Porsche 2003 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2003 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

Financial Statements 2003 ⁄ 04

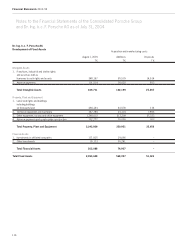

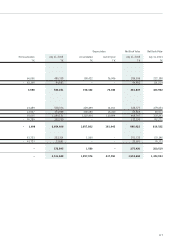

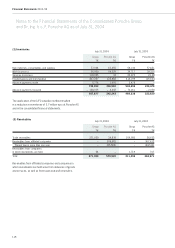

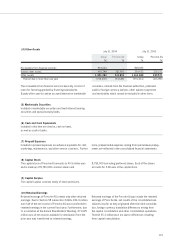

Notes to the Financial Statements of the Consolidated Porsche

Group and Dr. Ing. h.c. F. Porsche AG as of July 31, 2004

Raw materials, consumables and supplies are valued at the

lower of acquisitions cost or market value. The work and

services in process and finished goods valuation includes direct

material, direct labor, as well as material and manufacturing

overheads, in accordance with the minimum amounts to be

recorded according to Section 33 of the Guidelines to the

German Income Tax Law (EStG). Merchandise is valued at the

lower of the weighted average cost or market value as of

the balance sheet date. Due to tax laws and in order to avoid

unrealized profits, the periodic LIFO (Last-In, First-Out) method

for the valuation of inventories is utilized.

Devaluations for old or obsolete inventory have been provided

to an adequate extent.

Advance payments received, which are directly attributable

to individual inventory items, are offset against these items in

the balance sheet.

Receivables and other assets are recorded at their nominal

value. Individual allowances have been recorded for known

risks. A lump-sum allowance has been provided for the general

credit risk inherent in receivables.

Marketable securities are valued at the lower of acquisition

cost or market value at the balance sheet date.

Provisions for pensions and similar obligations are actuarially

computed on the basis of an interest rate of 5 percent, using

the entry age actuarial cost method and taking into account

Prof. Dr. Klaus Heubeck’s most recent mortality tables.

In the valuation of all other provisions, all known risks have

been considered.

Liabilities are valued at their repayment value.

Foreign Currency Translation

Receivables denominated in foreign currency are valued in the

individual financial statements at the lower of the entry date

or fiscal year-end exchange rates. To the extent receivables

have been hedged by the use of forward exchange rate con-

tracts, the forward rate has been used. In principle, liabilities

in foreign currency are valued at the higher selling rate effec-

tive on the entry date or fiscal year-end. Financial assets are

recorded using the exchange rate at the date of acquisition.

All assets and liabilities of foreign companies included in

the consolidated financial statements are translated at the

average of the buying and offering rates effective on the

balance sheet date. Average annual exchange rates are used

for the income statements. Net profit/loss and depreciation

are translated using the rate as of the balance sheet date. Any

resulting translation difference is recorded as other expense.

Exchange rate differences arising from the capital consolida-

tion and the consolidation of intercompany balances are re-

corded in shareholders’ equity with no income statement effect.