Royal Caribbean Cruise Lines 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

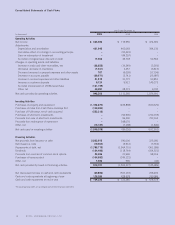

NOTE 6. LONG-TERM DEBT

Long-term debt consists of the following (in thousands):

2006 2005

Unsecured revolving credit facility,

LIBOR plus 0.875% and a

commitment fee of 0.175%

due 2010 $ 445,000 $ 135,000

Unsecured senior notes and

senior debentures,

6.75% to 8.75%,

due 2007 through 2016,

2018 and 2027 2,804,608 2,096,286

Liquid Yield Option™ Notes

with yield to maturity

of 4.875%, due 2021 –531,857

Zero coupon convertible notes

with yield to maturity

of 4.75%, due 2021 –137,942

¤750 million unsecured Bridge Loan,

EURIBOR plus 0.625%, due 2007 925,110 –

$570 million unsecured term loan,

3.77% due 2006 through 2013 529,286 –

$360 million unsecured term loan,

LIBOR plus 1.0%, due 2006 –270,000

$300 million unsecured term loan,

LIBOR plus 0.8%, due 2009

through 2010 200,000 200,000

$225 million unsecured term loan,

LIBOR plus 0.75%, due 2006

through 2012 192,848 225,000

¤6.0 million unsecured revolving

credit lines, EURIBOR plus

0.8% to 1.25% due 2007

through 2008 7,961 –

Unsecured term loans,

LIBOR plus 0.7%, due 2010 200,000 200,000

Unsecured term loan, 8.0%,

due through 2006 –11,811

Term loan, 8.0%, due through 2010,

secured by a certain Celebrity ship –172,979

Term loans, LIBOR plus 0.85%,

due through 2008, secured by

certain Celebrity ships 61,149 125,580

Capital lease obligations 47,782 48,320

5,413,744 4,154,775

Less – current portion (373,422) (600,883)

Long-term portion $ 5,040,322 $3,553,892

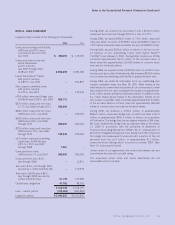

During 2006, we entered into and drew in full a $570.0 million

unsecured term loan due through 2013 at a rate of 3.77%.

During 2006, we issued $550.0 million of 7.0% senior unsecured

notes due 2013, at a price of 99.509% of par and $350.0 million of

7.25% senior unsecured notes due 2016, at a price of 99.690% of par.

During 2006, we paid $530.6 million to redeem in full the accret-

ed balance of our outstanding Liquid Yield Option Notes™

(“LYONs”) due February 2, 2021. During 2006, holders our LYONs

converted approximately $13.5 million of the accreted value of

these notes into approximately 319,000 shares of common stock

and cash for fractional shares.

During 2006, we prepaid a total of $153.8 million on an 8.0% term

loan secured by a certain Celebrity ship. We borrowed $150.0 million

on our unsecured revolving credit facility to prepay the term loan.

During 2006, we called for redemption all of our outstanding zero

coupon convertible notes due May 18, 2021. Most holders of the

notes elected to convert them into shares of our common stock, rather

than redeem them for cash, resulting in the issuance of approximate-

ly 4.1 million shares during the redemption period. In addition to the

4.1 million shares issued related to the redemption, holders of our

zero coupon convertible notes converted approximately $11.5 million

of the accreted balance of these notes into approximately 369,000

shares of common stock and cash for fractional shares.

During 2006, we obtained a ¤750.0 million, or approximately

$960.5 million, unsecured bridge loan, on which we drew ¤701.0

million, or approximately $925.1 million, to finance our acquisition

of Pullmantur. The bridge loan has an original maturity of 364 days.

We have classified the bridge loan as long-term debt at December

31, 2006 in accordance with the provisions of Statement of

Financial Accounting Standards (“SFAS”) No. 6, “Classification of

Short-Term Obligations Expected to be Refinanced”. We refinanced

the bridge loan subsequent to year-end with a portion of the net

proceeds from the ¤1.0 billion, or approximately $1.3 billion,

unsecured bond offering which occurred in January 2007. (See

Note 14.

Subsequent Events

)

Under certain of our agreements, the contractual interest rate and

commitment fee vary with our debt rating.

The unsecured senior notes and senior debentures are not

redeemable prior to maturity.

ROYAL CARIBBEAN CRUISES LTD. 33

Notes to the Consolidated Financial Statements (Continued)