Tesco 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008 49

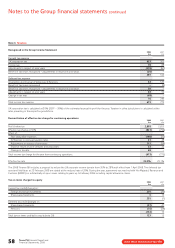

Pensions and similar obligations

The Group accounts for pensions and other post-employment benefits

(principally private healthcare) under IAS 19 ‘Employee Benefits’.

In respect of defined benefit plans, obligations are measured at discounted

present value (using the projected unit credit method) whilst plan assets

are recorded at fair value. The operating and financing costs of such plans

are recognised separately in the Group Income Statement; service costs

are spread systematically over the expected service lives of employees and

financing costs are recognised in the periods in which they arise. Actuarial

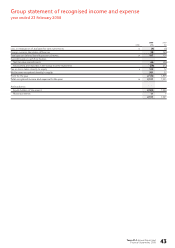

gains and losses are recognised immediately in the Group Statement of

Recognised Income and Expense.

Payments to defined contribution schemes are recognised as an expense

as they fall due.

Share-based payments

Employees of the Group receive part of their remuneration in the form

of share-based payment transactions, whereby employees render services

in exchange for shares or rights over shares (equity-settled transactions)

or in exchange for entitlements to cash payments based on the value of

the shares (cash-settled transactions).

The fair value of employee share option plans is calculated at the grant

date using the Black-Scholes model. In accordance with IFRS 2 ‘Share-based

payment’, the resulting cost is charged to the Group Income Statement

over the vesting period. The value of the charge is adjusted to reflect

expected and actual levels of vesting.

Taxation

The tax expense included in the Group Income Statement consists of

current and deferred tax.

Current tax is the expected tax payable on the taxable income for the year,

using tax rates enacted or substantively enacted by the Balance Sheet date.

Tax is recognised in the Group Income Statement except to the extent that

it relates to items recognised directly in equity, in which case it is recognised

in equity.

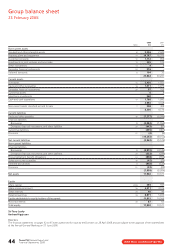

Deferred tax is provided using the Balance Sheet liability method,

providing for temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the amounts

used for taxation purposes.

Deferred tax is calculated at the tax rates that have been enacted or

substantively enacted by the Balance Sheet date. Deferred tax is charged

or credited in the Group Income Statement, except when it relates to items

charged or credited directly to equity, in which case the deferred tax is also

recognised in equity.

Deferred tax assets are recognised to the extent that it is probable that

taxable profits will be available against which deductible temporary

differences can be utilised.

The carrying amount of deferred tax assets is reviewed at each Balance

Sheet date and reduced to the extent that it is no longer probable that

sufficient taxable profits will be available to allow all or part of the asset

to be recovered.

Deferred tax assets and liabilities are offset against each other when

there is a legally enforceable right to set-off current taxation assets against

current taxation liabilities and it is the intention to settle these on a

net basis.

Foreign currencies

Transactions in foreign currencies are translated at the exchange rate on

the date of the transaction. At each Balance Sheet date, monetary assets

and liabilities that are denominated in foreign currencies are retranslated

at the rates prevailing on the Balance Sheet date. All differences are taken

to the Group Income Statement for the period.

The financial statements of foreign subsidiaries are translated into Pounds

Sterling according to the functional currency concept of IAS 21 ‘The Effects

of Changes in Foreign Exchange Rates’. Since the majority of consolidated

companies operate as independent entities within their local economic

environment, their respective local currency is the functional currency.

Therefore, assets and liabilities of overseas subsidiaries denominated in

foreign currencies are translated at exchange rates prevailing at the date

of the Group Balance Sheet; profits and losses are translated into Pounds

Sterling at average exchange rates for the relevant accounting periods.

Exchange differences arising, if any, are classified as equity and transferred

to the Group’s translation reserve. Such translation differences are

recognised as income or expenses in the period in which the operation

is disposed of.

Goodwill and fair value adjustments arising on the acquisition of a

foreign entity are treated as assets and liabilities of the foreign entity and

translated at the closing rate.

Financial instruments

Financial assets and financial liabilities are recognised on the Group’s

Balance Sheet when the Group becomes a party to the contractual

provisions of the instrument.

Trade receivables

Trade receivables are non interest-bearing and are recognised initially

at fair value, and subsequently at amortised cost using the effective

interest rate method, reduced by appropriate allowances for estimated

irrecoverable amounts.

Investments

Investments are recognised at trade date. Investments are classified as

either held for trading or available-for-sale, and are recognised at fair value.

For held for trading investments, gains and losses arising from changes

in fair value are recognised in the Group Income Statement.

For available-for-sale investments, gains and losses arising from changes

in fair value are recognised directly in equity, until the security is disposed

of or is determined to be impaired, at which time the cumulative gain or

loss previously recognised in equity is included in the net result for the period.

Interest calculated using the effective interest rate method is recognised

in the Group Income Statement. Dividends on an available-for-sale equity

instrument are recognised in the Group Income Statement when the

entity’s right to receive payment is established.

Financial liabilities and equity

Financial liabilities and equity instruments are classified according to

the substance of the contractual arrangements entered into. An equity

instrument is any contract that gives a residual interest in the assets of

the Group after deducting all of its liabilities.

Note 1 Accounting policies continued