Porsche 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

Stable Circle of Stockholders

A stable circle of stockholders provides a solid foundation

upon which to build a company and the latitude to develop a

sustainable long-term growth strategy. Frequent changes

of share ownership, on the other hand, often put a strain on

operational management. Porsche AG has been reaping the

benefits of such stability for many years now, with an un-

changed distribution of our EUR 45.5 million share capital into

8,750,000 ordinary and 8,750,000 listed preference shares.

The ordinary shares, which are held by members of the

Porsche and Piëch families, provide the company with a se-

cure base. More than half of the preference shares are held

by institutional investors such as stock funds, banks and in-

surance companies, based mainly in the USA, Germany and

the UK and, to a lesser extent, in other European and Asian

countries. Slightly less than half of Porsche’s preferred stock

is distributed among a large number of private investors,

predominantly from Germany. Porsche AG’s ordinary stock-

holders also hold preference stock.

Stockholders get to know the Leipzig Factory

Porsche not only wrote a new and positive chapter in the

history of the company with the Cayenne, but also built a brand

new factory for this model – in Leipzig. Both the Cayenne

sports SUV and the high performance Carrera GT sports car

are made there. It was therefore not surprising that many

stockholders expressed an interest in visiting the new plant.

In response to these wishes, Porsche AG decided to hold its

Annual General Meeting on 23 January, 2004 not in Stuttgart,

but for the first time in the company’s history in Leipzig.

Stockholders were offered an opportunity to tour the new

Porsche production plant, to view the architectural splendor

of our Customer Center, and to be driven for a few laps of

the test track in our automobiles. The next Porsche AG

Annual General Meeting in January 2005 will be held as usual

at our group headquarters in Stuttgart.

20 Years on the Stock Exchange –

without Quarterly Reports

During the year under review, Porsche celebrated the 20th

anniversary of its relationship with the stock market. The

sports car manufacturer’s preference shares were first listed

on the stock market on 4 May, 1984 at 1,020 Deutschmarks.

Converted to Euros and adjusted for the subsequent stock

split, this would be the equivalent of approximately EUR 50.

The stock proved very popular with investors even during this

first year. Demand for Porsche stock strengthened in 1996 –

the year of the Boxster launch – and thanks to its outstanding

performance, it has remained a favorite with investors and

analysts ever since. Our presence in the capital market has

had a positive affect on the company’s corporate image.

Although as a matter of principle Porsche has never published

quarterly reports during this entire period, this situation has

never undermined the stock’s performance. Rather than issu-

ing quarterly reports, we provide the financial markets with

detailed information on a regular basis – without the restraint

of rigid reporting deadlines.

These reports were subjected to increased political scrutiny

during the year under review. The EU Finance Ministers, close-

ly followed by the European Parliament, agreed in the Spring

of 2004 that quarterly reports should not be mandatory. This,

in our view, vindicates the position we have taken all along: that

quarterly reports provide investors with no additional value

whatsoever. On the contrary: a snapshot of the temporary

state of a business can result in sharp fluctuations in the price

of the company’s stock, damaging the stock’s continued per-

formance pattern and, in certain circumstances, having a

negative impact on the company’s decision-making processes.

Porsche’s refusal to publish quarterly reports has until now

disqualified it from inclusion in the Frankfurt Stock Exchange’s

Prime Standard. The international view is, of course, that the

quality of the stock is beyond question, and the company –

quarterly reports notwithstanding – is accordingly included in

two respected international indices: the Morgan Stanley

Capital International index and the Dow Jones STOXX 600.

