Pioneer 2015 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2015 Pioneer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The current portion of long-term debt amounting to

¥6,367 million ($53,058 thousand) as of March 31,

2015, was borrowed by the Company in accordance

with the syndicated loan agreement entered into with

the banks on March 27, 2015. This agreement in-

cludes certain financial covenants which require the

Company to maintain certain levels of equity on a

consolidated and nonconsolidated basis and certain

levels of operating income on a consolidated basis.

In addition, long-term debt amounting to ¥10,000

million ($83,333 thousand) as of March 31, 2015,

was borrowed by the Company in accordance with

the syndicated loan agreement entered into with

the banks on September 25, 2014. This agreement

includes certain financial covenants which require the

Company to maintain with the banks on September 25,

2014. This agreement includes certain financial cov-

enants which require the Company to maintain certain

levels of equity on a consolidated and nonconsoli-

dated basis.

The current portion of long-term debt amounting

to ¥52,270 million as of March 31, 2014, was borrowed

by the Company and Tohoku Pioneer Corporation in

accordance with the syndicated loan agreements en-

tered into with the banks on September 25, 2013 and

March 31, 2014. These agreements include certain

financial covenants which require the Company to

maintain certain levels of equity on a consolidated and

nonconsolidated basis and certain levels of operat-

ing income and net income on a consolidated basis,

as well as Tohoku Pioneer Corporation maintaining

certain levels of equity on a nonconsolidated basis.

In addition, the current portion of long-term debt

amounting to ¥10,000 million as of March 31, 2014,

was borrowed by the Company in accordance with

the syndicated loan agreement contracted with the

banks on September 27, 2011. This agreement in-

cludes certain financial covenants which require the

Company to maintain certain levels of equity on a

consolidated and nonconsolidated basis.

8. Retirement and Pension Plans

The Company and major Japanese subsidiaries have

defined benefit pension plans and defined contribution

pension plans. The benefits are determined based on

the sum of cumulative points and conditions under

which retirement occurred. The cumulative points are

accumulated based on years of service and job class.

In some cases, additional retirement benefits are paid

when an employee retires.

The Company and certain consolidated subsidiaries

have joined multi-employer pension fund plans. Each

company’s portion of plan assets corresponding to

its contributions has been reasonably computed

and included in the tables below for defined benefit

pension plans.

Certain consolidated subsidiaries apply the

simplified method in computing accrued pension

and severance costs and retirement benefit costs

for their defined benefit pension plans and lump-

sum severance payment plans. Reconciliations of

the plans to which the simplified method is applied

are omitted because they are immaterial.

Substantially all of the employees of U.S. and

European subsidiaries are covered by defined benefit

pension plans. Under such plans, the related cost of

benefit is funded or accrued. The benefits are based

on the level of salary at retirement or earlier termination

of employment, the years of service and conditions

under which termination occurs. Certain other foreign

subsidiaries sponsor defined contribution pension

plans or lump-sum payment plans.

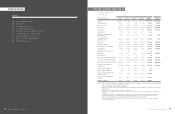

(1) The changes in projected benefit obligation for the years ended March 31, 2015 and 2014, were as follows:

(2) The changes in plan assets for the years ended March 31, 2015 and 2014, were as follows:

Defined benefit pension plans

Years ending March 31 Millions of Yen

Thousands of

U.S. Dollars

2016 ¥ 8,135 $ 67,792

2017 761 6,342

2018 10,175 84,791

2019 – –

2020 – –

2021 and thereafter – –

Total ¥19,071 $158,925

As of March 31, 2015 and 2014, the following assets were pledged as collateral for short-term borrowings and

long-term debt of the Group:

Annual maturities of long-term debt and long-term capital lease obligations as of March 31, 2015, and for the next

five years and thereafter were as follows:

Millions of Yen

Thousands of

U.S. Dollars

2015 2014 2015

Land ¥10,594 ¥12,953 $ 88,283

Building and structures 13,184 14,016 109,867

Investment securities 2,090 4,594 17,417

Total ¥25,868 ¥31,563 $215,567

Millions of Yen

Thousands of

U.S. Dollars

2015 2014 2015

Balance at beginning of year (as previously reported) ¥85,628 ¥80,185 $713,567

Cumulative effect of changes in accounting policies (812) –(6,767)

Balance at beginning of year (as restated) 84,816 80,185 706,800

Service cost 2,318 2,273 19,317

Interest cost 1,617 2,215 13,475

Actuarial losses 3,132 8,740 26,100

Benefits paid (4,122) (9,694) (34,350)

Others (491) 1,909 (4,092)

Balance at end of year ¥87,270 ¥85,628 $727,250

Millions of Yen

Thousands of

U.S. Dollars

2015 2014 2015

Balance at beginning of year ¥51,637 ¥52,292 $430,308

Expected return on plan assets 2,118 2,053 17,650

Actuarial losses 2,828 1,821 23,567

Contributions from the employer 3,823 3,830 31,858

Benefits paid (4,122) (9,694) (34,350)

Others (98) 1,335 (816)

Balance at end of year ¥56,186 ¥51,637 $468,217

36 Pioneer Corporation Annual Report 2015 37

Pioneer Corporation Annual Report 2015