Porsche 2003 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2003 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

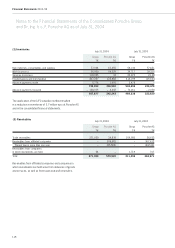

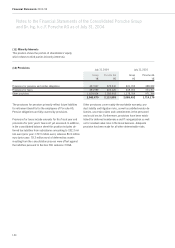

Principles of Consolidation

The capital consolidation of the fully consolidated subsidiaries

is recorded in accordance with GAS (German Accounting Stan-

dard) No. 4 using the fair value purchase method, which offsets

the cost of acquisition against the proportionately revalued

shareholders’ equity of the subsidiary at the time of the initial

inclusion in the consolidated financial statements.

Goodwill resulting from the initial consolidation is capitalized as

an intangible asset. Associated companies are included in the

consolidated financial statements using the book value method,

pursuant to GAS No. 8.

Assets and liabilities of fully consolidated domestic and foreign

subsidiaries use the same accounting and valuation methods as

applied by Porsche AG.

To the extent valuations at associated companies do not con-

form to Porsche AG Group guidelines, no adjustment has been

made. Investments not consolidated using the equity method

are shown at acquisition cost.

Receivables and liabilities between the consolidated companies,

as well as intercompany profits and losses from sales and ser-

vices have been eliminated. Revenues and expenses resulting

from intercompany transactions are eliminated from the Porsche

Group’s statement of income.

The net income of Porsche AG available for distribution equals

the net income available for distribution in the consolidated

financial statements.

Accounting Principles and Valuation Methods

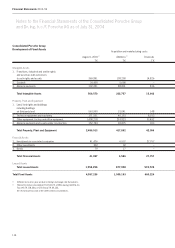

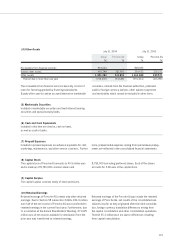

Acquired intangible assets are capitalized at acquisition cost

and amortized using the straight-line method over the expected

useful lives of the assets.

Additions to property, plant and equipment are valued at ac-

quisition or manufacturing costs. Internally generated property,

plant and equipment are capitalized at direct cost plus over-

heads in accordance with the German Income Tax regulations.

Depreciation is generally determined in accordance with the

estimated useful life guidelines established by the German

financial authorities or, in some cases, based on a shorter

expected useful life. For assets used in multiple shift produc-

tion, depreciation is increased by shift mark-ups. As far as

permissible by tax laws, the declining-balance method of cal-

culating depreciation is applied, additions were made up to

December 31, 2003 with a full year’s depreciation. From that

time on additions are depreciated pro rata temporis. The de-

clining-balance method is replaced by the straight-line method

(as permitted by Section 7 subsection 3 of the German Income

Tax Law) in the year when the change causes higher deprecia-

tion expense. Special tools and fixtures are depreciated based

on their actual usage. Leased vehicles capitalized in the con-

solidated financial statements are amortized over their future

estimated useful life on a straight-line basis or over the shorter

term of the lease considering the calculated residual value.

Low value assets are fully depreciated in the year of acquisition.

At Porsche AG, shares in affiliated companies and investments

are recorded at acquisition cost or, when deemed necessary,

at a lower value. Shares in associated companies are accounted

for in the consolidated financial statements using the equity-

method after eliminating any intercompany profits.

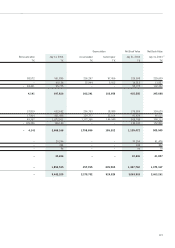

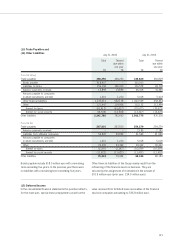

In order to improve the informative value of the lease and finan-

ce activities, the balance sheet classification and disclosure in

the notes has been adjusted in some respects for the current

and prior year. In the consolidated balance sheet the leased

assets are shown separately in the position fixed assets. Other

assets and other liabilities were further sub classified. Receiv-

ables from financial services and other financial liabilities con-

tained therein are explained separately.