Pioneer 2015 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2015 Pioneer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

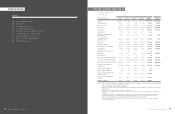

Year ended March 31, 2015,

compared with year ended March 31, 2014

Financial Position

Total assets as of March 31, 2015, were ¥328,277

million, an increase of ¥364 million from March 31,

2014, owing to an increase in cash and deposits that

more than offset decreases in inventories and trade

receivables. Inventories decreased ¥7,076 million, to

¥63,295 million, resulting from transfers of inventory

stock associated with business transfers more than

offsetting the effect of the Japanese yen’s deprecia-

tion. Trade receivables decreased ¥6,402 million, to

¥79,158 million, mainly due to the fact that fourth-

quarter sales were lower than in the fourth quarter of

the previous fiscal year, reflecting the effect of busi-

ness transfers. Cash and deposits increased ¥16,763

million, to ¥52,160 million, mainly as a result of busi-

ness transfers.

Total liabilities as of March 31, 2015, were

¥221,211 million, a decrease of ¥28,886 million from

March 31, 2014. This was the result of a ¥53,210

million reduction in borrowings, which more than off-

set increases of ¥15,861 million in accrued expenses,

mainly owing to the recording of restructuring costs

and ¥4,702 million in trade payables.

Total equity as of March 31, 2015, was ¥107,066

million, an increase of ¥29,250 million from March

31, 2014, reflecting net income of ¥14,632 million

and a ¥12,319 million increase in foreign currency

translation adjustments from the Japanese yen’s

depreciation.

Results of Operations

• Net sales

In fiscal 2015, consolidated net sales were roughly

flat with the previous fiscal year, at ¥501,676 million.

Sales of Home Electronics declined, but this was

offset by increased sales of Car Electronics, reflecting

the Japanese yen’s depreciation.

Car Electronics sales grew 2.2% year on year, to

¥355,591 million, reflecting the effect of the Japanese

yen’s depreciation. Sales of car navigation systems

declined. Consumer-market sales of car navigation

systems rose in overseas markets including North

America, Europe, and China, but Japan saw a decline

as a result of a shift to lower-priced models and a

Management’s Discussion and Analysis of Financial Position, Results of Operations, and Cash Flows

• Other income (expenses)—net

In fiscal 2015, other income (expenses)—net im-

proved by ¥22,956 million, to other income—net

of ¥17,452 million, compared with other expenses—

net of ¥5,504 million in fiscal 2014. This reflected a

¥48,415 million gain from the transfer of the DJ equip-

ment business, which more than offset a decrease

in operating income, and a ¥6,450 million foreign

exchange loss, as well as a ¥3,526 million loss from

the transfer of the home AV and its related businesses

and restructuring costs of ¥13,250 million in line with

organizational streamlining, despite the negative ef-

fect of foreign exchange rate movements.

• Income before income taxes and minority interests

As a result of the foregoing, income before income

taxes and minority interests increased to ¥25,230 mil-

lion, from ¥5,665 million in fiscal 2014.

• Income taxes

Income taxes for fiscal 2015 increased to ¥11,142

million, compared with ¥5,159 million for fiscal 2014,

principally due to a reversal of deferred tax assets.

• Net income

As a result of the above, net income rose to ¥14,632

million, from ¥531 million in fiscal 2014.

Cash Flows

During fiscal 2015, operating activities provided net

cash in the amount of ¥34,564 million, a ¥322 mil-

lion increase from fiscal 2014. Although net gain on

business transfers of ¥44,889 million was posted

and trade payables turned around to a ¥3,843 million

decrease in fiscal 2015, compared with an ¥11,278

million increase in fiscal 2014, trade receivables de-

creased ¥10,807 million in fiscal 2015, compared

with an ¥8,648 million increase in fiscal 2014, and

the amount of increase in accrued expenses grew

¥13,236 million, which resulted in an overall increase.

Investing activities provided net cash in the

amount of ¥36,880 million, compared with ¥21,862

million used in fiscal 2014. This was mainly because

of a ¥57,124 million cash inflow from business

transfers.

drop-off in consumption in the wake of accelerated

demand ahead of the consumption tax increase in

April 2014, which resulted in an overall decline. OEM

sales declined in Japan, but grew mainly in China and

North America, which resulted in an overall increase.

Sales of car audio products increased. Consumer-

market sales were flat year on year, with a decline in

Europe and Japan, despite growth mainly in Central

and South America and North America. OEM sales

rose, with increases in North America, Southeast Asia,

and Europe more than offsetting a decrease in China.

OEM sales accounted for 57% of total Car Electronics

sales, compared with 54% in the previous fiscal year.

By geographic region, sales in Japan declined 13.2%,

to ¥131,347 million, while overseas sales rose 13.9%,

to ¥224,244 million.

Home Electronics sales declined 6.3% year on

year, to ¥104,697 million, reflecting lower sales of

home AV products and the transfers of the home AV

and DJ equipment businesses. By geographic region,

sales in Japan grew 2.9%, to ¥37,139 million, while

overseas sales declined 10.7%, to ¥67,558 million.

In the Others segment, sales rose 8.2% year on

year, to ¥41,388 million, mainly from increased sales

of factory automation systems. By geographic region,

sales in Japan grew 8.5%, to ¥24,594 million, and

overseas sales rose 7.7%, to ¥16,794 million.

• Operating income

Cost of sales increased to ¥403,072 million from

¥396,705 million a year earlier. Cost of sales ac-

counted for 80.3% of net sales, worsening by 0.7

percentage point from 79.7% in fiscal 2014, mainly

resulting from the negative effect of foreign exchange

rate movements. Selling, general and administrative

(SG&A) expenses increased to ¥90,826 million from

¥90,177 million in fiscal 2014, mainly reflecting foreign

exchange rate movements. As a result, operating in-

come decreased to ¥7,778 million in fiscal 2015,

compared with ¥11,169 million in fiscal 2014. R&D

expenses, which were included in cost of sales and

SG&A expenses, increased 4.9% to ¥28,196 mil-

lion, representing 5.6% of net sales. R&D expenses

were mostly incurred to enhance our technological

advantage in our strategic products, such as car

navigation systems.

Financing activities used net cash in the amount

of ¥55,424 million, a ¥54,537 million increase from

fiscal 2014. This reflected a ¥44,795 million large

decrease in the amount of net borrowings from the

previous fiscal year, and the absence of the year-

earlier ¥8,643 million inflow from the capital increase

through third-party allotments.

Foreign currency translation adjustments on cash

and cash equivalents were a positive ¥1,752 million, a

¥308 million increase from March 31, 2014.

As a result, cash and cash equivalents as of

March 31, 2015, totaled ¥51,676 million, a ¥17,772

million increase from March 31, 2014.

Financial Review

20 Pioneer Corporation Annual Report 2015 21

Pioneer Corporation Annual Report 2015