Tesco 2008 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Tesco PLC Annual Report and

Financial Statements 2008 27

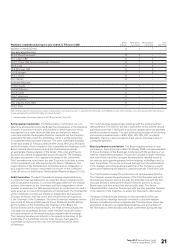

The Committee considers TSR performance against the FTSE 100 and a

comparator group of international retailers that includes Ahold, Carrefour,

J Sainsbury, Metro, Morrisons, Safeway Inc, Target and Walmart.

In order to motivate short-term performance and delivery of success in

the start-up phase of the US business, the Committee agreed last year

to increase the potential short-term bonus opportunity for the US CEO,

Mr Mason, from 100% to 150% of salary in cash and an equal amount

in deferred shares. Mr Mason’s total short-term opportunity is subject to

a combination of Group and US-specific performance conditions. In order

to incentivise and reward early stage success against financial and strategic

milestones for new business ventures, the potential opportunity under the

share element of the short-term bonus for the Group CEO, Sir Terry Leahy,

was also increased last year from 100% to 150% of salary (with his potential

cash bonus opportunity remaining at 100%). The additional awards to

Mr Mason and Sir Terry Leahy are subject to performance conditions which

measure the successful progress of the US business including leadership

and delivery of financial and strategic objectives and factors such as site

acquisitions, store openings, agreed capital expenditure, infrastructure,

early turnover and financial milestones for returns from store openings.

Share awards will continue to be deferred for three years before release.

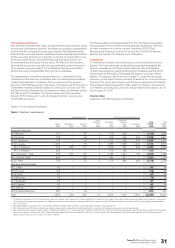

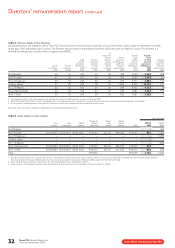

Following the Remuneration Committee’s consideration of the extent to

which the various performance measures in respect of the 2007/8 award

have been achieved, the Executive Directors have been awarded 90%

of the cash element and 83% of the deferred shares element of that part

of their annual bonus which is measured by reference to Group targets.

In addition, Mr Mason has been awarded 90% of the cash and deferred

shares elements of that part of his annual bonus which is measured by

reference to US-specific targets, and Sir Terry Leahy has been awarded

90% of the deferred shares element of that part of his annual bonus

which is measured by reference to US-specific targets.

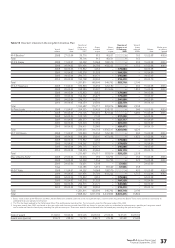

Performance Share Plan

The Performance Share Plan (PSP) provides the opportunity to earn

rewards for achieving superior long-term performance. By ensuring a focus

on longer-term business success and encouraging the Executive Directors

to build up a shareholding in the Company, the Plan further aligns the

interests of shareholders and Executive Directors.

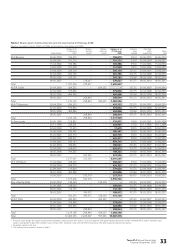

The rules of the PSP allow awards to be made over shares up to 150%

of salary. In the year ended 23 February 2008, awards were made to all

the Executive Directors except Mr Mason over Tesco PLC shares equal to

150% of salary. An award was made to Mr Mason over Tesco PLC shares

equal to 100% of salary.

For all the Executive Directors, awards over up to 100% of salary will vest

(together with reinvested dividends) subject to the achievement of Group

ROCE targets. The awards over the equivalent of a further 50% of salary

made to the Executive Directors other than Mr Mason will vest (together

with reinvested dividends) subject to the achievement of targets based

on International ROCE to incentivise and reward delivery of higher returns

from invested capital outside the UK (but excluding the US).

The first 75% of the awards will vest on a straight-line basis at the end

of the three-year performance period, with 25% vesting for baseline

performance and the full 75% vesting for maximum performance against

target. The target in respect of the first 75% of the 2007/8 PSP award is

achievement of 14.2% Group ROCE and 8.1% International ROCE (based

on profit before interest less tax) at the end of the three-year performance

period in 2009/10.

The remaining 25% of the award will vest for superior Return on Capital

performance. The Committee has agreed that it is appropriate to exercise

judgement on whether vesting should occur to encourage Executives to

make investment decisions in the long-term interests of the business

without being unduly influenced by the impact on the ROCE target. When

determining whether some, or all, of the remaining 25% of the award will

vest, the Committee will take into account a number of factors including:

> the level of ROCE achieved;

> the expected ROCE for additional and existing capital investment;

> whether capital spend is in line with strategic objectives and balances

short-term and long-term investment needs;

> sales growth and underlying profit growth; and

> whether this reflects other developments in the marketplace.

If the Committee exercises its judgement to allow some, or all, of the

remaining 25% of the PSP awards to vest, we will describe in the Directors’

Remuneration Report those factors taken into account in determining the

level of the award which would vest.

There is no re-testing of performance in respect of any targets.

Shareholder approval was obtained at last year’s AGM for the removal

of the requirement for any vested shares to be retained for a further

12 months.

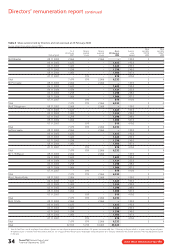

Following the completion of the three-year performance period for the

2005/6 PSP award, the Committee considered the level of performance

against the target for the first 75% of the PSP award of achieving post-tax

Group ROCE of 11.7% by the end of FY 2007/8. Post-tax ROCE at the

end of FY 2007/8 was 12.9%, so full vesting will occur in respect of the

first 75% of the award. The Committee also exercised its judgement as

to the extent to which the remaining 25% of the PSP award should vest

as a result of superior ROCE performance, taking into account factors

including the level of ROCE achieved, the expected ROCE for additional

and existing capital investment, whether capital spend was in line with

strategic objectives and balanced short-term and long-term investment

needs, the level of sales and underlying profit growth and whether this

reflected other developments in the marketplace. Having considered these

factors in detail the Committee concluded that the whole of the remaining

25% of the award should vest.

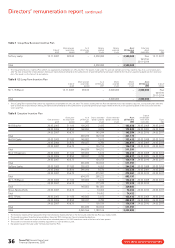

US Long-Term Incentive Plan

The Group is seeking to build a substantial presence in the US which

in time has the potential to become a significant driver of value for our

shareholders. Integral to the success of this strategy will be recruiting

and retaining high quality management to run this significant business.

The Tesco PLC US Long-Term Incentive Plan 2007 (the US LTIP) has been

designed to deliver reward only if the US business delivers significant value

for shareholders.

The US CEO and other senior members of the US management team

have been made awards under the US LTIP. No other Executive Directors

will participate in the Plan. The maximum number of shares which may

be awarded under the US LTIP is 2 million shares to the US CEO and

1.5 million shares to any other participant. An award of 2 million shares

was made to Mr Mason, US CEO, in November 2007. Awards may be

adjusted to take account of any dividends paid or that are payable in

respect of the number of shares earned.

The extent to which awards will vest under the US LTIP will be conditional

on the financial performance of the Company’s US business, based on

the achievement of stretching earnings before interest and tax (EBIT)

and return on capital employed (ROCE) targets set by reference to the

US long-term business plan.