Sunoco 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

transporters of crude oil. The terminal receives, stores, and distributes crude oil, feedstocks, lubricants,

petrochemicals, and bunker oils (used for fueling ships and other marine vessels), and also blends lubricants. The

terminal currently has a total storage capacity of approximately 22 million barrels in approximately

130 aboveground storage tanks with individual capacities of up to 660 thousand barrels.

The Nederland Terminal can receive crude oil at each of its five ship docks and three barge berths. The five

ship docks are capable of receiving over 2 million bpd of crude oil. In addition to our Crude Oil Pipelines, the

terminal can also receive crude oil through a number of other pipelines, including:

• the Cameron Highway pipeline, which is jointly owned by Enterprise Products and Genesis Energy;

• the ExxonMobil Pegasus pipeline;

• the Department of Energy (“DOE”) Big Hill pipeline; and

• the DOE West Hackberry pipeline.

The DOE pipelines connect the terminal to the United States Strategic Petroleum Reserve’s West Hackberry

caverns at Hackberry, Louisiana and Big Hill near Winnie, Texas, which have an aggregate storage capacity of

approximately 400 million barrels.

The Nederland Terminal can deliver crude oil and other petroleum products via pipeline, barge, ship, rail, or

truck. In total, the terminal is capable of delivering over 2 million bpd of crude oil to our Crude Oil Pipelines or a

number of third-party pipelines including:

• the ExxonMobil pipeline to its Beaumont, Texas refinery;

• the DOE pipelines to the Big Hill and West Hackberry Strategic Petroleum Reserve caverns;

• the Valero pipeline to its Port Arthur, Texas refinery; and

• the Total pipelines to its Port Arthur, Texas refinery.

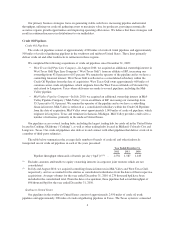

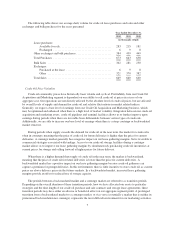

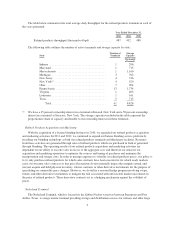

The table below summarizes the total average daily throughput for the Nederland Terminal in each of the

years presented:

Year Ended December 31,

2012 2011 2010

Crude oil and refined products throughput (thousands of bpd) .... 724 757 729

Revenues are generated at the Nederland Terminal primarily by providing term or spot storage services and

throughput capabilities to a number of customers.

Fort Mifflin Terminal Complex

The Fort Mifflin Terminal Complex is located on the Delaware River in Philadelphia and includes the Fort

Mifflin Terminal, the Hog Island Wharf, the Darby Creek tank farm and connecting pipelines. Revenues are

generated from the Fort Mifflin Terminal Complex by charging fees based on throughput. In connection with

Sunoco’s decision to exit the refining business, we recognized a charge in the fourth quarter 2011 related to the Fort

Mifflin Terminal Complex for asset write-downs and regulatory obligations which would have been incurred if

certain terminal assets were permanently idled as substantially all of the revenues from the Fort Mifflin Terminal

Complex are derived from the Philadelphia refinery. In September 2012, Sunoco completed the formation of

Philadelphia Energy Solutions (“PES”), a joint venture with The Carlyle Group, which enabled the Philadelphia

refinery to continue operating. In connection with this transaction, we entered into a new 10-year agreement to

provide terminalling services to PES related to the Fort Mifflin Terminal Complex. In addition, we reversed certain

regulatory obligations that were no longer expected to be incurred as a result of the formation of PES.

10