Progressive 2004 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2004 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

APP.-B-9

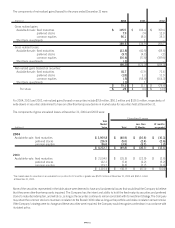

(millions, except per share amounts) 2004 2003 2002

Net income, as reported $ 1,648.7 $ 1,255.4 $ 667.3

Deduct: Total stock-based employee compensation expense

determined under the fair value based method for all awards,

net of related tax effects (6.3) (12.8) (16.9)

Net income, pro forma $ 1,642.4 $ 1,242.6 $ 650.4

Earnings per share

Basic – as reported $7.74$ 5.79 $ 3.05

Basic – pro forma 7.71 5.73 2.97

Diluted – as reported $ 7.63 $ 5.69 $ 2.99

Diluted – pro forma 7.62 5.65 2.92

The current year pro forma expense is not representative of the effect on net income for future years since the Company stopped issuing

non-qualified stock option awards as of December 31, 2002.

Supplemental Cash Flow Information Cash includes only bank demand deposits. The Company paid income taxes of $709.0 million,

$579.0 million and $392.0 million in 2004, 2003 and 2002, respectively. Total interest paid was $91.7 million during 2004, $99.0 million

during 2003 and $64.4 million during 2002. Non-cash activity includes the liability for deferred restricted stock compensation and the

changes in net unrealized gains (losses) on investment securities.

The Company effected a 3-for-1 stock split in the form of a dividend to shareholders on April 22, 2002. The Company issued its Common

Shares by transferring $147.0 million from retained earnings to the Common Share account. All share and per share amounts and stock

prices were adjusted to give effect to the split. Treasury shares were not split.

New Accounting Standards The Financial Accounting Standards Board (FASB) issued SFAS 123 (revised 2004), “Share-Based Payment,”

which requires the Company to expense the fair value at the grant date of unvested outstanding stock options. The Company intends to adopt

this statement using the modified prospective application. This new standard is effective for periods beginning after June 15, 2005, and is estimated

to reduce net income by approximately $1.5 million in 2005 and $1.0 million in 2006. The Company will not incur any additional expense relating

to stock options in years subsequent to 2006, since the latest vesting date of stock options previously granted is January 1, 2007.

Excluding the new standard discussed above, the other accounting standards recently issued by the FASB, Statements of Position and

Practice Bulletins issued by the American Institute of Certified Public Accountants and consensus positions of the Emerging Issues Task

Force are currently not applicable to the Company and, therefore, would have no effect on the Company’s financial condition, cash flows or

results of operations.

Reclassifications Certain amounts in the financial statements for prior periods were reclassified to conform to the 2004 presentation.