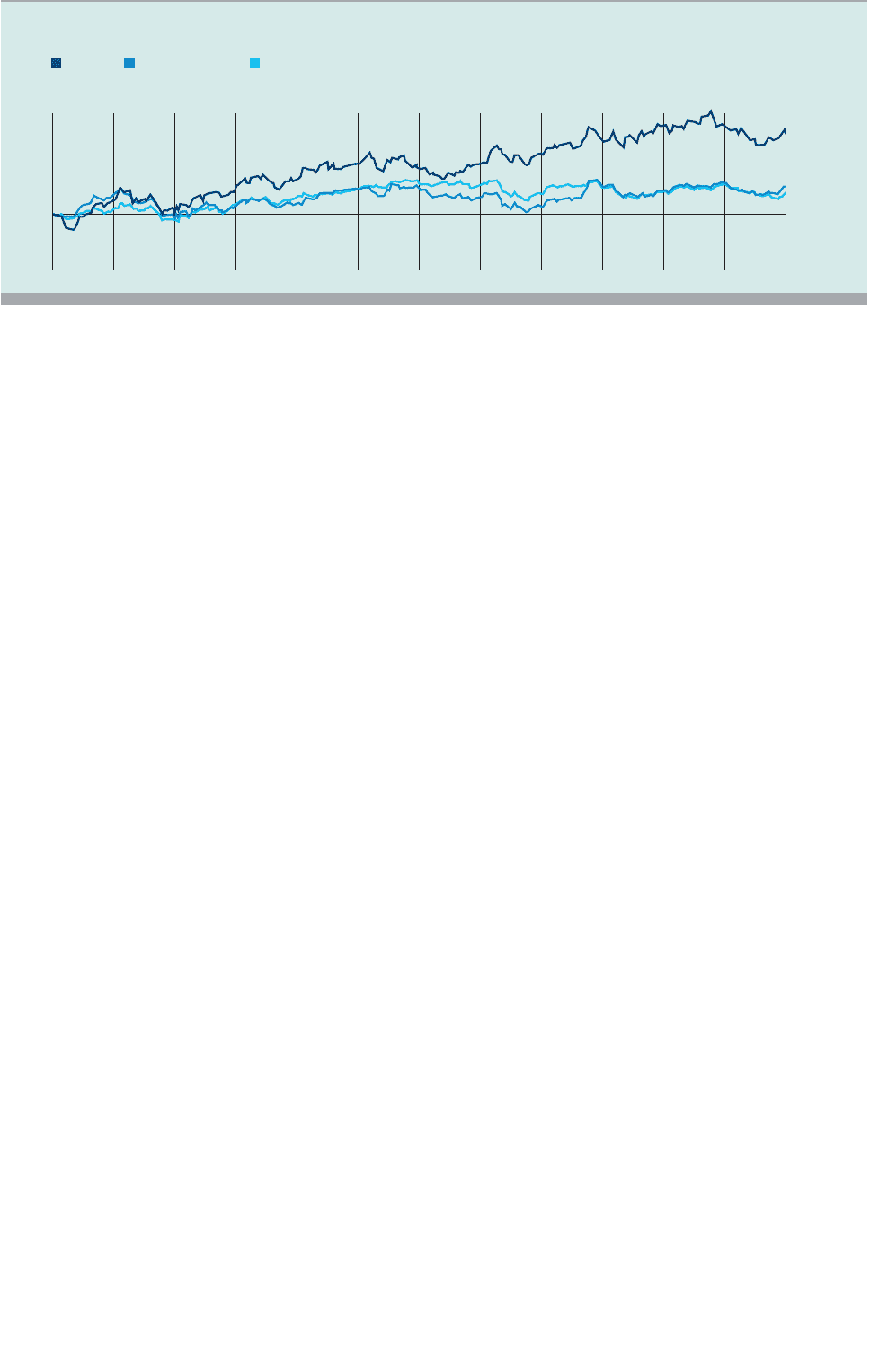

Development of Porsche Share compared to DAX und CDAX-Automobile

Porsche CDAX- Automobile DAX

160

140

120

100

80

1.8.03 1.9.03 1.10.03 1.11.03 1.12.03 1.1.04 1.2.04 1.3.04 1.4.04 1.5.04 1.6.04 1.7.04 31.7.04