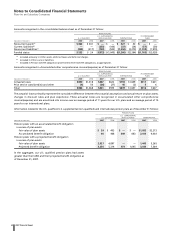

Pfizer 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Financial Report 63

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

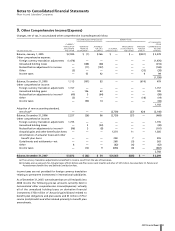

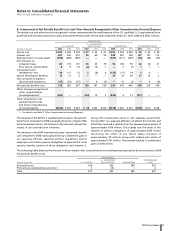

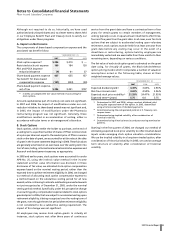

E. Plan Assets

The following table presents the weighted-average long-term

target asset allocations and the percentages of the fair value of plan

assets for our U.S. qualified and international pension plans and

postretirement plans by investment category as of December 31:

TARGET PERCENTAGE OF

ALLOCATION PLAN ASSETS

(PERCENTAGES) 2007 2007 2006

U.S. qualified pension plans:

Global equity securities 55.0 61.4 68.6

Debt securities 35.0 23.6 22.8

Alternative investments(a) 10.0 10.9 8.4

Cash — 4.1 0.2

Total 100.0 100.0 100.0

International pension plans:

Global equity securities 61.1 63.2 62.2

Debt securities 28.8 23.3 23.7

Alternative investments(b) 9.4 7.9 10.3

Cash 0.7 5.6 3.8

Total 100.0 100.0 100.0

U.S. postretirement plans(c):

Global equity securities 75.0 72.3 74.8

Debt securities 25.0 23.8 23.1

Alternative investments(a) — 2.8 2.1

Cash — 1.1 —

Total 100.0 100.0 100.0

(a) Private equity, venture capital, private debt and real estate.

(b) Real estate, insurance contracts and other investments.

(c) Reflects postretirement plan assets, which support a portion of

our U.S. retiree medical plans.

All long-term asset allocation targets reflect our asset class return

expectations and tolerance for investment risk within the context

of the respective plans’ long-term benefit obligations. The long-

term asset allocation is supported by an analysis that incorporates

historical and expected returns by asset class, as well as volatilities

and correlations across asset classes and our liability profile. This

analysis, referred to as an asset-liability analysis, also provides an

estimate of expected returns on plan assets, as well as a forecast

of potential future asset and liability balances. Due to market

conditions and other factors, actual asset allocations may vary from

the target allocation outlined above. For the U.S. qualified pension

plans, in late 2007, we modified our strategic asset target

allocation to reduce the volatility of our plan funded status and

the probability of future contribution requirements. Our target

allocations have been revised to increase the debt securities

allocation by 10% and to reduce the global equity securities

allocation by a corresponding amount. The year-end 2007 cash

allocation of 4.1% for U.S. qualified pensions plans and 5.6% for

international pension plans was above the target allocation,

primarily due to cash raised from the termination of certain

investment strategies, which will be redeployed during 2008.

The assets are periodically rebalanced back to the target allocation.

The U.S. qualified pension plans held no shares of our common

stock as of December 31, 2007, and approximately 10.2 million

shares (fair value of approximately $263 million, representing 3.3%

of U.S. plan assets) as of December 31, 2006. The plans received

approximately $12 million in dividends on shares of our common

stock in 2007 and approximately $10 million in dividends on

these shares in 2006.

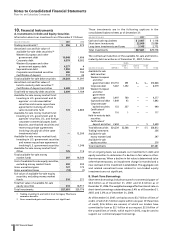

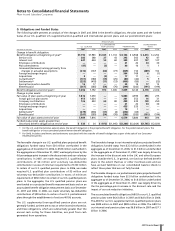

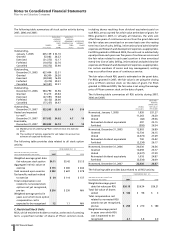

F. Cash Flows

It is our practice to fund amounts for our qualified pension plans

that are at least sufficient to meet the minimum requirements set

forth in applicable employee benefit laws and local tax laws.

The following table presents expected cash flow information:

FOR THE YEAR PENSION PLANS

___________________________________________________

ENDED U.S. POST-

DECEMBER 31, U.S. SUPPLEMENTAL RETIREMENT

(MILLIONS OF DOLLARS) QUALIFIED (NON-QUALIFIED) INTERNATIONAL PLANS

Employer

contributions:

2008 (estimated) $ — $253 $ 367 $164

Expected benefit

payments:

2008 $ 527 $253 $ 328 $164

2009 425 77 331 168

2010 441 76 342 170

2011 456 76 361 173

2012 477 75 374 173

2013–2017 2,823 379 2,102 812

The table reflects the total U.S. and international plan benefits

projected to be paid from the plans or from our general assets

under the current actuarial assumptions used for the calculation

of the benefit obligation and, therefore, actual benefit payments

may differ from projected benefit payments.

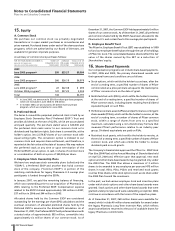

G. Defined Contribution Plans

We have savings and investment plans in several countries,

including the U.S., Japan, Spain and the Netherlands. For the

U.S. plans, employees may contribute a portion of their salaries and

bonuses to the plans, and we match, largely in company stock, a

portion of the employee contributions. In the U.S., employees

are permitted to diversify all or any portion of their company stock

match contribution. The contribution match for certain legacy

Pfizer U.S. participants is held in an employee stock ownership plan.

We recorded charges related to our plans of $203 million in 2007,

$222 million in 2006 and $234 million in 2005.