Health Care 2009 2008 Non-U.S. Defined Benefit 2009 2008 Change in plan ... -

Page 26

... 24 TEXAS INSTRUMENTS 2009 ANNUAL REPORT The amounts recorded in AOCI for the years ended December 31, 2009 and 2008, are detailed below by plan type: U.S. Defined Benefit Net Prior Actuarial Service Loss Cost U.S. Retiree Health Care Net Prior Actuarial Service Loss Cost Non-U.S. Defined Benefit... -

Page 27

... valued using inputs from the fund managers and internal models. Assumptions and investment policies Defined Benefit 2009 2008 Retiree Health Care 2009 2008 Weighted average assumptions used to determine benefit obligations: U.S. discount rate ...Non-U.S. discount rate ...U.S. average long-term pay... -

Page 28

... Voluntary Employee Benefit Association (VEBA) trusts. Weighted average asset allocations at December 31, are as follows: U.S. Defined Benefit U.S. Retiree Health Care 2009 2008 Non-U.S. Defined Benefit 2009 2008 Asset category Equity securities ...Fixed income securities Cash equivalents ... 2009... -

Page 29

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 27 Increasing or decreasing health care cost trend rates by one percentage point would have increased or decreased the accumulated postretirement benefit obligation for the U.S. retiree health care plan at December 31, 2009, by $21 million or $19 million ... -

Page 30

PAGE 28 TEXAS INSTRUMENTS 2009 ANNUAL REPORT Consistent with general industry practice, we enter into formal contracts with certain customers that include negotiated warranty remedies. Typically, under these agreements our warranty for semiconductor products includes: three years coverage; an ... -

Page 31

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 29 Authorizations for property, plant and equipment expenditures in future years were $414 million at December 31, 2009. Accrued expenses and other liabilities Accrued salaries, wages and vacation pay ...Customer incentive programs and allowances . ... -

Page 32

... on product shipment destination and royalty payor location, and property, plant and equipment based on physical location: Geographic area information U.S. Asia Europe Japan Rest of World Total Revenue 2009 ...2008 ...2007 ...Property, plant and equipment, net 2009 ...2008 ...2007 ... ... $ 1,140... -

Page 33

... 2009 ANNUAL REPORT PAGE 31 Report of independent registered public accounting firm The Board of Directors Texas Instruments Incorporated We have audited the accompanying consolidated balance sheets of Texas Instruments Incorporated and subsidiaries (the Company) as of December 31, 2009 and 2008... -

Page 34

... because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. TI management assessed the effectiveness of internal control over financial reporting as of December 31, 2009. In making this assessment, we used the criteria set forth by the... -

Page 35

... also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Texas Instruments Incorporated and subsidiaries as of December 31, 2009 and 2008, and the related consolidated statements of income, comprehensive... -

Page 36

PAGE 34 TEXAS INSTRUMENTS 2009 ANNUAL REPORT Years Ended December 31, Summary of selected financial data [Millions of dollars, except share and per-share amounts] 2009 2008 2007 2006 (a) 2005 (b) Revenue ...Operating costs and expenses (c) ...Operating profit ...Other income (expense) net ... -

Page 37

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 35 Management's discussion and analysis of financial condition and results of operations The following should be read in conjunction with the Financial Statements and the related Notes that appear elsewhere in this document. All dollar amounts in the ... -

Page 38

... graphing and scientific calculators, as well as royalties received for our patented technology that we license to other electronics companies. The semiconductor products in our Other segment include DLP® products (primarily used in projectors to create high-definition images), reduced-instruction... -

Page 39

...-millimeter analog wafer factory, located in Richardson, Texas, and are currently qualifying for production. We also opened a new assembly/test facility in the Philippines to significantly increase our assembly/test capacity. Product cycle The global semiconductor market is characterized by constant... -

Page 40

PAGE 38 TEXAS INSTRUMENTS 2009 ANNUAL REPORT Statement of operations - selected items For the Years Ended December 31, 2009 2008 2007 Revenue by segment: Analog ...Embedded Processing ...Wireless ...Other ...Revenue ...Cost of revenue ...Gross profit ...Gross profit % of revenue ...Research and ... -

Page 41

... standard on previously reported EPS. EPS in 2009 benefited $0.05 from a lower number of average shares outstanding as a result of our stock repurchase program. Orders were $11.36 billion, which was 4 percent lower than 2008. The decline reflected lower demand for baseband wireless products... -

Page 42

... 40 TEXAS INSTRUMENTS 2009 ANNUAL REPORT Wireless 2009 2008 2009 vs. 2008 Revenue ...Operating profit ...Operating profit % of revenue ... $2,558 332 13.0% $3,383 347 10.3% -24% -4% Wireless revenue declined $825 million, or 24 percent, from 2008 due to lower shipments of baseband products... -

Page 43

..., compared with $1.82 per share for 2007. The impact of restructuring costs reduced EPS by $0.12 per share in 2008 and by $0.02 per share in 2007. EPS in 2008 benefited $0.12 from a lower number of average shares outstanding as a result of our stock repurchase program. Orders were $11.86 billion... -

Page 44

..., the effect of the sale of our DSL customer-premises equipment product line in 2007 and lower royalties. Operating profit for 2008 from Other was $772 million, or 29.3 percent of revenue. This was a decrease of $124 million compared with 2007 due to lower revenue. Financial condition At the end of... -

Page 45

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 43 We believe we have the necessary financial resources and operating plans to fund our working capital needs, capital expenditures, dividend payments and other business requirements for at least the next 12 months. Long-term contractual obligations ... -

Page 46

...-related intangible assets; property, plant and equipment; and software for internal use or embedded in products sold to customers. Factors considered include the under-performance of an asset compared with expectations and shortened useful lives due to planned changes in the use of the assets... -

Page 47

TEXAS INSTRUMENTS 2009 ANNUAL REPORT PAGE 45 for each security that defines the interest rate paid to investors in the event of a failed auction; forward projections of the interest rate benchmarks specified in such formulas; the likely timing of principal repayments; the probability of full ... -

Page 48

... TEXAS INSTRUMENTS 2009 ANNUAL REPORT Quarterly financial data [Millions of dollars, except per-share amounts] Quarter 2009 1st 2nd 3rd 4th Revenue ...Gross profit ...Operating profit ...Net income ...Earnings per common share: Basic earnings per common share . . Diluted earnings per common share... -

Page 49

...dividends TI common stock is listed on the New York Stock Exchange and traded principally in that market. The table below shows the high and low closing prices of TI common stock as reported by Bloomberg L.P. and the dividends paid per common share for each quarter during the past two years. Quarter... -

Page 50

... The฀ability฀of฀TI฀and฀its฀customers฀and฀suppliers฀to฀access฀their฀bank฀accounts฀and฀lines฀of฀credit฀or฀otherwise฀access฀the฀capital฀ markets; •฀ Impairments฀of฀our฀non-financial฀assets Product฀liability฀or฀warranty฀claims,฀claims... -

Page 51

... by the New York Stock Exchange listing standards, an unqualiï¬ed annual certiï¬cation indicating compliance with the listing standards was signed by TI's Chief Executive Ofï¬cer and submitted on April 24, 2009. SEC Form 10-K Stockholders may obtain a copy of the company's annual report to the... -

Page 52

Texas Instruments Incorporated P.O. Box 660199 Dallas, TX 75266-0199 www.ti.com 10% XX% Cert no. Cert no. XXX-XXX-000 An equal opportunity employer © 2010 Texas Instruments Incorporated TI-30001K