Royal Caribbean Cruise Lines 2006 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2006 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dear Fellow Shareholders:

It has been a dramatic year for us, encompassing not only normal operations but also strategic steps to grow our business more globally,

ordering new ships, revitalizing our fleet and solidifying our brands’ market positions.

Over the last few years, our brands have been very successful in strengthening their image in their respective markets. This effort has

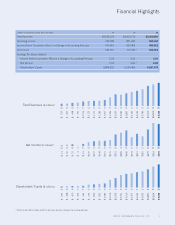

resulted in yield increases of more than 21 percent during the last three years alone. Last year’s contribution was a 3.4 percent increase in

yields. The key has been our brands’ success in differentiating themselves in the marketplace. Driven by modest capacity increases and

better pricing, our total revenues have increased to $5.2 billion. And, despite a 26.7 percent increase in fuel prices, we generated earnings

per share of $2.94 compared to $3.03 before the cumulative effect of a change in accounting principle for 2005.

We have launched several strategic initiatives to leverage our strengths, address some of our challenges, and seed our future with exciting

opportunities, including:

• We acquired the largest cruise line in Spain, Pullmantur S.A., in November 2006 for an enterprise value of approximately $900 million.

• We took delivery of the world’s largest and most innovative vessel,

Freedom of the Seas

, in April 2006, the first of three vessels in her class.

• We placed four additional ship orders, two for Royal Caribbean International and two for Celebrity Cruises, bringing our total number

of ships on order to seven for an additional capacity of approximately 26,550 berths. These vessels will continue our tradition of

innovation, while generating revenue premiums and providing cost efficiencies.

• We continued our vessel revitalization program, with major refurbishments to

Celebrity Century

and Royal Caribbean’s

Majesty of the

Seas.

This program ensures the competitiveness of our older vessels and enhances their financial performance.

While we have positive momentum on our side, we still face challenges. Fuel costs, despite some recent pull-back, remain high and volatile.

We have taken aggressive steps to reduce our energy consumption and to reduce our fuel expense. These initiatives have saved us tens of

millions of dollars, but they can’t completely offset the dramatic surge in fuel prices, which affected our earnings by $0.51 per share.

The acquisition of Pullmantur gives a real boost to our strategic ambitions in Europe, making us the largest operator in Spain and Portugal,

one of the fastest-growing market regions in Europe. This is Royal Caribbean’s first wholly owned European brand, and we look forward to

growing Pullmantur to its full potential. Royal Caribbean International and Celebrity Cruises already attract 18 percent of their revenues

from non-U.S. sources, clearly demonstrating the international attractiveness of our brands. At the same time, Pullmantur addresses the

dedicated national brand market along with our Island Cruises joint venture.

We recently announced a ship swap between different parts of our businesses, which shows the flexibility our fleet portfolio provides.

The ship swaps add capacity to Pullmantur, while enabling us to introduce a soon-to-be named, new ultra-premium brand.

2 ROYAL CARIBBEAN CRUISES LTD.