Royal Caribbean Cruise Lines 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 3

PART I

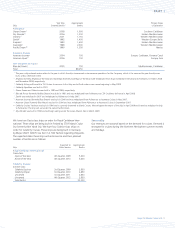

The following table details the growth in the global and North American cruise markets in terms of cruise passengers and estimated weighted-

average berths over the past five years:

Weighted-Average

Weighted-Average North American Supply of Berths

Global Cruise Supply of Berths Cruise Marketed in

Year Passengers

(1) Marketed Globally

(1) Passengers

(2) North America

(1)

2004 13,757,000 265,000 9,108,000 207,000

2005 14,818,000 282,000 9,909,000 216,000

2006 15,309,000 299,000 10,080,000 227,000

2007 16,586,000 323,000 10,330,000 242,000

2008 17,184,000 345,000 10,815,000 254,000

(1) Source: Our estimates.

(2) Source: Cruise Line International Association based on cruise passengers carried for at least two consecutive nights.

In an effort to penetrate untapped markets and diversify our customer

base, we have redeployed some of the ships in our Royal Caribbean

International and Celebrity Cruises brands from the North American

market to Europe, Latin America and Asia. This redeployment has

contributed to an increase in the growth of our global cruise brands

outside of the North American market.

Although the global and North American cruise markets have grown

steadily over the past several years, the recent weakening of the United

States and other economies has significantly deteriorated consumer

confidence and discretionary spending. This has caused a global drop in

demand for cruises and a resulting drop in cruise prices. The long-term

impact of these conditions on the continued growth of the cruise mar-

ket will depend on the depth and duration of this worldwide economic

downturn. In addition, the projected increase in capacity within the cruise

industry from new cruise ships currently on order could produce addi-

tional pricing pressures within the industry. See Item 1A. Risk Factors.

We compete with a number of cruise lines; however, our principal

competitors are Carnival Corporation & plc, which owns, among

others, Aida Cruises, Carnival Cruise Lines, Costa Cruises, Cunard

Line, Holland America Line, P&O Cruises and Princess Cruises and has

a joint venture with Orizonia Corporation under which they operate

Iberocruceros; Disney Cruise Line; MSC Cruises; Norwegian Cruise Line

and Oceania Cruises. Cruise lines compete with other vacation alter-

natives such as land-based resort hotels and sightseeing destinations

for consumers’ leisure time. Demand for such activities is influenced

by political and general economic conditions. Companies within the

vacation market are dependent on consumer discretionary spending.

Although vacation spending is likely to be curtailed significantly in the

midst of the current worldwide economic downturn, we believe that

cruising is perceived by consumers as a good value when compared

to other vacation alternatives.

Our ships operate worldwide and have itineraries that call on destina-

tions in Alaska, Asia, Australia, the Bahamas, Bermuda, California,

Canada, the Caribbean, Europe, the Galapagos Islands, Hawaii, Mexico,

New England, New Zealand, the Panama Canal and South America.

OPERATING STRATEGIES

Our principal operating strategies are to:

s manage the efficiency of our operating expenditures and preserve

cash and liquidity during the current worldwide economic downturn,

s increase the awareness and market penetration of our brands,

s expand our fleet with the new state-of-the-art cruise ships currently

on order,

s expand into new markets and itineraries,

s continue to expand and diversify our passenger mix through passen-

ger sourcing outside North America,

s protect the health, safety and security of our passengers and

employees and protect the environment in which our vessels

and organization operate,

s utilize sophisticated revenue management capabilities to optimize

revenue based on demand for our products,

s further improve our technological capabilities, and

s maintain strong relationships with travel agencies, the principal indus-

try distribution channel, while offering direct access for consumers.

Manage Operating Expenditures and Preserve Cash and Liquidity

During the current worldwide economic downturn we are focused on

maximizing the efficiency of our operating expenditures and preserving

cash and liquidity. During 2008, we announced the reduction in our

workforce of approximately 400 shoreside positions and implemented

a number of cost-saving initiatives in an effort to reduce our operating

costs. To preserve liquidity, we have discontinued our quarterly dividend

commencing in the fourth quarter of 2008, curtailed our non-shipbuild

capital expenditures, and currently do not have plans to place further

newbuild orders. We believe these strategies will enhance our ability to

fund our capital spending obligations and improve our balance sheet.