Tesco 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008

4

Business Review continued

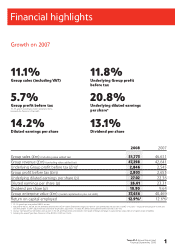

Group performance

This year’s results represent very good progress across the Group and have been achieved by investing to improve the shopping experience for customers

in our businesses in the UK and around the world. We have been able to deliver another solid sales performance, and through good cost control and

productivity improvements, we have grown profits slightly faster than revenue – and thereby improved returns for shareholders. These improvements have

been achieved whilst continuing to invest in the long term – in the people, assets, processes and systems, which will enable Tesco to sustain its success in

the future.

Results These results are for the 52 weeks ended 23 February 2008, compared with the same period ending in February 2007. Results from our business

in China are consolidated in the full-year results for the first time.

Group sales, including VAT, increased by 11.1% to £51.8bn (last year £46.6bn). At constant exchange rates, sales increased by 10.4%.

In April 2006, with our Preliminary Results for 2005/6, and following our transition to IFRS, we introduced an underlying profit measure, which excludes

the impact of the non-cash elements of IAS 19, IAS 32 and IAS 39 (principally pension costs and the marking to market of financial instruments). With

these Results, the underlying profit measure also excludes the impact of the non-cash element of IAS 17 ‘Leases’, relating to the impact of annual uplifts

in rent and rent free periods. Underlying profit before tax rose to £2,846m in the year (last year £2,545m), an increase of 11.8%.

With our Interim Results for 2006/7, we began reporting segmental trading profit, which excludes property profits and, as our underlying profit

measure does, excludes the non-cash element of the IAS 19 pension charge and now also excludes the non-cash element of the IAS 17 lease charge.

Group trading profits were £2,751m (last year £2,478m), up 11.0% on last year and Group trading margin, at 5.8%, was unchanged on last year.

Group operating profit rose by 5.4% to £2,791m (last year £2,648m). Within this, total net Group property profits were £188m in the year (last year

£139m, including asset disposals within joint ventures), comprising £186m in the UK and £2m in International. Group profit before tax increased 5.7%

to £2,803m (last year £2,653m). Excluding last year’s exceptional items; principally the Pensions A-Day credit, Group profit before tax rose 15.3% and

Group operating profit rose 15.1%.

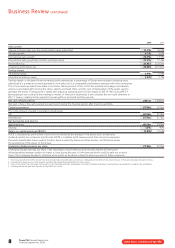

Group results Actual rates Actual rates Constant

Group sales (inc. VAT) £51,773m 11.1% 10.4%

Group profit before tax £2,803m 5.7% 5.1%

Group operating profit £2,791m 5.4% 4.8%

Group underlying profit before tax £2,846m 11.8% 11.2%

Group trading profit £2,751m 11.0% 10.4%

Trading margin 5.8% – –

International Our International business delivered a very strong performance, contributing 54% of the growth in Group sales and 50% of the growth

in Group trading profit. Underlying margins improved whilst reported margins were diluted slightly by the consolidation of our business in China for the

first time, following the increase in our shareholding to 90% in December 2006.

Total International sales grew strongly – by 25.3% at actual exchange rates to £13.8bn (last year £11.0bn) and by 22.5% at constant exchange rates.

China contributed £702m to sales, representing 6.4 percentage points of the year’s total International growth at actual rates. Excluding China, total

international sales grew by 19.0% at actual rates and by 15.7% at constant rates. Like-for-like sales in International grew by 2.0%, with net new space

contributing the remaining 20.5%.

www.tesco.com/annualreport08

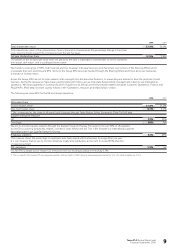

Group space 000 sq ft

International

UK

04 05 06 07 08

23,292

24,191

25,903

27,785

29,549

22,111

27,580

32,817

40,404

46,410

45,403

51,771

58,720

68,189

75,959

Number of stores

International

UK

04 05 06 07 08

1,877

1,779

1,897

1,988

2,115

441

586

814

1,275

1,614

2,318

2,365

2,711

3,263

3,729

Sales performance £m

International

UK

* Including 60 weeks International.

04 05 06*07 08

26,876

29,511

32,657

35,580

37,949

6,681

7,559

10,480

11,031

13,824

33,557

37,070

43,137

46,611

51,773