Tesco 2008 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008

30

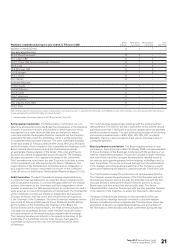

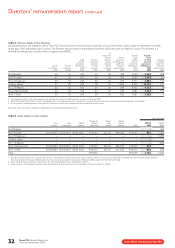

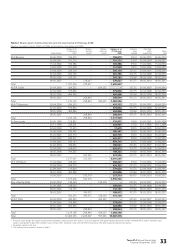

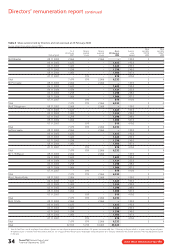

Directors’ remuneration report continued

Other elements

>Shares In Success The Group operates a profit-sharing scheme (Shares

in Success) for the benefit of UK employees including Executive Directors.

The scheme is available to employees with at least one year’s service

at the Group’s year end and is recognised as a powerful incentive and

retention tool for all employees. Shares in the company are allocated

to participants in the scheme on a pro rata basis to base salary earned

up to HMRC approved limits (currently £3,000 per annum). The amount

of profit allocated to the scheme is determined by the Board, taking

account of Company performance.

>Save as You Earn Since 1981, the Group has operated a HMRC

approved savings-related share option scheme (SAYE) for the benefit of

employees including Executive Directors. Under this scheme, employees

save up to a limit of £250 on a four-weekly basis via a bank/building

society with an option to buy shares in Tesco PLC at the end of a three-

year or five-year period at a discount of up to 20% of the market value.

There are no performance conditions attached to SAYE options.

>Buy as You Earn Since January 2002, the Group has operated the

partnership shares element of a HMRC approved share investment plan

for the benefit of employees including Executive Directors. Under this

scheme, employees save up to a limit of £110 on a four-weekly basis

to buy shares at market value in Tesco PLC.

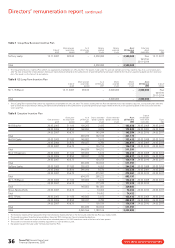

Pensions

The retention of key management is critical to the future success of the

business and to the growth of shareholder value. Pension provision is

central to our ability to foster loyalty and retain experience which is why

Tesco wants to ensure that the Tesco PLC Pension Scheme is a highly

valued benefit.

All Executive Directors are members of the Tesco PLC Pension Scheme

which provides a pension of up to two-thirds of base salary on retirement,

normally at age 60, dependent on service. The Final Salary Scheme is now

closed to new entrants but has been replaced throughout the organisation

by a different defined-benefit pension scheme which accumulates each

year and is based on career average earnings.

Since April 2006, following implementation of the regulations contained

within the Finance Act 2004, Executive Directors have been eligible to

receive the maximum pension that can be provided from the registered

pension scheme. The balance of any pension entitlement is delivered

through a secured unapproved retirement benefits scheme (SURBS).

Except for Mr Mason, the SURBS is ‘secured’ by using a fixed charge over

a cash deposit in a designated account. This provides no greater security

than under the registered scheme. In particular, in the unlikely event that

the registered scheme were to be wound up with a deficit, members would

be no better off under the SURBS arrangements than those paid out of the

registered scheme. Under these circumstances, to ensure parity, members

of the SURBS would receive the same proportion of their total entitlement

as those in the registered scheme.

Over the last few years pension contributions by our Executive Directors

have been increasing progressively. In 2007/8 the level of contribution was

7% of salary which is in line with senior management’s contribution levels.

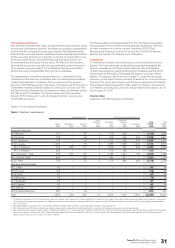

Further details of the pension benefits earned by the Directors can be

found on page 32.

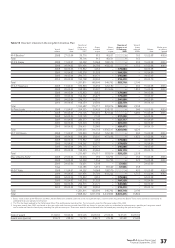

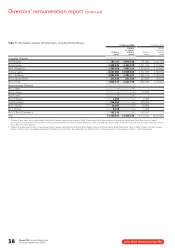

Performance graph

The graph below highlights the Group’s total shareholder return

performance over the last five financial years, relative to the FTSE 100 index

of companies. This index has been selected to provide an established and

broad-based comparator group of retail and non-retail companies of similar

scale to Tesco.

Service agreements

The Executive Directors all have rolling service agreements with no fixed

expiry date. These contracts are terminated on notice of 12 months by the

Company and six months’ notice by the Executive.

If an Executive Director’s employment is terminated (other than pursuant

to the notice provisions in the service agreement or by reason of resignation

or unacceptable performance or conduct) the Company will pay a sum

calculated on the basis of basic salary and the average annual bonus

paid for the last two years. No account will be taken of pension.

Termination payments will be subject to mitigation. This means that

amounts will be paid in instalments to permit mitigation. If the termination

occurs within one year of retirement, the termination payment will be

reduced accordingly.

To reflect his length of service with Tesco and the early age of his

appointment as CEO, Sir Terry Leahy’s service agreement provides for

his full pension entitlement to become available on retirement on or

after his 57th birthday.

The Committee has agreed that new appointments of Executive Directors

will normally be on a notice period of 12 months. The Committee reserves

the right to vary this period to 24 months for the initial period of

appointment and for the notice period to then revert to 12 months.

The service agreements are available to shareholders to view on request

from the Company Secretary.

Outside appointments

Tesco recognises that its Executive Directors may be invited to become

Non-executive Directors of other companies. Such non-executive duties

can broaden experience and knowledge which can benefit Tesco. Subject

to approval by the Board, Executive Directors are allowed to accept

non-executive appointments and retain the fees received, provided that

these appointments are not likely to lead to conflicts of interest. Executive

Directors’ biographies can be found in the Annual Review and Summary

Financial Statement 2008 on page 27 and fees retained for any

non-executive directorships are set out below.

Company in which Fee retained by

non-executive Director in

Director directorship held 2007/8 (£000)

Mr P A Clarke Whitbread Group PLC 55

Mr A T Higginson BSkyB 60

Total shareholder return (TSR) 1 March 2003 to 28 February 2008

TSR is the notional return from a share or index based on share price

movements and declared dividends.

£300

£250

£200

£150

£100

Feb 03 Feb 04 Feb 05 Feb 06 Feb 07 Feb 08

Te s c o

FTSE 100

www.tesco.com/annualreport08