Pfizer 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 2007 Financial Report

Financial Review

Pfizer Inc and Subsidiary Companies

medicines that led their therapeutic areas based on revenues.

(See further discussion in the “Analysis of the Consolidated

Statement of Income” section of this Financial Review.)

•Decision to Exit Exubera:

Exubera was the first inhaled insulin therapy for the treatment

of diabetes, and since May 2006, had been launched in

Germany, Ireland, the U.K. and the U.S. In the third quarter of

2007, after an assessment of the financial performance of

Exubera, as well as its lack of acceptance by patients, physicians

and payers, we decided to exit the product.

Our Exubera-related exit plans included working with physicians

over a three-month period to transition patients to other

treatment options, evaluating redeployment options for

colleagues, working with our partners and vendors with respect

to transition and exit activities, working with regulators on

concluding outstanding clinical trials, implementing an

extended transition program for those patients unable to

transition to other medications within the three-month period,

and exploring asset disposal or redeployment opportunities, as

appropriate, among other activities.

As part of this exit plan, in 2007, we paid $135 million to one

of our partners in satisfaction of all remaining obligations

under existing agreements relating to Exubera and a next

generation insulin (NGI) under development. In addition, in the

event that a new partner is selected, we have agreed to transfer

our remaining rights and all economic benefits for Exubera and

NGI. This transfer of our interests would include the transfer of

the Exubera New Drug Application and Investigational New

Drug Applications and all non-U.S. regulatory filings and

applications, continuation of ongoing Exubera clinical trials and

certain supply chain transition activities.

Total pre-tax charges for 2007 were $2.8 billion, virtually all of

which were recorded in the third quarter. The financial

statement line items in which the various charges are recorded

and related activity are as follows:

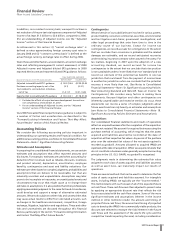

SELLING

CUSTOMER INFORMATIONAL & RESEARCH & ACTIVITY ACCRUAL AS

RETURNS- COST OF ADMINISTRATIVE DEVELOPMENT THROUGH OF DEC. 31,

(MILLIONS OF DOLLARS) REVENUES SALES EXPENSES EXPENSES TOTAL DEC. 31, 2007(a) 2007

Intangible asset

impairment charges(b) $— $1,064 $41 $ — $1,105 $1,105 $ —

Inventory write-offs — 661 — — 661 661 —

Fixed assets impairment

charges and other — 451 — 3 454 454 —

Other exit costs 10 427 44 97 578 164 414(c)

Total $10 $2,603 $85 $100 $2,798 $2,384 $414

(a) Includes adjustments for foreign currency translation.

(b) Amortization of these assets had previously been recorded in

Cost of sales

and

Selling, informational and administrative expenses

.

(c) Included in

Other current liabilities

($375 million) and

Other noncurrent liabilities

($39 million).

The asset write-offs (intangibles, inventory and fixed assets)

represent non-cash charges. The other exit costs, primarily

severance, contract and other termination costs, as well as other

liabilities, are associated with marketing and research programs,

and manufacturing operations related to Exubera. These exit

costs resulted in cash expenditures in 2007 (such as the $135

million settlement referred to above) and will result in additional

cash expenditures in 2008. We expect that substantially all of the

cash spending will be completed within the next year. During the

exit of this product, certain additional cash costs will be incurred

and reported in future periods, such as maintenance-level

operating costs. However, those future costs are not expected to

be significant. We expect that substantially all exit activities will

be completed within the next year.

•Income from continuing operations before cumulative effect

of a change in accounting principles was $8.2 billion compared

to $11.0 billion in 2006. The decrease was primarily due to

event-driven expenses, such as:

䡬higher asset impairment charges. In 2007, we expensed $2.8

billion, pre-tax, related to our decision to exit Exubera,

compared to $320 million, pre-tax, in 2006, related to the

impairment of our Depo-Provera intangible asset; and

䡬higher restructuring charges and acquisition-related costs

associated with our expanded cost-reduction initiatives,

partially offset by:

䡬lower Acquisition-related in-process research and development

charges (IPR&D). In 2007, we incurred IPR&D expenses of $283

million, pre-tax, primarily related to our acquisitions of BioRexis

Pharmaceutical Corp. (BioRexis) and Embrex, Inc. (Embrex),

compared with IPR&D of $835 million, pre-tax, in 2006,

primarily related to our acquisitions of PowderMed Ltd.

(PowderMed), and Rinat Neuroscience Corp. (Rinat);

䡬higher interest income compared to 2006, due primarily to

higher net financial assets during 2007 compared to 2006,

reflecting proceeds of $16.6 billion from the sale of our

Consumer Healthcare business, and higher interest rates; and

䡬a lower effective income tax rate. In 2007, our effective tax rate

on continuing operations of 11.0% was lower than the 15.3%

rate in 2006, which largely reflects the tax impact of our decision

to exit Exubera in 2007, the tax impact of higher cost-reduction

expenditures in 2007 compared to 2006 and the volume and

geographic mix of product sales in 2007 compared to 2006.

•Discontinued operations—net of tax were losses of $69 million

in 2007, compared with income of $8.3 billion in 2006. The

results in 2006 relate primarily to our former Consumer

Healthcare business, which was sold on December 20, 2006. The

2006 amount includes the gain on the sale of this business of