Royal Caribbean Cruise Lines 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Passenger Cruise Days represent the number of passengers carried for

the period multiplied by the number of days of their respective cruises.

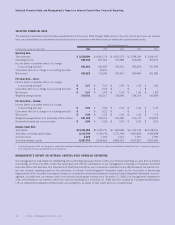

OVERVIEW

Our revenues consist of the following items:

Passenger ticket revenues consist of revenue recognized from the sale

of passenger tickets and the sale of air transportation to our ships.

Onboard and other revenues consist primarily of revenues from the

sale of goods and/or services onboard our ships not included in pas-

senger ticket prices, cancellation fees, sales of vacation protection

insurance and pre and post cruise hotel and air packages. Also includ-

ed are revenues we receive from independent third party concession-

aires that pay us a percentage of their revenues in exchange for the

right to provide selected goods and/or services onboard our ships.

Our cruise operating expenses consist of the following items:

Commissions, transportation and other expenses consist of those costs

directly associated with passenger ticket revenues, including travel

agent commissions, air and other transportation expenses, port costs

that vary with passenger head counts and related credit card fees.

Onboard and other expenses consist of the direct costs associated with

onboard and other revenues. These costs include the cost of products

sold onboard our ships, vacation protection insurance premiums, costs

associated with pre and post tours and related credit card fees.

Concession revenues have minimal costs associated with them, as the

costs related to these activities are incurred by the concessionaires.

Payroll and related expenses consist of costs for shipboard personnel.

Food expenses include food costs for both passengers and crew.

Fuel expenses include fuel costs, net of the financial impact of fuel

swap agreements, and fuel delivery costs.

Other operating expenses consist of operating costs such as repairs

and maintenance, port costs that do not vary with passenger head

counts, insurance, entertainment and all other operating costs.

We do not allocate payroll and related costs, food costs, fuel costs

or other operating costs to the expense categories attributable to

passenger ticket revenues or onboard and other revenues since

they are incurred to provide the total cruise vacation experience.

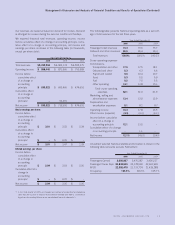

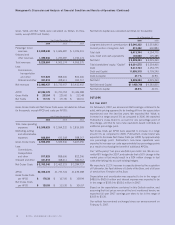

Summary of Historical Results of Operations

We achieved a 3.4% increase in Net Yields in 2006 as compared to

2005, marking the third consecutive year of positive yield growth.

This increase is primarily due to a favorable pricing environment

driven by a positive demand for our products. In contrast, increases

in fuel costs represented a challenge for us again in 2006. Although

price and consumption related initiatives partially mitigated the

increase in fuel costs, fuel expenses on an APCD basis increased

26.7% in 2006 as compared to 2005. As a result, income before the

cumulative effect of a change in accounting principle in 2006

decreased to $633.9 million or $2.94 per share on a fully diluted

basis compared to $663.5 million or $3.03 per share on a fully

diluted basis in 2005.

Highlights for 2006 included:

• Total revenues increased 6.7% to $5.2 billion from total revenues

of $4.9 billion in 2005 primarily due to a 3.5% increase in Gross

Yields and a 3.0% increase in capacity.

• Net Cruise Costs per APCD increased 6.4% compared to 2005

primarily as a result of increases in the cost of fuel and market-

ing, selling and administrative expenses during the year.

• Our Net Debt-to-Capital ratio increased to 46.6% in 2006 from

42.0% in 2005 primarily due to the financing of our acquisition of

Pullmantur. Similarly, our Debt-to-Capital ratio increased to

47.1% in 2006 from 42.8% in 2005.

• We took delivery of

Freedom of the Seas

, Royal Caribbean

International’s first Freedom-class ship, which was financed with

a $570.0 million unsecured term loan.

• We placed three additional ship orders, one for Royal Caribbean

International and two for Celebrity Cruises bringing our total

number of ships on order to six for an additional capacity of

approximately 21,150 berths.

• We acquired Pullmantur in November 2006. For reporting pur-

poses, however, we will be including Pullmantur’s results of oper-

ations on a two-month lag beginning with the first quarter of 2007.

We have included Pullmantur’s balance sheet in our consolidated

balance sheet as of December 31, 2006.

• We called for redemption all of our outstanding zero coupon

convertible notes due May 18, 2021. Most note holders elected

to convert their notes into shares of our common stock rather

than redeem them for cash, resulting in the issuance of approx-

imately 4.1 million shares of our common stock through the end

of the redemption period.

• Under a forward sale agreement relating to an Accelerated Share

Repurchase (“ASR”) transaction, we purchased 4.6 million

shares of our common stock at a price of $35.99 per share. The

ASR transaction was initiated to offset the dilution from the call for

redemption and conversion of our zero coupon convertible notes

into common shares.

• We paid $530.6 million to redeem in full the accreted balance of

our outstanding Liquid Yield Option™ Notes (“LYONs”) due

February 2, 2021.

• We issued at a discount, $900.0 million of senior unsecured notes

to fund the redemption of our LYONs and the ASR transaction.

• We recorded a net gain of $36.0 million resulting from the partial

settlement of a pending lawsuit against Rolls Royce and Alstom

Power Conversion for recurring pod failures on Millennium-class

ships.

Total revenues for 2005 increased 7.6% to $4.9 billion from total

revenues of $4.6 billion in 2004. The increase in total revenues was

primarily as a result of increases in ticket prices. During 2005, Net

Yields increased 7.4% and Net Cruise Costs per APCD increased

6.3% compared to 2004. Gross Cruise Costs increased 6.5% in 2005

compared to 2004 primarily as a result of increases in fuel expenses.

12 ROYAL CARIBBEAN CRUISES LTD.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (Continued)