Sharp 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

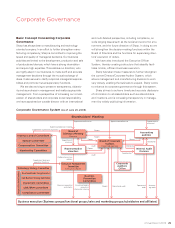

The Board of Directors Meetings of Sharp Corporation are

held on a monthly basis to make decisions on matters

stipulated by law and management-related matters of

importance, and to supervise the state of business execu-

tion. To improve management agility and flexibility, and to

clarify the responsibilities of the company management

during each accounting period, the term of office for

members of the Board of Directors is set at one year.

In addition to the Board of Directors, the Company has

the Executive Management Committee, where matters of

importance related to corporate management and business

operation are discussed and reported twice a month. This

committee facilitates prompt executive decision-making. To

further strengthen our operation and business execution

system we instituted the Executive Officer System from

June 24, 2008. Then, from June 23, 2009 we appointed an

outside director, thereby strengthening decision-making

and supervision of directors’ execution of duties.

The Board of Corporate Auditors formulates audit poli-

cies, listens to reports from accounting auditors, and

receives reports on the execution of duties, in particular from

the Board of Directors. Corporate auditors also exchange

information and opinions on such matters as the progress of

deliberations of important meetings, and auditing (on-site

auditing) results, which increases the validity of audits.

In May 2006, the Board of Directors passed a resolution to

adopt a basic policy related to the development of systems

necessary to ensure the properness of business (Basic

Policy for Internal Control), which has been partially amended

at the Board of Directors Meetings in July 2008 and April

2009. This amended policy forms the basis for Sharp’s ongo-

ing development and implementation of its internal control

system. Sharp has set up the Internal Control Committee as

an advisory body to the Board of Directors. The committee

deliberates on basic policies regarding internal controls and

internal audits, and the state of development and implemen-

tation of initiatives related to the internal control system,

then reports on and discusses important matters with the

Board of Directors. The Internal Control Promotion Depart-

ment within the CSR Promotion Group is responsible for

internal control of all business execution departments

company-wide. Meanwhile the Internal Audit Division

makes concrete proposals on how to improve business

operations and reinforces internal controls by checking the

validity of business execution as well as the appropriateness

and efficiency of management.

To enhance compliance throughout the group, Sharp

introduced the Sharp Group Charter of Corporate Behavior,

a set of principles to guide corporate behavior, and the

Sharp Code of Conduct, which clarifies the conduct

expected of every employee and director of Sharp. Sharp

has also set up a Compliance Committee and is developing

a company-wide compliance promotion system. Meanwhile,

Sharp is taking thorough measures to prevent compliance

breaches by distributing a Sharp Group Compliance

Guidebook to all employees and implementing training

based on the guidebook.

In order to comprehensively and systematically deal

with diverse business risk, Sharp formulated the Business

Risk Management Guideline to achieve prevention of and

swift responses to risk.

When there are attempts to purchase shares of a target

company without the agreement of its board of directors so

as to take control over that company’s policy decisions on

finance and business operations, various inappropriate

actions may result from this objective. These include clearly

harming the corporate value and common interests of the

shareholders, undermining corporate value by harming the

interests of stakeholders such as customers, business

partners and employees, putting undue pressure on

shareholders to sell their shares, not providing sufficient

information about the purchase activity or the buyer, and

not providing enough time for the board of directors of the

target company to provide an alternative plan having con-

sidered the details of the purchase.

Especially, in the case of manufacturing firms such as

Sharp, where in-house development and use of cutting-

edge technologies and manufacturing technologies is

crucial to securing and raising corporate value and the

common interests of shareholders, it may take many

years to commercialize the results of R&D work, during

which time it is essential to build good cooperative rela-

tionships with stakeholders such as customers, business

partners and employees. Therefore, it is essential that

Sharp approaches management from a medium- to long-

term perspective in order to maximize its corporate value.