Shutterfly 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We generate the majority of our revenues by producing and selling professionally-bound photo books,

greeting and stationery cards, personalized calendars, other photo-based merchandise and high-quality

prints ranging in size from wallet-sized to jumbo-sized 20x30 enlargements. We manufacture most of these

items in our Fort Mill, South Carolina, Phoenix, Arizona and Elmsford, New York production facilities. By

controlling the production process in our own production facilities, we are able to produce high-quality

products, innovate rapidly, maintain a favorable cost structure and ensure timely shipment to customers,

even during peak periods of demand. Additionally, we sell a variety of photo-based merchandise that is

currently manufactured for us by third parties, such as calendars, mugs, canvas prints, mouse pads,

magnets, and puzzles. We generate substantially all of our revenue from sales originating in the United

States and our sales cycle has historically been highly seasonal as we generate more than 50% of our total

net revenues during our fiscal fourth quarter. Our operations and financial performance depend on

general economic conditions in the United States, consumer sentiment and the levels of consumer

discretionary spending. We closely monitor these economic measures as their trends are indicators of the

health of the overall economy and are some of the key external factors that impact our business.

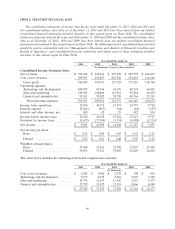

In 2013, we delivered record financial results for net revenues, which increased 22% to more than

$783 million. This increase was driven by a 15% increase in customers, a 14% increase in orders, and a 7%

increase in average order value in our consumer category, as well as increased revenues from new and

existing customers in our enterprise category. In addition, this growth was also supported by our

acquisitions of MyPublisher and BorrowLenses, which expanded our portfolio of premium lifestyle brands

to seven, and R&R Images which added additional printing capabilities. We achieved this growth, while

simultaneously focusing on long term strategic priorities and investments in consumer facing programs and

infrastructure projects that will provide future scale and scope efficiencies. These included the following:

• We launched the beta version of our new, enhanced cloud service, ThisLife, where consumers

can gather and organize photos and videos from across devices, cloud services and social

networks, and which include easy to use features like facial recognition, duplicate detection,

chronological organization, and images search. During 2014, we plan to make continued

investments in features and functionality of this service as we exit the beta stage. However, we

do not expect to generate a significant amount of revenue from this service in 2014.

• We opened our new Fort Mill, South Carolina production facility, which significantly

increased the size of our Southeast manufacturing footprint. During 2013, we entered into

leases for new facilities in Shakopee, Minnesota and Tempe, Arizona which are expected to be

operational in 2014 and 2015, respectively. Our Shakopee facility will provide us with a

production facility in the Midwest, to round out our current West, Northeast, and Southeast

capabilities. It will also provide a level of redundancy in our manufacturing network and

supply chain. Our Arizona facility will allow us to consolidate all of our locations in the

greater Phoenix area, including the recently acquired R&R Images facility, as well as offer

flexibility for future expansion.

• During 2013, we decided to move from our current California based co-location facility to a

new co-location facility in Las Vegas, Nevada. This move will significantly expand our storage

capacity and reduce our power costs. Due to the time duration required for this migration, we

expect to incur duplicate co-location facility costs of between $6 million to $8 million during

2014, as both facilities will be operational.

Finally, to provide for strategic flexibility, we increased our cash position and availability to cash, by

issuing $300 million aggregate principal amount of 0.25% Senior Convertible notes due 2018 (the

‘‘Notes’’), and through the sale of warrants (the ‘‘Warrants’’) in a private offering to qualified institutional

48