Royal Caribbean Cruise Lines 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other

Some of the contracts that we enter into include indemnification pro-

visions that obligate us to make payments to the counterparty if cer-

tain events occur. These contingencies generally relate to changes

in taxes, increased lender capital costs and other similar costs. The

indemnification clauses are often standard contractual terms and

are entered into in the normal course of business. There are no stat-

ed or notional amounts included in the indemnification clauses and

we are not able to estimate the maximum potential amount of future

payments, if any, under these indemnification clauses. We have not

been required to make any payments under such indemnification

clauses in the past and, under current circumstances, we do not

believe an indemnification in any material amount is probable.

If any person other than A. Wilhelmsen AS. and Cruise Associates,

our two principal shareholders, acquires ownership of more than

30% of our common stock and our two principal shareholders, in

the aggregate, own less of our common stock than such person

and do not collectively have the right to elect, or to designate for

election, at least a majority of the board of directors, we may be

obligated to prepay indebtedness outstanding under the majority

of our credit facilities, which we may be unable to replace on sim-

ilar terms. If this were to occur, it could have an adverse impact on

our liquidity and operations.

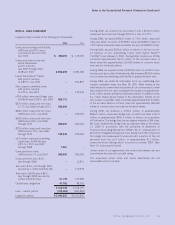

At December 31, 2006, we have future commitments to pay for our

usage of certain port facilities, marine consumables, services and

maintenance contracts as follows (in thousands):

Year

2007 $ 138,511

2008 87,353

2009 42,846

2010 30,795

2011 25,582

Thereafter 103,242

$ 428,329

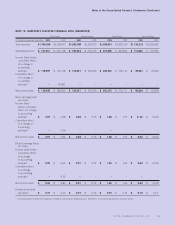

NOTE 13. RELATED PARTIES

A. Wilhelmsen AS. and Cruise Associates collectively own approxi-

mately 35.9% of our common stock and are parties to a sharehold-

ers’ agreement which provides that our board of directors will consist

of four nominees of A. Wilhelmsen AS., four nominees of Cruise

Associates and our Chief Executive Officer. They have the power to

determine, among other things, our policies and the policies of our

subsidiaries and actions requiring shareholder approval.

NOTE 14. SUBSEQUENT EVENTS

In January 2007, we issued ¤1.0 billion, or approximately $1.3 bil-

lion, of 5.63% senior unsecured notes due 2014 at a price of

99.638% of par. The net proceeds from the offering were used to

retire the ¤701.0 million, or approximately $925.1 million, drawn on

the ¤750.0 million, or approximately $960.5 million, unsecured

bridge loan facility obtained to finance our acquisition of Pullmantur.

The remainder of the net proceeds, approximately ¤289.0 million, or

approximately $374.8 million, were used to repay a portion of the

outstanding balance on our unsecured revolving credit facility.

In February 2007, we entered into interest rate swap agreements

that effectively change ¤1.0 billion of fixed rate debt with a weight-

ed-average fixed rate of 5.63% to EURIBOR-based floating rate

debt. We also entered into cross currency swap agreements that

effectively change ¤300.0 million of floating EURIBOR-based debt

to $389.1 million of floating LIBOR-based debt.

38 ROYAL CARIBBEAN CRUISES LTD.

Notes to the Consolidated Financial Statements (Continued)