Progressive 2004 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2004 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

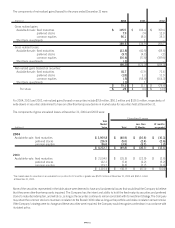

APP.-B-5

(millions)

For the years ended December 31, 2004 2003 2002

Cash Flows From Operating Activities

Net income $ 1,648.7 $ 1,255.4 $ 667.3

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation 99.4 89.3 83.9

Amortization of fixed maturities 168.9 103.2 42.6

Amortization of restricted stock 23.8 11.0 —

Net realized (gains) losses on securities (79.3) (12.7) 78.6

Changes in:

Unearned premiums 213.3 590.4 587.6

Loss and loss adjustment expense reserves 709.3 763.3 575.0

Accounts payable, accrued expenses and other liabilities 70.2 124.5 256.6

Prepaid reinsurance premiums (5.1) (18.0) (19.1)

Reinsurance recoverables (110.3) (55.6) (14.2)

Premiums receivable (207.6) (336.8) (245.7)

Deferred acquisition costs (19.9) (48.8) (46.9)

Income taxes 98.5 (.1) (65.1)

Tax benefits from exercise/vesting of stock-based compensation 44.3 44.0 19.3

Other, net 8.3 (72.2) (7.9)

Net cash provided by operating activities 2,662.5 2,436.9 1,912.0

Cash Flows From Investing Activities

Purchases:

Available-for-sale: fixed maturities (6,686.3) (9,491.6) (7,924.9)

equity securities (678.3) (771.2) (680.7)

Sales:

Available-for-sale: fixed maturities 5,885.7 7,189.3 5,823.3

equity securities 876.3 337.8 412.0

Maturities, paydowns, calls and other:

Available-for-sale: fixed maturities 639.7 779.2 594.0

equity securities 78.2 91.7 —

Net purchases of short-term investments (728.6) (80.2) (340.4)

Net unsettled security transactions (43.2) (37.1) 115.3

Purchases of property and equipment (192.0) (171.1) (89.9)

Net cash used in investing activities (848.5) (2,153.2) (2,091.3)

Cash Flows From Financing Activities

Proceeds from exercise of stock options 51.7 50.0 22.6

Proceeds from debt —— 398.6

Payments of debt (206.0) — (.8)

Dividends paid to shareholders (23.3) (21.7) (21.1)

Acquisition of treasury shares (1,628.5) (316.8) (214.3)

Net cash provided by (used in) financing activities (1,806.1) (288.5) 185.0

Increase (decrease) in cash 7. 9 (4.8) 5.7

Cash, Beginning of year 12.1 16.9 11. 2

Cash, End of year $20.0$12.1$ 16.9

See notes to consolidated financial statements.

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS