Progressive 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

APP.-B-1

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES

APPENDIX B

2004 ANNUAL REPORT TO SHAREHOLDERS

Table of contents

-

Page 1

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES APPENDIX B 2004 ANNUAL REPORT TO SHAREHOLDERS APP.-B-1 -

Page 2

... the years ended December 31, 2004 2003 2002 Revenues Net premiums earned Investment income Net realized gains (losses) on securities Service revenues Other income1 Total revenues Expenses Losses and loss adjustment expenses Policy acquisition costs Other underwriting expenses Investment expenses... -

Page 3

... Liabilities and Shareholders' Equity Unearned premiums Loss and loss adjustment expense reserves Accounts payable, accrued expenses and other liabilities Income taxes Debt Total liabilities Shareholders' equity: Common Shares, $1.00 par value (authorized 600.0, issued 213.2 and 230.1, including... -

Page 4

... benefits from exercise/vesting of stock-based compensation Treasury shares purchased1 Restricted stock issued, net of forfeitures Other Balance, End of year Unamortized Restricted Stock Balance, Beginning of year Restricted stock issued, net of forfeitures Restricted stock market value adjustment... -

Page 5

... Unearned premiums Loss and loss adjustment expense reserves Accounts payable, accrued expenses and other liabilities Prepaid reinsurance premiums Reinsurance recoverables Premiums receivable Deferred acquisition costs Income taxes Tax benefits from exercise/vesting of stock-based compensation Other... -

Page 6

... insurance and related services throughout the United States. The Company's Personal Lines segment writes insurance for private passenger automobiles and recreation vehicles through both an independent agency channel and a direct channel. The Company's Commercial Auto segment writes insurance... -

Page 7

... insurance and related services to individuals and small commercial accounts throughout the United States, and offers a variety of payment plans. Generally, premiums are collected prior to providing risk coverage, minimizing the Company's exposure to credit risk. The Company performs a policy... -

Page 8

... currently. Such loss and loss adjustment expense reserves could be susceptible to significant change in the near term. Reinsurance The Company's reinsurance transactions include premiums written under state-mandated involuntary plans for commercial vehicles (Commercial Auto Insurance Procedures... -

Page 9

... and stock prices were adjusted to give effect to the split. Treasury shares were not split. New Accounting Standards The Financial Accounting Standards Board (FASB) issued SFAS 123 (revised 2004), "Share-Based Payment," which requires the Company to expense the fair value at the grant date of... -

Page 10

... Gross Unrealized Losses Market Value % of Total Portfolio (millions) Cost 2004 Available-for-sale: U.S. government obligations State and local government obligations Foreign government obligations Corporate and U.S. agency debt securities Asset-backed securities Preferred stocks Common equities... -

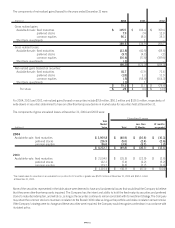

Page 11

... 31, 2004 and 2003 were: Total Market Value Unrealized Losses Total Less than 12 Months 12 months or greater1 (millions) 2004 Available-for-sale: fixed maturities preferred stocks common equities 2003 Available-for-sale: fixed maturities preferred stocks common equities $ 3,909.8 216.9 86... -

Page 12

...and results of operations of the Company and were reported as part of the available-for-sale portfolio, with gains (losses) reported as a component of realized gains (losses) on securities. The composition of fixed maturities by maturity at December 31, 2004 was: Market Value (millions) Cost Less... -

Page 13

... had completed its review of a Federal income tax settlement agreed to by the Internal Revenue Service, primarily attributable to the amount of loss reserves deductible for tax purposes. As a result, the Company received an income tax refund of approximately $58 million during 2004, which was... -

Page 14

... rate (LIBOR). No commitment fees are required to be paid. There are no rating triggers under this line of credit. The Company had no borrowings under this arrangement at December 31, 2004. In January 2004, the Company entered into a revolving credit arrangement with National City Bank, replacing... -

Page 15

... to favorable claims settlement during 2003, the Company benefited from a change in its estimate of the Company's future operating losses due to business assigned from the New York Automobile Insurance Plan. Because the Company is primarily an insurer of motor vehicles, it has limited exposure to... -

Page 16

... health and life insurance benefits to all employees who met requirements as to age and length of service at December 31, 1988. This group of employees represents less than one-half of one percent of the Company's current workforce. The Company's funding policy is to contribute annually the maximum... -

Page 17

... restricted stock awards are expensed pro rata over the vesting period based on the market value of the non-deferred awards at the time of grant, while the deferred awards are based on the current market value at the end of the reporting period. Prior to 2003, the Company issued nonqualified stock... -

Page 18

... and exercisable were 242,277 shares, 311,061 shares and 343,044 shares, respectively. Under SFAS 123, the Company used the modified Black-Scholes pricing model to calculate the fair value of the options awarded as of the date of grant, including 23,571 options awarded to the non-employee directors... -

Page 19

... and Accounting Policies. Following are the operating results for the years ended December 31: 2004 (millions) Revenues Pretax Profit (Loss) Revenues 2003 Pretax Profit (Loss) Revenues 2002 Pretax Profit (Loss) Personal Lines - Agency Personal Lines - Direct Total Personal Lines1 Commercial Auto... -

Page 20

... 2004 (millions) Underwriting Margin Combined Ratio Underwriting Margin 2003 Combined Ratio Underwriting Margin 2002 Combined Ratio Personal Lines - Agency Personal Lines - Direct Total Personal Lines Commercial Auto Business Other businesses - indemnity Total underwriting operations 14.0% 14.1 14... -

Page 21

... to estimate a range of loss, if any, at this time. There are three putative class action lawsuits challenging the Company's practice of specifying aftermarket (non-original equipment manufacturer) replacement parts in the repair of insured or claimant vehicles. Plaintiffs in these cases generally... -

Page 22

... filed by individuals who opted out of the nationwide class action settlement, within the reserve amount established in prior years for these groups of cases. The Company is defending one putative class action lawsuit alleging that the Company's rating practices at renewal are improper. The Company... -

Page 23

... 2002 equaled the then current market price of the Company's stock as quoted on the New York Stock Exchange and were part of the Company's ongoing repurchase program to eliminate the effect of dilution created by equity compensation awards. Date of Purchase Number of Shares Price per Share October... -

Page 24

...Annual Report, has issued an attestation report on management's assessment of the Company's internal control over financial reporting as of December 31, 2004, which is included herein. CEO AND CFO CERTIFICATIONS Glenn M. Renwick, President and Chief Executive Officer of The Progressive Corporation... -

Page 25

... reporting, evaluating management's assessment, testing and evaluating the design and operating effectiveness of internal control, and performing such other procedures as we consider necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinions. A company... -

Page 26

... Company's Personal Lines segment writes insurance for private passenger automobiles and recreation vehicles through both the independent agency channel and the direct channel. The Company ranks third in the U.S. personal auto insurance market, based on 2003 and estimated 2004 net premiums written... -

Page 27

... 2004, the Company achieved underwriting profitability in all of the 49 Personal Lines markets in which it writes business, with only Florida not meeting or exceeding its 4% underwriting profit objective due to hurricane-related losses. In Commercial Auto, two states, out of the 45 markets in which... -

Page 28

... a building in Austin, Texas, which it plans to convert to a call center. The project is scheduled to be completed in June 2005, at an estimated total cost of $38 million. The Company is also currently pursuing the acquisition of additional land for future development to support corporate operations... -

Page 29

... have definitive due dates and the ultimate payment dates are subject to a number of variables and uncertainties. As a result, the total loss and LAE reserve payments to be made by period, as shown above, are estimates. To further understand the Company's claims payments, see Claims Payment Patterns... -

Page 30

... level under varying market conditions. These retention measures, like loss reserves, are estimates of future outcomes based on past behaviors. The Company will continue to focus on this issue into 2005, recognizing that good customer service, efficient operations and fair pricing are necessary... -

Page 31

... Premiums Earned Personal Lines-Agency Personal Lines-Direct Total Personal Lines Commercial Auto Business Other businesses - indemnity Total underwriting operations Personal Lines-Agency Loss & loss adjustment expense ratio Underwriting expense ratio Combined ratio Personal Lines-Direct Loss & loss... -

Page 32

... certain class action lawsuits (see Note 11 - Litigation). Policy acquisition costs are amortized over the policy period in which the related premiums are earned (see Note 1 -Reporting and Accounting Policies). The Company benefited from the shift in its mix of business from new to renewal, which... -

Page 33

... Company is advertising on a national basis and supplements its coverage by local market media campaigns in over 100 designated marketing areas. The Company's Direct Business expense ratio benefited from business mix changes (i.e., a higher percentage of its business came from renewals). APP.-B-33 -

Page 34

...of payment of medical bills, rating practices at renewal and cases challenging other aspects of the Company's claims and marketing practices and business operations. Other insurance companies face many of these same issues. During 2002, the Company settled several long-standing class action lawsuits... -

Page 35

... the practice of taking betterment on first party personal automobile claims. In 2004, the Company settled a number of individual actions concerning alternative agent commission programs, a national and several state wage and hour class action cases and a claim brought by Florida medical providers... -

Page 36

...managed by maintaining a minimum average portfolio credit quality rating of A+, as defined by nationally recognized rating agencies, and limiting non-investment-grade securities to a maximum of 5% of the fixed-income portfolio. Concentration in a single issuer's bonds and preferred stocks is limited... -

Page 37

... time. The Company monitors the value at risk of the fixed-income and equity portfolios, as well as the total portfolio, to evaluate the potential maximum expected loss. For further information, see Quantitative Market Risk Disclosures, a supplemental schedule provided in this Annual Report. TRADING... -

Page 38

... does not satisfy the guidance set forth in the current accounting guidance (see Critical Accounting Policies, Other-than-Temporary Impairment for further discussion). For fixed-income investments with unrealized losses due to market or industry-related declines where the Company has the intent and... -

Page 39

... Company reduces the book value of such security to its current market value, recognizing the decline as a realized loss in the income statement. All other unrealized gains or losses are reflected in shareholders' equity. The write-down activity for the years ended December 31 was as follows: Total... -

Page 40

...on Loss Reserving Practices, which was filed on June 29, 2004 via Form 8-K. The Company's carried reserve balance of $4.9 billion implicitly assumes the loss and LAE severity will increase for accident year 2004 over accident year 2003 by 2.7% and 9.0% for personal auto liability and commercial auto... -

Page 41

...the reserve setting process. The following table shows the Company's original estimated changes in severity included when establishing its loss reserves, compared to the Company's estimated changes in severity one year later. Personal Auto Liability Accident Year Original One Year Later Commercial... -

Page 42

... to the discussion above, the Company annually publishes a comprehensive Report on Loss Reserving Practices, which is filed via Form 8-K, and is available on the Company's Web site at investors.progressive.com. OTHER-THAN-TEMPORARY IMPAIRMENT SFAS 115, "Accounting for Certain Investments in Debt and... -

Page 43

... and auto repair costs; and other matters described from time to time by the Company in releases and publications, and in periodic reports and other documents filed with the United States Securities and Exchange Commission. In addition, investors should be aware that generally accepted accounting... -

Page 44

....1x Earnings to fixed charges3 11 Price to earnings4 Price to book 3.3 Net premiums earned Total revenues Underwriting margins5 Personal Lines Commercial Auto Other businesses - indemnity Total underwriting operations Net income Per share6 Dividends per share Number of people employed $ 13,169.9 13... -

Page 45

...7x Earnings to fixed charges3 18 Price to earnings4 Price to book 1.9 Net premiums earned Total revenues Underwriting margins5 Personal Lines Commercial Auto Other businesses - indemnity Total underwriting operations Net income Per share6 Dividends per share Number of people employed $ 5,683.6 6,124... -

Page 46

... risk is represented in terms of changes in fair value due to selected hypothetical movements in market rates. Bonds and preferred stocks are individually priced to yield to the worst case scenario. State and local government obligations, including lease deals and super sinkers, are assumed to hold... -

Page 47

...(1.4)% The model results represent the 95th percentile loss in a one month period or the 9,500th worst case scenario out of 10,000 Monte Carlo generated simulations. Fixed-income securities are priced off simulated term structures and risk is calculated based on the volatilities and correlations of... -

Page 48

THE PROGRESSIVE CORPORATION AND SUBSIDIARIES INCENTIVE COMPENSATION PLANS (unaudited) The Company believes that equity compensation awards align management interests with those of shareholders. Between 1989 and 2002, the Company awarded non-qualified stock options (NQSO) annually to key employees ... -

Page 49

... the Company's total unvested awards is 2.3 years. The Company recognizes compensation expense on a pro rata basis over the vesting period for all non-deferred awards based on the market value at the date of grant. The compensation expense on the deferred awards is based on the current market value... -

Page 50

...and changes in the reserve estimates, it is important to understand the Company's paid development patterns. The charts below show the Company's auto claims payment patterns, reflecting both dollars and claims counts paid, for auto physical damage and bodily injury claims, as well as on a total auto... -

Page 51

Total Auto 70% 60% 50% Percent Paid 40% 30% 20% 10% 0% 0 T T T T Counts T T 4 T Dollars T T T 8 Quarters 12 16 Note: The above graphs are presented on an accident period basis. APP.-B-51 -

Page 52

... amounts and stock prices were adjusted for the April 22, 2002, 3-for-1 stock split. 1 Prices as reported on the consolidated transaction reporting system. The Company's Common Shares are listed on the New York Stock Exchange. Represents premiums earned plus service revenues. Presented on a diluted... -

Page 53

...PROGRESSIVE CORPORATION AND SUBSIDIARIES NET PREMIUMS WRITTEN BY STATE (unaudited) (millions) 2004 2003 2002 2001 2000 Florida $ 1,522.6 Texas 1,181.1 New York 935.7 California 892.7 Ohio 754.2 Georgia 733.2 Pennsylvania 634.4 All other 6,724.2 Total...913.9 47.0 $ 6,196.1 100.0% $ APP.-B-53 -

Page 54

... ability to contact non-management directors as a group by sending a written communication clearly addressed to the non-management directors and sent to any of the following: Peter B. Lewis, Chairman of the Board, The Progressive Corporation, 6300 Wilson Mills Road, Mayfield Village, Ohio 44143 or... -

Page 55

...the Company's Web site: progressive.com/sec. To view its earnings and other releases, access progressive.com/investors. To request copies of public financial information on the Company, write to: The Progressive Corporation, Investor Relations, 6300 Wilson Mills Road, Box W33, Mayfield Village, Ohio...