Royal Caribbean Cruise Lines 2008 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 25

The current economic environment has also led to more dramatic levels

of volatility in fuel prices and foreign exchange rates which have become

extremely volatile with significant daily or even hourly price fluctuations.

For planning purposes, we do not forecast future fuel prices or exchange

rates, but instead use current spot prices for calculation purposes.

In an effort to offset the impact of the weaker demand environment,

we have increased our focus on cost reductions and on preserving cash

and liquidity. The cost cutting initiatives we announced in July 2008 are

on track to produce the anticipated savings and we have implemented

a number of new initiatives including the targeting of synergies and

capturing deflationary opportunities from our vendors. As a result of

these initiatives, we expect a reduction in our 2009 Net Cruise Costs

in the range of 7% to 9% per APCD compared to 2008. Approximately

2 percentage points of this decrease relates to reductions in the price of

fuel in 2009.

We have also discontinued our quarterly dividend commencing in the

fourth quarter of 2008, curtailed our non-shipbuild capital expendi-

tures, and currently do not have plans to place further newbuild ship

orders. We are also exploring other activities to improve our liquidity.

We believe these strategies will enhance our ability to better fund our

capital spending obligations and improve our balance sheet.

While cutting costs throughout the organization, we have not altered

our strategy of substantially growing our sourcing of passengers out-

side of North America. We continue to increase our investments in

growth outside of North America with the goal of diversifying our

sources and increasing our opportunities for revenue growth.

We have four Solstice-class vessels under construction in Germany, all

of which have committed bank financing arrangements and include

financing guarantees from HERMES (Euler Hermes Kreditrersicherungs

AG), the export credit agency of the German government for 95%

of the financed amount. We also have two Oasis-class vessels under

construction in Finland each of which has commitments for financ-

ing guarantees from Finnvera, the export credit agency of Finland for

80% of the financed amount. We are working with the relevant export

credit agencies and various financial institutions to obtain committed

financing for Oasis of the Seas. This includes exploring opportunities to

increase the guarantee level and obtain partial funding support from

the relevant export credit agencies. Although we believe that we will

secure committed financing for these ships before their delivery dates,

there can be no assurance that we will be able to do so or that we will

do so on acceptable terms.

SUMMARY OF HISTORICAL RESULTS OF OPERATIONS

Although the operating environment has deteriorated since September

2008, total revenues increased 6.2% to $6.5 billion from total revenues

of $6.1 billion for 2007 primarily due to a 5.2% increase in capacity and

a 1.0% increase in Gross Yields. Net Yields increased by approximately

0.5% compared to 2007. The increase in Net Yields was primarily due

to an increase in ticket prices partially offset by a decrease in onboard

and other revenues. The increase in total revenues was partially offset

by an increase in expenses primarily due to the increase in fuel and to

a lesser extent, payroll and related expenses. In addition, we recorded

a one-time litigation gain of approximately $17.6 million related to the

settlement of our pending case against Pentair Water Treatment (OH)

Company (formerly known as Essef Corporation). As a result, our net

income was $573.7 million or $2.68 per share on a diluted basis for

2008 compared to $603.4 million or $2.82 per share on a diluted basis

for 2007.

Highlights for 2008 included:

s Total revenues increased 6.2% to $6.5 billion from total revenues

of $6.1 billion in 2007 primarily due to a 5.2% increase in capacity

and a 1.0% increase in Gross Yields. Net Yields increased by approxi-

mately 0.5% compared to the same period in 2007.

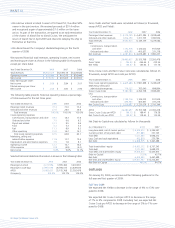

s Net Cruise Costs per APCD increased 3.7% compared to 2007.

s Fuel expenses per APCD, net of the financial impact of fuel swap

agreements, increased 25.7% per APCD as compared to the same

period in 2007.

s Our Net Debt-to-Capital ratio increased to 49.3% in 2008 from

44.7% in 2007. Similarly, our Debt-to-Capital ratio increased to

50.8% in 2008 from 45.7% in 2007.

s As of December 31, 2008, liquidity was $1.0 billion, including cash

and the undrawn portion of our unsecured revolving credit facility.

s We took delivery of Independence of the Seas, the third Freedom-

class ship for Royal Caribbean International in the second quarter

of 2008. To finance the purchase, we borrowed $530.0 million

under an unsecured term loan due through 2015. The loan bears

interest at LIBOR plus an applicable margin. Currently, the rate is

approximately 5.40%.

s We took delivery of Celebrity Solstice, the first Solstice-class ship

for Celebrity Cruises in the fourth quarter of 2008. To finance the

purchase, we borrowed $519.1 million under an unsecured term

loan due through 2020. The loan bears interest at LIBOR plus 0.45%;

the rate is currently 4.28%.

s We implemented a cost savings initiative expected to save approxi-

mately $125.0 million annually. As part of this initiative, we eliminated

approximately 400 shore-side positions. In addition, we discontinued

some non-core operations, including The Scholar Ship. As a result of

this initiative, we incurred charges of approximately $14.3 million, or

$0.07 per share.

s We settled our pending case against Pentair Water Treatment (OH)

Company (formerly known as Essef Corporation). Pursuant to the

terms of the settlement agreement, we were paid, net of costs and

payments to insurers, approximately $17.6 million which we recog-

nized during the third quarter.

s We finalized our contract with Meyer Werft GmbH to build a fifth

Solstice-class ship for Celebrity Cruises, for an additional capacity

of approximately 2,850 berths, which is expected to enter service in

the fourth quarter of 2012. We signed a credit agreement to finance

approximately 80% of the contract price at delivery.

PART II