Royal Caribbean Cruise Lines 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 31

$1.1 billion at December 31, 2007. Substantially all customer deposits

represent deferred revenue rather than an actual current cash liability.

We generate substantial cash flows from operations and our business

model has historically allowed us to maintain this working capital deficit

and still meet our operating, investing and financing needs. We expect

that we will continue to have working capital deficits in the future.

We have four Solstice-class vessels under construction in Germany, all

of which have committed bank financing arrangements and include

financing guarantees from HERMES (Euler Hermes Kreditrersicherungs

AG), the export credit agency of the German government for 95% of

the financed amount. The terms of the financing guarantees and bank

commitments are similar to those established for the Celebrity Solstice

and are executable at our option. During 2008, we signed a credit

agreement for our fifth Solstice-class ship and have elected our option

to finance Celebrity Equinox. We must elect to use the remaining com-

mitments within six months of the relevant ship delivery and they are

each subject to customary funding conditions.

We also have two Oasis-class vessels under construction in Finland.

Oasis of the Seas is scheduled for delivery in the fourth quarter of

2009 and Allure of the Seas is scheduled for delivery in late 2010. We

have commitments for financing guarantees from Finnvera, the export

credit agency of Finland for 80% of the financed amount. We must

elect to use these commitments within five months of the ship delivery

and they are each subject to customary funding conditions. We are

working with the relevant export credit agencies and various financial

institutions to obtain committed financing for Oasis of the Seas. This

includes exploring opportunities to increase the guarantee level and

obtain partial funding support from the relevant export credit agencies.

Although we believe that we will secure committed financing for these

ships before their delivery dates, there can be no assurance that we will

be able to do so or that we will do so on acceptable terms.

The current worldwide economic downturn has adversely impacted

our cash flows from operations. In addition, the turmoil in the credit

and capital markets may make it more difficult for us to secure new

financing or to raise additional capital or to do so on acceptable terms.

During 2008, our credit rating was lowered from BBB– with a nega-

tive outlook to BB with a negative outlook by Standard and Poor’s. In

January 2009, Standard and Poor’s placed our credit rating on credit

watch with negative implications. In addition, our credit rating was

lowered from Ba1 with a stable outlook to Ba2 with a negative outlook

by Moody’s. There is no assurance that our credit ratings will not be

lowered further. The lowering of our credit ratings may increase our

cost of financing and can make it more difficult for us to access the

credit and capital markets.

In response to the current environment and in light of our funding

needs, we have increased our focus on preserving cash and improving

our liquidity. We have discontinued our dividends, curtailed our non-

shipbuild capital expenditures, currently do not have plans to place

further newbuild orders, and are working with various financial institu-

tions to secure financing for our Oasis-class ships. In addition, we may

elect to fund our contractual obligations through other means if current

conditions in the capital markets improve. While we anticipate that our

cash flows from operations, our current available credit facilities, our cur-

rent financing arrangements and those that we expect to obtain will

be adequate to meet our capital expenditures and debt repayments

over the next twelve-month period, there can be no assurance that

this will be the case.

If any person other than A. Wilhelmsen AS. and Cruise Associates, our

two principal shareholders, acquires ownership of more than 30% of

our common stock and our two principal shareholders, in the aggre-

gate, own less of our common stock than such person and do not

collectively have the right to elect, or to designate for election, at least

a majority of the board of directors, we may be obligated to prepay

indebtedness outstanding under the majority of our credit facilities,

which we may be unable to replace on similar terms. If this were to

occur, it could have an adverse impact on our liquidity and operations.

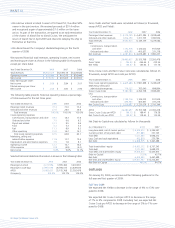

DEBT COVENANTS

Our financing agreements contain covenants that require us, among

other things, to maintain minimum net worth and fixed coverage

ratio and limit our net debt-to-capital ratio. Our minimum net worth

and maximum net debt-to-capital calculations exclude the impact of

accumulated other comprehensive income (loss) on total shareholders’

equity. The fixed coverage ratio is calculated by dividing net cash from

operations by the sum of dividend payments plus scheduled principal

debt payments in excess of any new financings. We are currently in

compliance with all debt covenants. The specific covenants and related

definitions can be found in the applicable debt agreements, the majority

of which have been previously filed with the Securities and Exchange

Commission. As of December 31, 2008, our net worth was $7.1 billion

compared with a minimum requirement of $5.1 billion, our fixed cover-

age ratio was 8.37x compared with a minimum requirement of 1.25x

and our net-debt-to-capital ratio was 48.1% compared to a maximum

requirement of 62.5%.

DIVIDENDS

During fiscal year 2008, we paid out dividends totaling $128.0 million.

In November 2008 our board of directors discontinued our quarterly

dividend commencing with the fourth quarter of 2008. This decision

is intended to enhance our liquidity during this period of heightened

economic and financial market uncertainty.

ITEM 7A. QUANTITATIVE AND QUALITATIVE

DISCLOSURES ABOUT MARKET RISK

FINANCIAL INSTRUMENTS AND OTHER

General

We are exposed to market risk attributable to changes in interest

rates, foreign currency exchange rates and fuel prices. We manage

these risks through a combination of our normal operating and financ-

ing activities and through the use of derivative financial instruments

pursuant to our hedging practices and policies. The financial impacts

of these hedging instruments are primarily offset by corresponding

changes in the underlying exposures being hedged. We achieve this

by closely matching the amount, term and conditions of the derivative

instrument with the underlying risk being hedged. We do not hold or

issue derivative financial instruments for trading or other speculative

purposes. We monitor our derivative positions using techniques includ-

ing market valuations and sensitivity analyses. (See Note 15. Fair Value

Measurements to our consolidated financial statements under Item 8.

Financial Statements and Supplementary Data.)

PART II