Royal Caribbean Cruise Lines 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

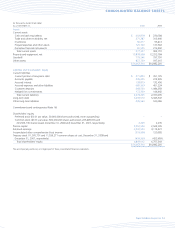

Royal Caribbean Cruises Ltd. F-6

Accumulated

Other Total

Common Paid-in Retained Comprehensive Treasury Shareholders’

(in thousands) Stock Capital Earnings Income (Loss) Stock Equity

Balances at January 1, 2006 $2,165 $2,706,236 $3,132,286 $ (28,263) $(257,959) $5,554,465

Issuance under employee related plans 12 42,031 – – (559) 41,484

Purchases of treasury stock – – – – (164,582) (164,582)

Common stock dividends – – (126,997) – – (126,997)

Changes related to cash flow derivative hedges – – – 3,507 – 3,507

Adoption of SFAS Statement No. 158 – – – (6,981) – (6,981)

Minimum pension liability adjustment – – – 834 – 834

Foreign currency translation adjustments – – – 101 – 101

Debt converted to common stock 48 155,774 – – – 155,822

Net income – – 633,922 – – 633,922

Balances at December 31, 2006 2,225 2,904,041 3,639,211 (30,802) (423,100) 6,091,575

Issuance under employee related plans 10 38,894 – – (559) 38,345

Common stock dividends – – (127,739) – – (127,739)

Changes related to cash flow derivative hedges – – – 152,523 – 152,523

Change in defined benefit plans – – – 3,500 – 3,500

Foreign currency translation adjustments – – – (4,266) – (4,266)

Net income – – 603,405 – – 603,405

Balances at December 31, 2007 2,235 2,942,935 4,114,877 120,955 (423,659) 6,757,343

Issuance under employee related plans 4 9,605 – – (701) 8,908

Common stock dividends – – (96,070) – – (96,070)

Changes related to cash flow derivative hedges – – – (430,051) – (430,051)

Change in defined benefit plans – – – (2,835) – (2,835)

Foreign currency translation adjustments – – – (8,005) – (8,005)

Net income – – 573,722 – – 573,722

Balances at December 31, 2008 $2,239 $2,952,540 $4,592,529 $(319,936) $(424,360) $6,803,012

Comprehensive income is as follows (in thousands):

Year Ended December 31, 2008 2007 2006

Net income

$ 573,722 $ 603,405 $ 633,922

Changes related to cash flow derivative hedges (430,051) 152,523 3,507

Minimum pension liability adjustment – – 834

Change in defined benefit plans (2,835) 3,500 –

Foreign currency translation adjustments (8,005) (4,266) 101

Total comprehensive income $ 132,831 $ 755,162 $ 638,364

The following tables summarize activity in accumulated other comprehensive income (loss) related to derivatives designated as cash flow hedges,

change in defined benefit plans and the foreign currency translation adjustments (in thousands):

Year Ended December 31, 2008 2007 2006

Accumulated net (loss) gain on cash flow derivative hedges at beginning of year $ 137,859 $ (14,664) $ (18,171)

Net gain (loss) on cash flow derivative hedges (374,810) 163,444 (7,483)

Net (loss) gain reclassified into earnings (55,241) (10,921) 10,990

Accumulated net gain (loss) on cash flow derivative hedges at end of year $(292,192) $ 137,859 $ (14,664)

Changes Foreign Accumulated

Related to Cash Change in Currency Other

Flow Derivative Defined Translation Comprehensive

Hedges Benefit Plans Adjustments Income (Loss)

Accumulated other comprehensive loss at beginning of the year $ 137,859 $ (12,739) $ (4,165) $ 120,955

Current-period change (430,051) (2,835) (8,005) (440,891)

Accumulated other comprehensive loss at end of year $ (292,192) $ (15,574) $ (12,170) $ (319,936)

The accompanying notes are an integral part of these consolidated financial statements.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY