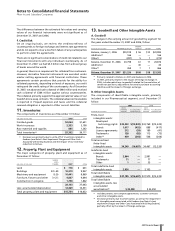

Pfizer 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62 2007 Financial Report

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

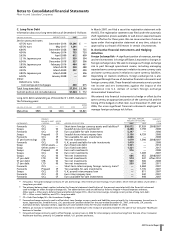

In the aggregate, our U.S. qualified pension plans had assets

greater than their ABO and their projected benefit obligation as

of December 31, 2007.

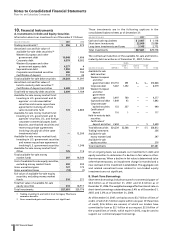

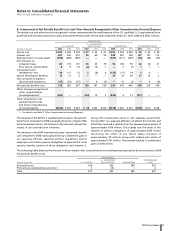

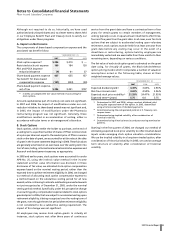

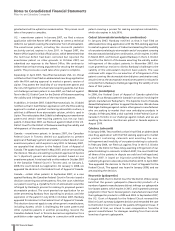

Information related to the U.S. qualified, U.S. supplemental (non-qualified) and international pension plans as of December 31 follows:

PENSION PLANS

_______________________________________________________________________________

U.S. SUPPLEMENTAL

U.S. QUALIFIED (NON-QUALIFIED) INTERNATIONAL

(MILLIONS OF DOLLARS) 2007 2006 2007 2006 2007 2006

Pension plans with an accumulated benefit obligation

in excess of plan assets:

Fair value of plan assets $39 $ 403 $— $— $1,052 $2,273

Accumulated benefit obligation 40 468 849 883 2,413 4,002

Pension plans with a projected benefit obligation

in excess of plan assets:

Fair value of plan assets 2,927 4,897 ——1,445 5,265

Projected benefit obligation 3,256 5,314 973 1,045 3,033 7,569

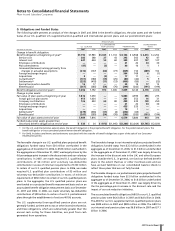

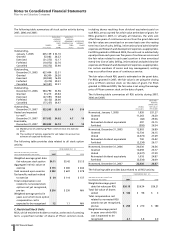

PENSION PLANS

U.S. SUPPLEMENTAL POSTRETIREMENT

U.S. QUALIFIED (NON-QUALIFIED) INTERNATIONAL PLANS

(MILLIONS OF DOLLARS) 2007 2006 2007 2006 2007 2006 2007 2006

Noncurrent assets(a) $ 862 $ 441 $— $—$ 327 $40$—$—

Current liabilities(b) ——(253) (100) (37) (34) (57) (50)

Noncurrent liabilities(c) (329) (417) (720) (945) (1,550) (2,270) (1,708) (1,970)

Funded status $ 533 $ 24 $(973) $(1,045) $(1,260) $(2,264) $(1,765) $(2,020)

(a) Included primarily in Other assets, deferred taxes and deferred charges.

(b) Included in Other current liabilities.

(c) Included in Pension benefit obligations and Postretirement benefit obligations, as appropriate.

Amounts recognized in the consolidated balance sheet as of December 31 follow:

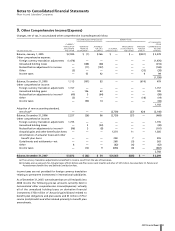

Amounts recognized in Accumulated other comprehensive income/(expense) as of December 31 follow:

PENSION PLANS

U.S. SUPPLEMENTAL POSTRETIREMENT

U.S. QUALIFIED (NON-QUALIFIED) INTERNATIONAL PLANS

(MILLIONS OF DOLLARS) 2007 2006 2007 2006 2007 2006 2007 2006

Actuarial losses $890 $1,418 $487 $622 $794 $1,649 $311 $621

Prior service costs/(credits) and other (4) 50 (26) (27) 45 (2) 56

Total $886 $1,468 $461 $595 $839 $1,647 $316 $627

The actuarial losses primarily represent the cumulative difference between the actuarial assumptions and actual return on plan assets,

changes in discount rates and plan experience. These actuarial losses are recognized in Accumulated other comprehensive

income/(expense) and are amortized into income over an average period of 11 years for our U.S. plans and an average period of 14

years for our international plans.