Royal Caribbean Cruise Lines 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

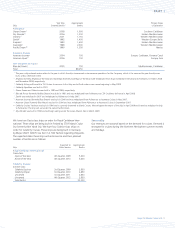

Royal Caribbean Cruises Ltd. 11

PART I

We maintain war risk insurance for our ships, including terrorist risk

insurance, on each ship through a Norwegian war risk insurance

organization. This coverage includes coverage for physical damage to

the ship which is not covered under the hull policies as a result of war

exclusion clauses in such hull policies. We also maintain protection and

indemnity war risk coverage for risks that would be excluded by the

rules of the indemnity insurance organizations, subject to certain limita-

tions. Consistent with most marine war risk policies, under the terms

of our war risk insurance coverage, underwriters can give seven days

notice to us that the policy will be canceled and reinstated at higher

premium rates.

We also maintain insurance coverage for certain events, which would

result in a delayed delivery of our contracted new ships, which we

normally place starting approximately two years prior to the scheduled

delivery dates.

Insurance coverage for shoreside property, shipboard inventory, and

general liability risks are maintained with insurance underwriters in

the United States and the United Kingdom.

We do not carry business interruption insurance for our ships nor

our shoreside operations based on our evaluation of the risks involved

and protective measures already in place, as compared to the cost

of insurance.

All insurance coverage is subject to certain limitations, exclusions and

deductible levels. In addition, in certain circumstances, we co-insure a

portion of these risks. Premiums charged by insurance carriers, includ-

ing carriers in the maritime insurance industry, increase or decrease

from time to time and tend to be cyclical in nature. These cycles are

impacted both by our own loss experience and by losses incurred

in direct and reinsurance markets. We historically have been able

to obtain insurance coverage in amounts and at premiums we have

deemed to be commercially acceptable. No assurance can be given

that affordable and secure insurance markets will be available to us

in the future, particularly for war risk insurance.

The Athens Convention relating to the Carriage of Passengers and their

Luggage by Sea (1974) and the 1976 Protocol to the Athens Conven-

tion are generally applicable to passenger ships. The United States has

not ratified the Athens Convention; however, with limited exceptions,

the 1976 Athens Convention Protocol may be contractually enforced

with respect to those of our cruises that do not call at a United States

port. The International Maritime Organization Diplomatic Conference

agreed upon a new Protocol to the Athens Convention on November 1,

2002. The 2002 Protocol, which is not yet in force, substantially increases

the level of compulsory insurance, which must be maintained by pas-

senger ship operators. No assurance can be given as to if or when the

2002 Protocol will come into force. If in force, no assurance can be

given that affordable and secure insurance markets will be available

to provide the level of coverage required under the 2002 Protocol.

TRADEMARKS

We own a number of registered trademarks related to the Royal Carib-

bean International, Celebrity Cruises, Pullmantur, Azamara Cruises

and CDF Croisières de France cruise brands. The registered trademarks

include the name “Royal Caribbean” and its crown and anchor logo,

the name “Celebrity Cruises” and its “X” logo, the names “Pullman-

tur Cruises” and “Pullmantur” and their logos, the name “Azamara

Cruises” and its logo, the name “CDF Croisières de France” and its

logo, and the names of various cruise ships. We believe trademarks

related to the Royal Caribbean International, Celebrity Cruises and Pull-

mantur Cruises brands are widely recognized throughout the world and

have considerable value. We also believe trademarks related to our new

brands, Azamara Cruises and CDF Croisières de France, have received

recent recognition throughout the world and have significant value.

REGULATION

Our ships are regulated by various international, national, state and

local laws, regulations and treaties in force in the jurisdictions in which

they operate. In addition, our ships are registered in the Bahamas,

Malta or in the case of Celebrity Xpedition, Ecuador. Each ship is

subject to regulations issued by its country of registry, including reg-

ulations issued pursuant to international treaties governing the safety

of the ship and its passengers. Each country of registry conducts

periodic inspections to verify compliance with these regulations. Ships

operating out of United States ports are subject to inspection by the

United States Coast Guard for compliance with international treaties

and by the United States Public Health Service for sanitary conditions.

Our ships are also subject to similar inspections pursuant to the laws

and regulations of various other countries our ships visit.

Our ships are required to comply with international safety standards

defined in the Safety of Life at Sea Convention. The Safety of Life at

Sea Convention standards are revised from time to time and the most

recent modifications are being phased in through 2010. We do not

anticipate that we will be required to make any material expenditures

in order to comply with these rules.

We are required to obtain certificates from the United States Federal

Maritime Commission relating to our ability to satisfy liability in cases

of non-performance of obligations to passengers, as well as casualty

and personal injury. Pursuant to the United States Federal Maritime

Commission regulations, we arrange through our insurers for the pro-

vision of guarantees aggregating $45.0 million for our ship-operating

companies as a condition to obtaining the required certificates. The

United States Federal Maritime Commission has proposed various

revisions to the financial responsibility regulations, which could require

us to significantly increase the amount of our bonds and accordingly

increase our costs of compliance.

We are also required by the United Kingdom and other jurisdictions to

establish our financial responsibility for any liability resulting from the

non-performance of our obligations to passengers from these jurisdic-

tions. In the United Kingdom, we are currently required by the United

Kingdom Passenger Shipping Association to provide performance

bonds totaling approximately £42.0 million. We are also required to

pay to the United Kingdom Civil Aviation Authority a non-refundable

tax of £1 per passenger.

We are subject to various United States and international laws and

regulations relating to environmental protection. Under such laws

and regulations, we are prohibited from, among other things, dis-

charging certain materials, such as petrochemicals and plastics, into

the waterways. We have made, and will continue to make, capital and

other expenditures to comply with environmental laws and regulations.