Pfizer 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2007 Financial Report 51

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

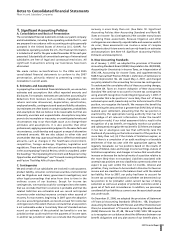

We operate manufacturing subsidiaries in Puerto Rico, Ireland and

Singapore. We benefit from Puerto Rican incentive grants that

expire between 2017 and 2027. Under the grants, we are partially

exempt from income, property and municipal taxes. Under Section

936 of the U.S. Internal Revenue Code, Pfizer was a “grandfathered”

entity and was entitled to the benefits under such statute until

September 30, 2006. In Ireland, we benefit from an incentive tax rate

effective through 2010 on income from manufacturing operations.

In Singapore, we benefit from incentive tax rates effective through

2031 on income from manufacturing operations.

The U.S. research tax credit was effective through December 31,

2007. For a discussion about the repatriation of foreign earnings and

the tax legislation impact, see Note 8B. Taxes on Income: Taxes on

Income. For a discussion about the resolution of certain tax positions,

see Note 8E. Taxes on Income: Tax Contingencies. The charges for

acquired IPR&D in 2007, 2006 and 2005 are not deductible.

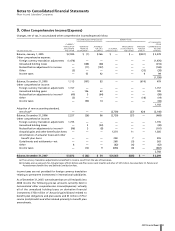

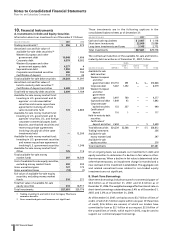

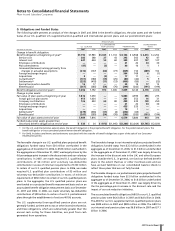

D. Deferred Taxes

Deferred taxes arise because of different timing treatment

between financial statement accounting and tax accounting,

known as “temporary differences.” We record the tax effect of

these temporary differences as “deferred tax assets” (generally

items that can be used as a tax deduction or credit in future

periods) or “deferred tax liabilities” (generally items for which we

received a tax deduction, but that have not yet been recorded in

the consolidated statement of income).

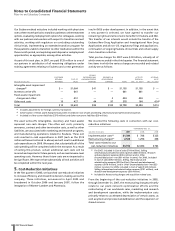

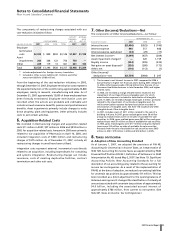

The tax effect of the major items recorded as deferred tax assets and

liabilities, shown before jurisdictional netting, as of December 31,

is as follows:

2007 2006

DEFERRED TAX DEFERRED TAX

_____________________________ _____________________________

(MILLIONS OF DOLLARS) ASSETS (LIABILITIES) ASSETS (LIABILITIES)

Prepaid/deferred

items $1,315 $ (431) $1,164 $ (312)

Intangibles 897 (6,737) 841 (7,704)

Property, plant

and equipment 300 (957) 104 (1,105)

Employee

benefits 2,552 (740) 3,141 (804)

Restructurings

and other

charges 717 (11) 573 (19)

Net operating

loss/credit

carryforwards 1,842 — 1,061 —

Unremitted

earnings — (3,550) — (3,567)

State and local tax

adjustments(a) 529 — ——

All other 848 (37) 912 (392)

Subtotal 9,000 (12,463) 7,796 (13,903)

Valuation

allowance (158) — (194) —

Total deferred

taxes $8,842 $(12,463) $7,602 $(13,903)

Net deferred

tax liability $ (3,621) $ (6,301)

(a) Reclassified as a result of the adoption of a new accounting standard.

The reduction in the net deferred tax liability position in 2007

compared to 2006 is primarily due to amortization of deferred tax

liabilities related to identifiable intangibles in connection with our

acquisition of Pharmacia in 2003, partially offset by an increase

in noncurrent deferred tax assets related to the impairment of

Exubera. (See Note 4. Asset Impairment Charges and Other Costs

Associated with Exiting Exubera.)

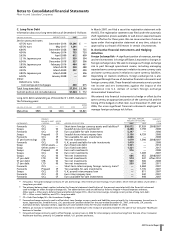

We have carryforwards primarily related to foreign tax credit

carryovers and net operating losses, which are available to reduce

future U.S. federal and state, as well as international, income with

either an indefinite life or expiring at various times between

2008 and 2026. Certain of our U.S. net operating losses are subject

to limitations under Internal Revenue Code Section 382.

Valuation allowances are provided when we believe that our

deferred tax assets are not recoverable, based on an assessment

of estimated future taxable income that incorporates ongoing,

prudent, feasible tax planning strategies.

Deferred tax assets and liabilities in the preceding table, netted

by taxing jurisdiction, are in the following captions in our

consolidated balance sheets:

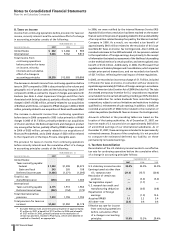

AS OF DEC. 31,

__________________________________

(MILLIONS OF DOLLARS) 2007 2006

Current deferred tax asset(a) $ 1,664 $ 1,384

Noncurrent deferred tax assets(b) 2,441 354

Current deferred tax liability(c) (30) (24)

Noncurrent deferred tax liability(d) (7,696) (8,015)

Net deferred tax liability $(3,621) $(6,301)

(a) Included in

Prepaid expenses and taxes

.

(b) Included in

Other assets, deferred taxes and deferred charges

.

(c) Included in

Other current liabilities

.

(d) Included in

Deferred taxes

.

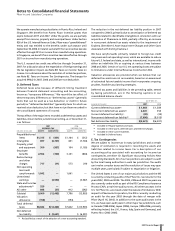

E. Tax Contingencies

We are subject to income tax in many jurisdictions and a certain

degree of estimation is required in recording the assets and

liabilities related to income taxes. For a description of our

accounting policy associated with accounting for income tax

contingencies, see Note 1D. Significant Accounting Policies: New

Accounting Standards. All of our tax positions are subject to audit

by the local taxing authorities in each tax jurisdiction. Tax audits

can involve complex issues and the resolution of issues may span

multiple years, particularly if subject to negotiation or litigation.

The United States is one of our major tax jurisdictions and the IRS

is currently conducting audits of the Pfizer Inc. tax returns for the

years 2002, 2003 and 2004. The 2005, 2006 and 2007 tax years are

also currently under audit as part of the IRS Compliance Assurance

Process (CAP), a real-time audit process. All other tax years in the

U.S. for Pfizer Inc. are closed under the statute of limitations. With

respect to Pharmacia Corporation, the IRS is currently conducting

an audit for the year 2003 through the date of merger with

Pfizer (April 16, 2003). In addition to the open audit years in the

U.S., we have open audit years in other major tax jurisdictions, such

as Canada (1998-2006), Japan (2006), Europe (1996-2006, primarily

reflecting Ireland, the U.K., France, Italy, Spain and Germany), and

Puerto Rico (2003-2006).