Progressive 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

APP.-B-10

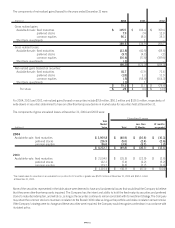

The components of net investment income for the years ended December 31 were:

(millions) 2004 2003 2002

Available-for-sale: fixed maturities $ 374.6 $ 369.5 $ 379.4

preferred stocks 49.3 53.0 45.1

common equities 41.2 31.1 22.8

Short-term investments 19. 3 11.7 7.9

Investment income 484.4 465.3 455.2

Investment expenses (13.9) (11.5) (11.5)

Net investment income $ 470.5 $ 453.8 $ 443.7

See

Note 10 — Other Comprehensive Income

for changes in the net unrealized gains (losses) during the period.

At December 31, 2004, bonds in the principal amount of $84.3 million were on deposit with various regulatory agencies to meet statutory

requirements. The Company did not have any securities of one issuer with an aggregate cost or market value exceeding ten percent of total

shareholders’ equity at December 31, 2004 or 2003.

2) Investments

The composition of the investment portfolio at December 31 was:

Gross Gross % of

Unrealized Unrealized Market Total

(millions) Cost Gains Losses Value Portfolio

2004

Available-for-sale:

U.S. government obligations $ 1,970.1 $ 5.7 $ (13.3) $ 1,962.5 15.0%

State and local government obligations 2,873.2 71.2 (4.0) 2,940.4 22.5

Foreign government obligations 30.8 .6 — 31.4 .2

Corporate and U.S. agency debt securities 1,752.8 35.6 (7.1) 1,781.3 13.6

Asset-backed securities 2,345.7 39.5 (16.5) 2,368.7 18.1

8,972.6 152.6 (40.9) 9,084.3 69.4

Preferred stocks 749.4 24.5 (5.0) 768.9 5.9

Common equities 1,314.0 541.8 (3.9) 1,851.9 14.2

Short-term investments 1,376.6 .3 — 1,376.9 10.5

$ 12,412.6 $ 719.2 $ (49.8) $13,082.0 100.0%

2003

Available-for-sale:

U.S. government obligations $ 1,307.9 $ 7.3 $ (3.0) $ 1,312.2 10.5%

State and local government obligations 2,841.7 94.6 (6.1) 2,930.2 23.4

Foreign government obligations 13.9 .7 — 14.6 .1

Corporate and U.S. agency debt securities 1,763.1 73.9 (3.2) 1,833.8 14.6

Asset-backed securities 2,972.4 83.4 (13.2) 3,042.6 24.3

8,899.0 259.9 (25.5) 9,133.4 72.9

Preferred stocks 751.3 34.9 (7.4) 778.8 6.2

Common equities 1,590.6 390.3 (8.8) 1,972.1 15.7

Short-term investments 648.0 — — 648.0 5.2

$ 11,888.9 $ 685.1 $ (41.7) $ 12,532.3 100.0%