Sharp 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

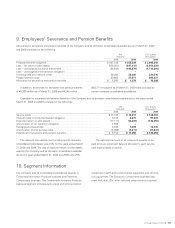

Research and development expenses are charged to income

as incurred. The research and development expenses are

charged to income amounted to ¥196,186 million and

¥195,525 million ($2,015,722 thousand) for the years ended

March 31, 2008 and 2009, respectively.

Software costs are recorded principally in other assets.

Software used by the Company is amortized using the

straight-line method over the estimated useful life of princi-

pally 5 years, and software embedded in products is amor-

tized over the forecasted sales quantity.

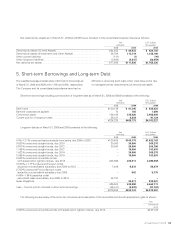

The Company and some of its consolidated subsidiaries use

derivative financial instruments, including foreign exchange

forward contracts and interest rate swap agreements, in

order to hedge the risk of fluctuations in foreign currency

exchange rates and interest rates associated with assets and

liabilities denominated in foreign currencies, investments in

securities and debt obligations.

All derivative financial instruments are stated at fair value

and recorded on the balance sheets. The deferred method is

used for recognizing gains or losses on hedging instruments

and the hedged items. When foreign exchange forward con-

tracts meet certain conditions, the hedged items are stated

by the forward exchange contract rates.

If certain hedging criteria are met, interest rate swaps are

not recognized at their fair values as an alternative method under

Japanese accounting standards. The net amounts received or

paid for such interest rate swap arrangements are charged or

credited to income as incurred.

Derivative financial instruments are used based on inter-

nal policies and procedures on risk control.

The risks of fluctuations in foreign currency exchange

rates and interest rates have been assumed to be completely

hedged over the period of hedging contracts as the major

conditions of the hedging instruments and the hedged items

are consistent. Accordingly, an evaluation of the effectiveness

of the hedging contracts is not required.

The credit risk of such derivatives is assessed as being

low because the counter-parties of these transactions have

good credit ratings with financial institutions.

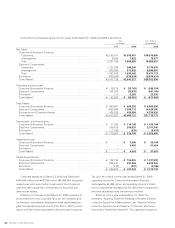

(1) Depreciation Methods Used for Amortization for

Tangible Fixed Assets

Effective for the year ended March 31, 2008, pursuant to an

amendment to the Corporate Tax Law, the Company and its

domestic consolidated subsidiaries have depreciated tangible

fixed assets acquired on and after April 1, 2007 in accordance

with the method stipulated in the amended Corporate Tax Law.

As a result, for the year ended March 31, 2008, operating

income and income before income taxes and minority interests

decreased by ¥7,234 million, compared to amounts calculated

under the previous method. The effect of this change on seg-

mented information is stated in Note 10. Segment Information.

(2) Accounting Method for Reserve for Director and

Corporate Auditor Retirement Benefits

Effective for the year ended March 31, 2008, the amended

“Auditing Treatment Relating to Reserve Defined under the

Special Tax Measurement Law, Reserve Defined under the

Special Law and Reserve for Director and Corporate Auditor

Retirement Benefits” (The Japanese Institute of Certified

Public Accountants (“JICPA”) Auditing and Assurance Prac-

tice Committee Report No. 42, April 13, 2007) have been

adopted. As a result, for the year ended March 31, 2008,

operating income and income before income taxes and

minority interests decreased by ¥133 million and ¥896 million,

respectively, compared to amounts calculated under the

previous method. The effect of this change on segmented

information is stated in Note 10. Segment Information.

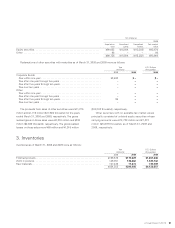

(3) Standard and Method for Measurement

of Inventories

Effective for the year ended March 31, 2009, the Company and

its domestic consolidated subsidiaries have applied the

“Accounting Standard for Measurement of Inventories”

(Accounting Standards Board of Japan (ASBJ) Statement No.

9, issued by the ASBJ on July 5, 2006). As a result, for the year

ended March 31, 2009, operating loss and loss before income

taxes and minority interests increase by ¥5,274 million

($54,371 thousand) and ¥12,919 million ($133,186 thousand),

respectively, compared to amounts calculated under the previ-

ous method.

Also, valuation methods for raw materials and work in

process had previously been based on the last invoice

method. However, effective for the year ended March 31,