Shutterfly 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Intellectual Property Prepaid Royalties

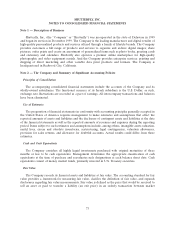

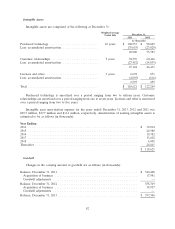

The Company has patent license agreements with various third parties. The Company has accounted

for these agreements as prepaid royalties that are amortized over the remaining life of the patents.

Amortization expense is recorded on a straight-line basis as a component of cost of revenue. The current

portion of the prepaid royalty is recorded as a component of prepaid expenses and the long term portion is

recorded in other assets.

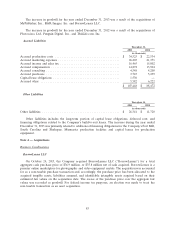

Lease Obligations

The Company categorizes leases at their inception as either operating or capital leases. On certain of

our lease agreements, the Company may receive rent holidays and other incentives. The Company

recognizes lease costs on a straight-line basis without regard to deferred payment terms, such as rent

holidays that defer the commencement date of required payments. Additionally, incentives the Company

receives are treated as a reduction of our costs over the term of the agreement.

The Company establishes assets and liabilities for the estimated construction costs incurred under

build-to-suit lease arrangements to the extent the Company is involved in the construction of structural

improvements or takes construction risk prior to commencement of a lease. Upon occupancy of facilities

under build-to-suit leases, the Company assesses whether these arrangements qualify for sales recognition

under the sale-leaseback accounting guidance. If the Company continues to be the deemed owner, the

facilities are accounted for as financing leases.

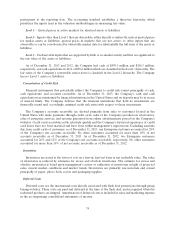

Revenue Recognition

The Company recognizes revenue from Consumer and Enterprise product sales, net of applicable

sales tax, upon shipment of fulfilled orders, when persuasive evidence of an arrangement exists, the selling

price is fixed or determinable and collection of resulting receivables is reasonably assured. Customers place

Consumer product orders through the Company’s websites and pay primarily using credit cards. Enterprise

customers are invoiced upon fulfillment. Shipping charged to customers is recognized as revenue at the

time of shipment.

For camera, lenses, and video equipment rentals from our BorrowLenses brand, we recognize rental

revenue and the related shipping and insurance revenue, ratably over the rental period. Revenue from the

sale of rental equipment is recognized upon shipment of the equipment.

For gift card sales and flash deal promotions through group buying websites, the Company recognizes

revenue on a gross basis, as it is the primary obligor, when redeemed items are shipped. Revenues from

sales of prepaid orders on its websites are deferred until shipment of fulfilled orders or until the prepaid

period expires. The Company’s share of revenue generated from its print to retail relationships, is

recognized when orders are picked up by its customers at the respective retailer.

The Company provides its customers with a 100% satisfaction guarantee whereby products can be

returned within a 30-day period for a reprint or refund. The Company maintains an allowance for

estimated future returns based on historical data. The provision for estimated returns is included in

accrued expenses.

The Company periodically provides incentive offers to its customers in exchange for setting up an

account and to encourage purchases. Such offers include free products and percentage discounts on

current purchases. Discounts, when accepted by customers, are treated as a reduction to the purchase price

76