Sunoco 2012 Annual Report Download - page 17

Download and view the complete annual report

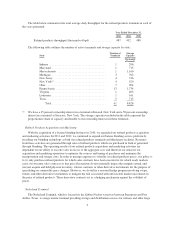

Please find page 17 of the 2012 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Refined Products Pipelines

A substantial portion of the Refined Products Pipelines are located in the northeast United States and were

constructed or acquired to distribute refined products to Sunoco’s retail network. While Sunoco completed the

exit from its refining business in 2012, Sunoco continues to operate its retail marketing network and we expect

that Sunoco will continue to utilize our Refined Products Pipelines as an efficient means to meet its retail

marketing demand. For further information on the impact, see Item 7. “Management’s Discussion and Analysis

of Financial Condition and Results of Operations – Agreements with Related Parties.”

Generally, pipelines are the lowest cost method for long-haul, overland movement of refined products.

Therefore, the most significant competitors for large volume shipments in these areas are other pipelines. Our

management believes that high capital requirements, environmental considerations, and the difficulty in

acquiring rights-of-way and related permits make it difficult for other companies to build competing pipelines in

areas served by our pipelines. As a result, competing pipelines are likely to be built only in those cases in which

strong market demand and attractive tariff rates support additional capacity in an area. Although it is unlikely that

a pipeline system comparable in size and scope to the northeast and midwest portion of the Refined Products

Pipelines will be built in the foreseeable future, new pipelines (including pipeline segments that connect with

existing pipeline systems) could be built to effectively compete with it in particular locations.

In the southwest United States, our MagTex refined products pipeline system faces competition from

existing third-party owned and joint venture pipelines that have excess capacity. Gulf Coast refinery expansions

could justify the construction of a new pipeline that would compete with our refined products pipeline system in

the southwest. However, at this time, we believe the existing pipelines have the capacity to satisfy expected

future demand.

In addition to competition from other pipelines, we face competition from trucks that deliver refined

products in a number of areas that we serve. While their costs may not be competitive for longer hauls or large

volume shipments, trucks compete effectively for incremental and marginal volume in many areas where such

means of transportation are prevalent. The availability of truck transportation places a significant competitive

constraint on our ability to increase tariff rates.

Safety Regulation

A majority of our pipelines are subject to United States Department of Transportation (“DOT”) regulations

and to regulations under comparable state statutes relating to the design, installation, testing, construction,

operation, replacement and management of pipeline facilities.

DOT regulations require operators of hazardous liquid interstate pipelines to develop and follow a program

to assess the integrity of all pipeline segments that could affect designated “high consequence areas,” including:

high population areas, drinking water and ecological resource areas that are unusually sensitive to environmental

damage from a pipeline release, and commercially navigable waterways. We have prepared our own written Risk

Based Integrity Management Program, identified the line segments that could impact high consequence areas and

completed a full assessment of these segments as prescribed by the regulations.

We believe that our pipeline operations are in substantial compliance with applicable DOT regulations and

comparable state requirements. However, an increase in expenditures may be needed in the future to comply with

higher industry and regulatory safety standards. Such expenditures cannot be estimated accurately at this time,

but we do not believe they would likely have a material adverse effect relative to our results of operations,

financial position or expected cash flows.

15