Tesco 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008

106 www.tesco.com/annualreport08

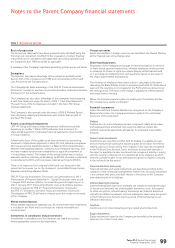

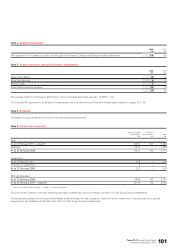

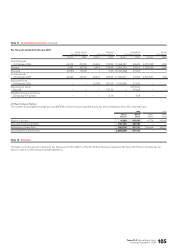

Note 13 Called up share capital

2008 2007

Ordinary shares of 5p each Ordinary shares of 5p each

Number £m Number £m

Authorised:

At beginning of year 10,858,000,000 543 10,700,000,000 535

Authorised during the year ––158,000,000 8

At end of year 10,858,000,000 543 10,858,000,000 543

Allotted, called up and fully paid:

At beginning of year 7,947,349,558 397 7,894,476,917 395

Scrip dividend election ––75,205,082 3

Share options 65,432,552 3 75,994,892 4

Share buy-back (149,283,327) (7) (98,327,333) (5)

At end of year 7,863,498,783 393 7,947,349,558 397

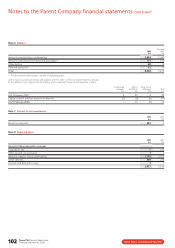

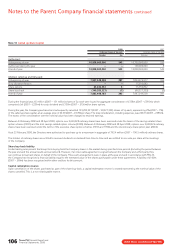

During the financial year, 65 million (2007 – 151 million) shares of 5p each were issued for aggregate consideration of £138m (2007 – £395m), which

comprised £nil (2007 – £239m) for scrip dividend and £138m (2007 – £156m) for share options.

During the year, the Company purchased and subsequently cancelled 149,283,327 (2007 – 98,327,333) shares of 5p each, representing 2% (2007 – 1%)

of the called up share capital, at an average price of £4.38 (2007 – £3.89) per share. The total consideration, including expenses, was £657m (2007 – £385m).

The excess of the consideration over the nominal value has been charged to retained earnings.

Between 24 February 2008 and 28 April 2008, options over 4,690,928 ordinary shares have been exercised under the terms of the savings-related share

option scheme (1981) and the Irish savings-related option scheme (2000). Between 24 February 2008 and 28 April 2008, options over 4,048,526 ordinary

shares have been exercised under the terms of the executive share option schemes (1994 and 1996) and the discretionary share option plan (2004).

As at 23 February 2008, the Directors were authorised to purchase up to a maximum in aggregate of 793.4 million (2007 – 790.5 million) ordinary shares.

The holders of ordinary shares are entitled to received dividends as declared from time to time and are entitled to one vote per share at the meetings

of the Company.

Share buy-back liability

Insider trading rules prevent the Group from buying back the Company shares in the market during specified close periods (including the period between

the year end and the annual results announcement). However, if an irrevocable agreement is signed between the Company and a third party, they

can continue to buy back shares on behalf of the Company. Three such arrangements were in place at the year end and in accordance with FRS 25,

the Company has recognised a financial liability equal to the estimated value of the shares purchasable under these agreements. A liability of £100m

(2007 – £90m) has been recognised within other creditors for this amount.

Capital redemption reserve

Upon cancellation of the shares purchased as part of the share buy-back, a capital redemption reserve is created representing the nominal value of the

shares cancelled. This is a non-distributable reserve.

Notes to the Parent Company financial statements continued