Porsche 2003 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2003 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Statements 2003 ⁄ 04

Notes to the Financial Statements of the Consolidated Porsche Group

and Dr. Ing. h.c. F. Porsche AG as of July 31, 2004

120

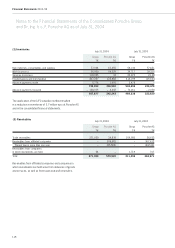

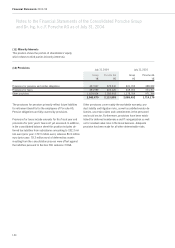

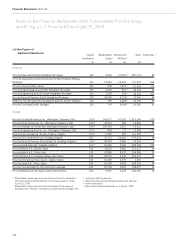

The provisions for pensions primarily reflect future liabilities

for retirement benefits for the employees of Porsche AG.

Pension obligations are fully covered by provisions.

Provisions for taxes include amounts for this fiscal year and

provisions for prior years’ taxes not yet assessed. In addition,

in the consolidated balance sheet this position includes de-

ferred tax liabilities from subsidiaries amounting to 182.3 mil-

lion euro (prior year: 172.9 million euro), whereas 86.9 million

euro (prior year: 78.3 million euro) of deferred tax assets

resulting from the consolidation process were offset against

the liabilities pursuant to Section 306 sentence 3 HGB.

Other provisions cover mainly the worldwide warranty, pro-

duct liability and litigation risks, as well as unbilled vendor de-

liveries, uncertain claims and commitments in the personnel

and social sector. Furthermore, provisions have been estab-

lished for deferred maintenance and IT reorganization as well

as for residual value risks in the lease business. Adequate

provision has been made for all other determinable risks.

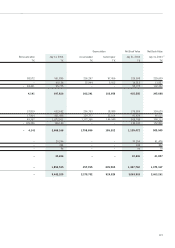

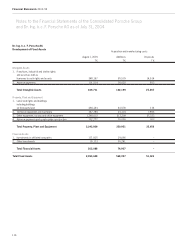

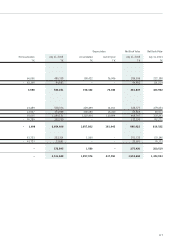

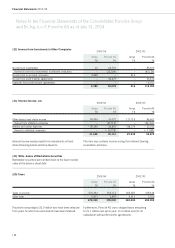

(12) Provisions July 31, 2004 July 31, 2003

Group Porsche AG Group Porsche AG

T€T€T€T€

Provisions for pensions and similar obligations 457,067 429,930 401,702 388,422

Provisions for taxes 483,989 403,126 408,006 354,357

Other provisions 1,619,414 1,280,903 1,278,784 971,396

2,560,470 2,113,959 2,088,492 1,714,175

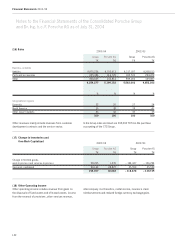

(11) Minority Interests

This position shows the portion of shareholders’ equity

which relates to third parties (minority interests).