Pioneer 2015 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2015 Pioneer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5. Long-lived Assets

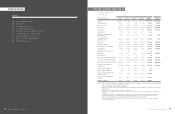

Short-term borrowings as of March 31, 2015 and 2014, consisted of the following:

7. Short-term Borrowings and Long-term Debt

The Group reviewed its long-lived assets for impair-

ment as of March 31, 2015. As a result, the Group

recognized an impairment loss as other expenses for

certain processing machinery groups related to organic

light-emitting diodes and idle assets whose disposal is

planned due to a decline of the market value and the

prospects for future profit.

In 2015, the group of business assets relating to or-

ganic light-emitting diodes was reduced to the value

in use since the book value of the group exceeded

the expected future cash flows. As for the group of

assets to be disposed of, each individual asset group

was reduced to the net selling price and the amount of

decrease was recorded in other income (expenses) as

loss on impairment of property, plant and equipment.

In November 2008, the ASBJ issued ASBJ State-

ment No. 20, “Accounting Standard for Investment

Property and Related Disclosures” and ASBJ Guid-

ance No. 23, “Guidance on Accounting Standard for

Investment Property and Related Disclosures.”

As of March 31, 2015, the Group held certain idle

properties in Yamanashi and other areas in Japan.

In principle, business assets are grouped based

on management classification. However, idle assets

whose disposal is planned or whose future use is not

forecasted are grouped individually in the smallest cash

flow generating unit independent of each other.

The value in use of the organic light-emitting di-

ode business asset group was estimated based on

the memorandum value. As for the group of assets to

be disposed of, the projected selling price was used

as the basis of recoverable values for machinery and

equipment, etc., and the value in use of zero as the

basis of values for software.

As of March 31, 2014, the Group held certain idle

properties in Shizuoka and other areas in Japan.

Gain on sales of idle properties for the year

ended March 31, 2015, was ¥1,473 million ($12,275

thousand).

There were neither losses on sales nor impairment

on those properties for the year ended March 31, 2014.

For the year ended March 31, 2015, the Group recognized an impairment loss of ¥1,331 million ($11,092 thousand),

as summarized in the table below:

There were no impairment of long-lived assets for the year ended March 31, 2014.

Millions of Yen

Carrying Amount Fair Value

April 1, 2014 Increase/Decrease March 31, 2015 March 31, 2015

Idle property ¥5,259 ¥(2,184) ¥3,075 ¥5,398

Total ¥5,259 ¥(2,184) ¥3,075 ¥5,398

Millions of Yen

Carrying Amount Fair Value

April 1, 2013 Increase/Decrease March 31, 2014 March 31, 2014

Idle property ¥5,260 ¥(1) ¥5,259 ¥15,392

Total ¥5,260 ¥(1) ¥5,259 ¥15,392

Thousands of U.S. Dollars

Carrying Amount Fair Value

April 1, 2014 Increase/Decrease March 31, 2015 March 31, 2015

Idle property $43,825 $(18,200) $25,625 $44,983

Total $43,825 $(18,200) $25,625 $44,983

Notes: 1. Carrying amount reported in the consolidated balance sheet is net of accumulated depreciation and accumulated

impairment losses, if any.

2. Decrease during the fiscal year ended March 31, 2015, principally represents the sales of idle property of ¥2,182 million

($18,183 thousand).

3. Fair value is principally based on the values provided by third-party real estate appraisers.

The carrying amounts, changes in such balances and fair value of such properties as of March 31, 2015 and

2014 were as follows:

6. Investment Property

Millions of Yen

Thousands of

U.S. Dollars

2015 2014 2015

Short-term borrowings:

Weighted-average interest rate of 3.88% as of March 31, 2015

and 2.80% as of March 31, 2014

Collateralized ¥ 4,892 ¥ 9,400 $ 40,767

Uncollateralized 12,979 12,778 108,158

Total ¥17,871 ¥22,178 $148,925

Millions of Yen

Thousands of

U.S. Dollars

Application Type Location Impairment Loss Impairment Loss

Organic light-emitting

diodes manufacturing facilities Machinery and equipment, etc.

Yonezawa, Yamagata,

Japan ¥ 4 $ 33

Assets to be disposed of Machinery and equipment, etc. China 1,245 10,375

Assets to be disposed of Software Brazil 82 684

Total ¥1,331 $11,092

Long-term debt as of March 31, 2015 and 2014, consisted of the following:

Millions of Yen

Thousands of

U.S. Dollars

2015 2014 2015

Long-term debt:

Collateralized ¥ 6,367 ¥52,270 $ 53,058

Uncollateralized 10,000 13,000 83,333

Long-term capital lease obligation, due principally in 2018 2,704 3,725 22,534

Total 19,071 68,995 158,925

Less—portion due within one year 8,135 67,476 67,792

Long-term debt, less current portion ¥10,936 ¥ 1,519 $ 91,133

34 Pioneer Corporation Annual Report 2015 35

Pioneer Corporation Annual Report 2015