Royal Caribbean Cruise Lines 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

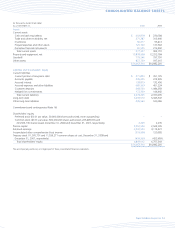

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

F-11 Royal Caribbean Cruises Ltd.

We discounted the projected cash flows using rates specific to each

reporting unit based on their respective weighted average cost of capital.

Based on the probability-weighted discounted cash flows of each report-

ing unit we determined the fair values of Royal Caribbean International

and Pullmantur exceeded their carrying values. Therefore, we did not

proceed to step two of the impairment analysis and we do not consider

goodwill to be impaired.

NOTE 5.

INTANGIBLE ASSETS

Intangible assets consist of the following (in thousands):

2008 2007

Indefinite-life intangible asset –

Pullmantur tradename $246,014 $222,525

Foreign currency translation adjustment (10,404) 23,489

Total $235,610 $246,014

We performed the annual impairment review of our trademarks and

trade names during the fourth quarter of 2008 using a discounted cash

flow model and the relief-from-royalty method. The royalty rate used is

based on comparable royalty agreements in the tourism and hospitality

industry. We used the same discount rate used in valuing the Pullmantur

reporting unit. Based on the discounted cash flow model we deter-

mined the fair value of our trademarks and trade names exceeded

their carrying value.

Finite-life intangible assets and related accumulated amortization are

immaterial to our 2008, 2007, and 2006 consolidated financial statements.

NOTE 6.

PROPERTY AND EQUIPMENT

Property and equipment consists of the following (in thousands):

2008 2007

Land $ 16,288 $ 16,288

Ships 16,214,832 14,284,639

Ships under construction 749,822 652,131

Other 862,129 705,304

17,843,071 15,658,362

Less – accumulated depreciation

and amortization (3,964,073) (3,404,578)

$13,878,998 $12,253,784

Ships under construction include progress payments for the construc-

tion of new ships as well as planning, design, interest, commitment

fees and other associated costs. We capitalized interest costs of

$44.4 million, $39.9 million and $27.8 million for the years 2008,

2007 and 2006, respectively.

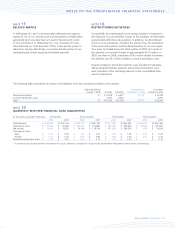

NOTE 7.

OTHER ASSETS

Variable Interest Entities

Financial Accounting Standard Board Interpretation No. 46 (Revised),

Consolidation of Variable Interest Entities (“FIN 46”), addresses con-

solidation by business enterprises of Variable Interest Entities (“VIEs”),

which are entities in which the equity investors have not provided enough

equity to finance its activities or the equity investors (1) cannot directly

or indirectly make decisions about the entity’s activities through their

voting rights or similar rights; (2) do not have the obligation to absorb

the expected losses of the entity; (3) do not have the right to receive the

expected residual returns of the entity; or (4) have voting rights that are

not proportionate to their economic interests and the entity’s activities

involve or are conducted on behalf of an investor with a disproportion-

ately small voting interest.

We have determined that our 40% minority interest in a ship repair

and maintenance facility which we invested in 2001 and again in 2008,

is a VIE. The facility serves cruise and cargo ships, oil and gas tankers,

and offshore units. We utilize this facility, amongst other ship repair

facilities, for our regularly scheduled drydocks and certain emergency

repairs as may be required. As of December 31, 2008, our investment

in this entity including equity and loans, which is also our maximum

exposure to loss as we are not contractually required to provide any

financial or other support to the facility, was approximately $72.2 mil-

lion and was included within other assets in the consolidated balance

sheet. Of this amount, $26.1 million was invested in 2008 as part of

an expansion of the facility. We have determined we are not the primary

beneficiary as we would not absorb a majority of the facility’s expected

losses nor receive a majority of the facility’s residual returns. Accord-

ingly, we do not consolidate this entity and account for this investment

under the equity method of accounting.

In conjunction with our acquisition of Pullmantur, we obtained a 49%

minority interest in Pullmantur Air, S.A. (“Pullmantur Air”), a small air

business that operates three aircraft in support of Pullmantur’s opera-

tions. We have determined Pullmantur Air is a VIE for which we are the

primary beneficiary as we are obligated to absorb the losses. In accor-

dance with FIN46, we have consolidated the assets and liabilities of

Pullmantur Air at their fair value. The assets and liabilities of Pullmantur

Air are immaterial to our December 31, 2008 and 2007 consolidated

financial statements.

Other

During 2007, we received proceeds from the repayment of $100.0 mil-

lion of notes from TUI Travel, which we purchased in March 2006.