Royal Caribbean Cruise Lines 2006 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2006 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

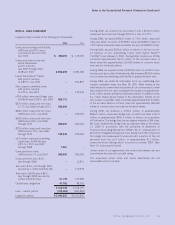

Advertising Costs

Advertising costs are expensed as incurred except those costs,

which result in tangible assets, such as brochures, which are treat-

ed as prepaid expenses and charged to expense as consumed.

Advertising costs consist of media advertising as well as brochure,

production and direct mail costs. Media advertising was $141.3 mil-

lion, $139.1 million and $133.2 million, and brochure, production

and direct mail costs were $89.5 million, $86.9 million and $82.2

million for the years 2006, 2005 and 2004, respectively.

Derivative Instruments

We enter into various forward, swap and option contracts to manage

our interest rate exposure and to limit our exposure to fluctuations in

foreign currency exchange rates and fuel prices. Generally these

instruments are designated as hedges and are recorded on the bal-

ance sheet at their fair value. Our derivative instruments are not held

for trading or speculative purposes.

At inception of the hedge relationship, a derivative instrument that

hedges the exposure to changes in the fair value of a recognized

asset or liability, or a firm commitment is designated as a fair value

hedge. A derivative instrument that hedges a forecasted transaction

or the variability of cash flows related to a recognized asset or liabil-

ity is designated as a cash flow hedge.

Changes in the fair value of derivatives that are designated as fair

value hedges are offset against changes in the fair value of the under-

lying hedged assets, liabilities or firm commitments. Changes in fair

value of derivatives that are designated as cash flow hedges are

recorded as a component of accumulated other comprehensive

(loss) income until the underlying hedged transactions are recog-

nized in earnings. The foreign-currency transaction gain or loss of our

nonderivative financial instrument designated as a hedge of our net

investment in our foreign operations are recognized as a component

of accumulated other comprehensive income along with the associ-

ated cumulative translation adjustment of the foreign operation.

On an ongoing basis, we assess whether derivatives used in hedg-

ing transactions are “highly effective” in offsetting changes in fair

value or cash flow of hedged items. If it is determined that a deriva-

tive is not highly effective as a hedge, changes in fair value of the

derivatives are recognized in earnings immediately. The ineffective

portion of hedges is recognized in earnings immediately.

Foreign Currency Translations and Transactions

We translate assets and liabilities of our foreign subsidiaries whose

functional currency is the local currency, at exchange rates in effect

at the balance sheet date. We translate revenues and expenses at

weighted-average exchange rates for the period. Equity is translated

at historical rates and the resulting cumulative foreign currency

translation adjustments are included as a component of accumulat-

ed other comprehensive (loss) income, which is reflected as a sep-

arate component of shareholders’ equity. Exchange gains or losses

arising from the remeasurement of monetary assets and liabilities

denominated in a currency other than the functional currency of the

entity involved are immediately included in our earnings, unless cer-

tain liabilities have been designated to act as a hedge of a net invest-

ment in a foreign operation. The majority of our transactions are set-

tled in United States dollars. Gains or losses resulting from

transactions denominated in other currencies are recognized in

income at each balance sheet date.

Earnings Per Share

Basic earnings per share is computed by dividing net income by the

weighted-average number of shares of common stock outstanding

during each period. Diluted earnings per share incorporates the

incremental shares issuable upon the assumed exercise of stock

options and conversion of potentially dilutive securities, including

shares contingently issuable under our previously outstanding con-

vertible debt instruments. In addition, net income is adjusted to add

back the amount of interest recognized in the period associated with

the dilutive securities. (See Note 8.

Earnings Per Share

.)

Stock-Based Employee Compensation

We have three stock-based compensation plans, which provide for

awards to our officers, directors and key employees. The plans con-

sist of a 1990 Employee Stock Option Plan, a 1995 Incentive Stock

Option Plan and a 2000 Stock Award Plan. The 1990 Stock Option

Plan and the 1995 Incentive Stock Option Plan terminated by their

terms in March 2000 and February 2005, respectively. The 2000

Stock Award Plan, as amended, provides for the issuance of (i)

incentive and non-qualified stock options, (ii) stock appreciation

rights, (iii) restricted stock, (iv) restricted stock units and (v) per-

formance shares of up to 13,000,000 shares of our common stock.

During any calendar year, no one individual shall be granted awards

of more than 500,000 shares. We awarded 204,154, 160,574, and

331,756 restricted stock units in 2006, 2005 and 2004 respective-

ly. Options and restricted stock units outstanding as of December

31, 2006, vest in equal installments over three to five years and four

to five years, respectively, from the date of grant. Generally, options

and restricted stock units are forfeited if the recipient ceases to be a

director or employee before the shares vest. Options are granted at

a price not less than the fair value of the shares on the date of grant

and expire not later than ten years after the date of grant.

In September 2006, the Compensation Committee amended the

Company’s 2000 Stock Award Plan. The amendment extends to one

year the period during which a participant must exercise non-quali-

fied options following a termination of service. It also limits to one

year the period for exercise of both qualified and non-qualified

options following termination of service due to a participant’s death

or disability. This amendment is effective for options granted on or

after September 18, 2006. The amendment did not have any impact

on our December 31, 2006 consolidated financial statements.

We also provide an Employee Stock Purchase Plan to facilitate the

purchase by employees of up to 800,000 shares of common stock.

Offerings to employees are made on a quarterly basis. Subject to

certain limitations, the purchase price for each share of common

stock is equal to 90% of the average of the market prices of the com-

mon stock as reported on the New York Stock Exchange on the first

28 ROYAL CARIBBEAN CRUISES LTD.

Notes to the Consolidated Financial Statements (Continued)