Sunoco 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

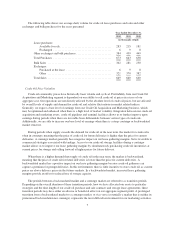

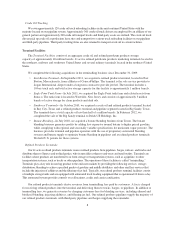

The table below summarizes the total average daily throughput for the refined products terminals in each of

the years presented:

Year Ended December 31,

2012 2011 2010

Refined products throughput (thousands of bpd) ............... 487 492 488

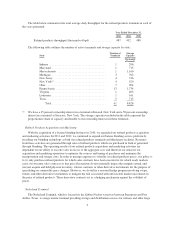

The following table outlines the number of active terminals and storage capacity by state:

State

Number of

Terminals

Storage

Capacity

(thousands

of barrels)

Indiana ........................................ 1 206

Maryland ...................................... 1 715

Massachusetts .................................. 1 1,160

Michigan ...................................... 3 762

New Jersey .................................... 4 746

New York(1) .................................... 4 920

Ohio .......................................... 7 904

Pennsylvania ................................... 13 1,734

Virginia ....................................... 1 403

Louisiana ...................................... 1 161

Texas ......................................... 5 715

Total ...................................... 41 8,426

(1) We have a 45 percent ownership interest in a terminal at Inwood, New York and a 50 percent ownership

interest in a terminal at Syracuse, New York. The storage capacities included in the table represent the

proportionate share of capacity attributable to our ownership interests in these terminals.

Refined Products Acquisition and Marketing

With the acquisition of a butane blending business in 2010, we expanded our refined products acquisition

and marketing activities. In 2011 and 2012, we continued to expand our butane blending service platform by

installing our blending technology at both our refined products terminals and third-party facilities. Revenues

from these activities are generated through sales of refined products which are purchased in bulk or generated

through blending. The operating results of our refined products acquisition and marketing activities are

dependent on our ability to execute sales in excess of the aggregate cost, and therefore we structure our

acquisition and marketing operations to optimize the sources and timing of purchases and minimize the

transportation and storage costs. In order to manage exposure to volatility in refined products prices, our policy is

to (i) only purchase refined products for which sales contracts have been executed or for which ready markets

exist, (ii) structure sales contracts so that price fluctuations do not materially impact the margins earned, and

(iii) not acquire and hold physical inventory, futures contracts or other derivative instruments for the purpose of

speculating on commodity price changes. However, we do utilize a seasonal hedge program involving swaps,

futures and other derivative instruments to mitigate the risk associated with unfavorable market movements in

the price of refined products. These derivative contracts act as a hedging mechanism against the volatility of

prices.

Nederland Terminal

The Nederland Terminal, which is located on the Sabine-Neches waterway between Beaumont and Port

Arthur, Texas, is a large marine terminal providing storage and distribution services for refiners and other large

9