Royal Caribbean Cruise Lines 2006 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2006 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

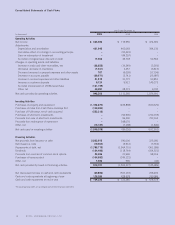

Our debt agreements contain covenants that require us, among

other things, to maintain minimum net worth and fixed charge cov-

erage ratio and limit our net debt-to-capital ratio. We are in compli-

ance with all covenants as of December 31, 2006. Following is a

schedule of annual maturities on long-term debt as of December 31,

2006 for each of the next five years (in thousands):

Year

2007 $ 373,422

2008 283,371

2009 265,113

2010 1,058,493

2011 619,735

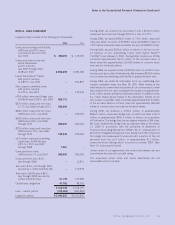

NOTE 7. SHAREHOLDERS’ EQUITY

In September 2005, we announced that we and an investment bank

had finalized a forward sale agreement relating to an Accelerated

Share Repurchase (“ASR”) transaction. The forward sale agreement

matured in February 2006. As part of the ASR transaction, we pur-

chased 5.7 million shares of our common stock from the investment

bank at a price of $43.67 per share. Total consideration paid to

repurchase such shares, including commissions and other fees, was

approximately $249.1 million and was recorded in shareholders'

equity as a component of treasury stock.

On June 2, 2006, we announced that we and an investment bank

had finalized a forward sale agreement relating to an Accelerated

Share Repurchase (“ASR”) transaction. The forward sale agree-

ment matured in August 2006. As part of the ASR transaction, we

purchased 4.6 million shares of our common from the investment

bank at a price of $35.99 per share. Total consideration paid to

repurchase such shares, including commissions and other fees,

was approximately $164.6 million and was recorded in sharehold-

ers' equity as a component of treasury stock.

We declared cash dividends on our common stock of $0.15 per

share in each of the quarters of 2006. Cash dividends of $0.13 per

share were declared in each of the first and second quarters of 2005

and $0.15 per share in each of the third and fourth quarters of 2005.

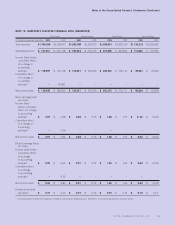

NOTE 8. EARNINGS PER SHARE

A reconciliation between basic and diluted earnings per share is as

follows (in thousands, except per share data):

Year Ended December 31,

2006 2005 2004

Income before cumulative

effect of a change in

accounting principle $633,922 $663,465 $474,691

Cumulative effect of a

change in accounting

principle (Note 2) – 52,491 –

Net income 633,922 715,956 474,691

Interest on dilutive

convertible notes 17,237 48,128 54,530

Net income for diluted

earnings per share $651,159 $764,084 $529,221

Weighted-average common

shares outstanding 210,703 206,217 198,946

Dilutive effect of stock

options and restricted

stock awards 1,725 2,725 4,161

Dilutive effect of

convertible notes 9,057 25,772 31,473

Diluted weighted-average

shares outstanding 221,485 234,714 234,580

Basic earnings per share:

Income before cumulative

effect of a change in

accounting principle $ 3.01 $ 3.22 $ 2.39

Cumulative effect of a

change in accounting

principle $–$ 0.25 $ –

Net income $ 3.01 $ 3.47 $ 2.39

Diluted earnings per share:

Income before cumulative

effect of a change in

accounting principle $ 2.94 $ 3.03 $ 2.26

Cumulative effect of a

change in accounting

principle $–$ 0.22 $ –

Net income $ 2.94 $ 3.26 $ 2.26

Diluted earnings per share did not include options to purchase 3.2 mil-

lion shares for the year ending December 31, 2006 and 1.3 million

shares for each of the years ended December 31, 2005 and 2004

because the effect of including them would have been antidilutive.

34 ROYAL CARIBBEAN CRUISES LTD.

Notes to the Consolidated Financial Statements (Continued)