Royal Caribbean Cruise Lines 2008 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Royal Caribbean Cruises Ltd. F-18

NOTE 17.

RELATED PARTIES

A. Wilhelmsen AS. and Cruise Associates collectively own approxi-

mately 35.7% of our common stock and are parties to a shareholders’

agreement which provides that our board of directors will consist

of four nominees of A. Wilhelmsen AS., four nominees of Cruise

Associates and our Chief Executive Officer. They have the power to

determine, among other things, our policies and the policies of our

subsidiaries and actions requiring shareholder approval.

NOTE 18.

RESTRUCTURING INITIATIVES

During 2008, we implemented a costs savings initiative in response to

the reduction in our profitability. As part of this initiative, we eliminated

approximately 400 shore-side positions. In addition, we discontinued

some non-core operations, including The Scholar Ship. The elimination

of the shore-side positions and the discontinuation of non-core opera-

tions were concluded during the third quarter of 2008. As a result of

this initiative, we incurred charges of approximately $14.3 million, or

$0.07 per share in 2008, comprised of $9.0 million related to termina-

tion benefits and $5.3 million related to contract termination costs.

Expenses related to termination benefits were included in marketing,

selling and administrative expenses and contract termination costs

were included in other operating expenses in the consolidated state-

ments of operations.

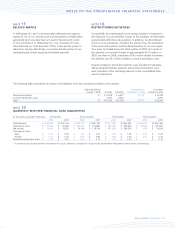

The following table summarizes the status of the liabilities from the cost savings initiative (in thousands):

Beginning Balance Ending Balance Cumulative

January 1, 2008 Accruals Payments December 31, 2008 Charges Incurred

Termination benefits $ – $ 9,039 $ 6,937 $2,102 $ 9,039

Contract termination costs – 5,291 5,291 – 5,291

Total $ – $14,330 $12,228 $2,102 $14,330

NOTE 19.

QUARTERLY SELECTED FINANCIAL DATA (UNAUDITED)

(in thousands, except per share data) First Quarter Second Quarter Third Quarter Fourth Quarter

2008 2007 2008 2007 2008 2007 2008 2007

Total revenues

1 $1,429,085 $1,223,126 $1,583,774 $1,481,325 $2,063,389 $1,953,592 $1,456,277 $1,491,095

Operating income $ 137,568 $ 79,643 $ 168,950 $ 200,883 $ 461,907 $ 482,834 $ 63,559 $ 137,974

Net income $ 75,607 $ 8,825 $ 84,749 $ 128,745 $ 411,887 $ 395,000 $ 1,479 $ 70,834

Earnings per share:

Basic $ 0.35 $ 0.04 $ 0.40 $ 0.61 $ 1.93 $ 1.85 $ 0.01 $ 0.33

Diluted $ 0.35 $ 0.04 $ 0.40 $ 0.60 $ 1.92 $ 1.84 $ 0.01 $ 0.33

Dividends declared per share $ 0.15 $ 0.15 $ 0.15 $ 0.15 $ 0.15 $ 0.15 $ – $ 0.15

1 Our revenues are seasonal based on the demand for cruises. Demand is strongest for cruises during the Northern Hemisphere summer months and holidays.