Pfizer 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26 2007 Financial Report

Financial Review

Pfizer Inc and Subsidiary Companies

intangible assets for the increase to fair value. Therefore, the

Adjusted income measure includes the revenues earned upon

the sale of the acquired products without considering the

aforementioned significant charges.

Certain of the purchase-accounting adjustments associated with a

business combination, such as the amortization of intangibles

acquired in connection with our acquisition of Pharmacia in 2003,

can occur for up to 40 years (these assets have a weighted-average

useful life of approximately nine years), but this presentation

provides an alternative view of our performance that is used by

management to internally assess business performance. We believe

the elimination of amortization attributable to acquired intangible

assets provides management and investors an alternative view of

our business results by trying to provide a degree of parity to

internally developed intangible assets for which research and

development costs have been previously expensed.

However, a completely accurate comparison of internally

developed intangible assets and acquired intangible assets cannot

be achieved through Adjusted income. This component of

Adjusted income is derived solely with the impacts of the items

listed in the first paragraph of this section. We have not factored

in the impacts of any other differences in experience that might

have occurred if we had discovered and developed those

intangible assets on our own, and this approach is not intended

to be representative of the results that would have occurred in

those circumstances. For example, our research and development

costs in total, and in the periods presented, may have been

different; our speed to commercialization and resulting sales, if

any, may have been different; or our costs to manufacture may

have been different. In addition, our marketing efforts may have

been received differently by our customers. As such, in total,

there can be no assurance that our Adjusted income amounts

would have been the same as presented had we discovered and

developed the acquired intangible assets.

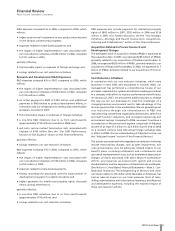

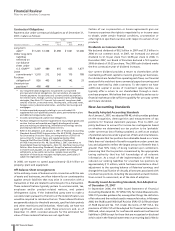

Acquisition-Related Costs

Adjusted income is calculated prior to considering integration and

restructuring costs associated with business combinations because

these costs are unique to each transaction and represent costs that

were incurred to restructure and integrate two businesses as a

result of the acquisition decision. For additional clarity, only

restructuring and integration activities that are associated with

a purchase business combination or a net-asset acquisition are

included in acquisition-related costs. We have made no

adjustments for the resulting synergies.

We believe that viewing income prior to considering these charges

provides investors with a useful additional perspective because the

significant costs incurred in a business combination result primarily

from the need to eliminate duplicate assets, activities or

employees—a natural result of acquiring a fully integrated set of

activities. For this reason, we believe that the costs incurred to

convert disparate systems, to close duplicative facilities or to

eliminate duplicate positions (for example, in the context of a

business combination) can be viewed differently from those costs

incurred in other, more normal business contexts.

The integration and restructuring costs associated with a business

combination may occur over several years, with the more

significant impacts ending within three years of the transaction.

Because of the need for certain external approvals for some

actions, the span of time needed to achieve certain restructuring

and integration activities can be lengthy. For example, due to the

highly regulated nature of the pharmaceutical business, the

closure of excess facilities can take several years, as all

manufacturing changes are subject to extensive validation and

testing and must be approved by the FDA.

Discontinued Operations

Adjusted income is calculated prior to considering the results of

operations included in discontinued operations, such as our

Consumer Healthcare business, which we sold in December 2006,

as well as any related gains or losses on the sale of such operations.

We believe that this presentation is meaningful to investors

because, while we review our businesses and product lines

periodically for strategic fit with our operations, we do not build

or run our businesses with an intent to sell them.

Cumulative Effect of a Change in Accounting Principles

Adjusted income is calculated prior to considering the cumulative

effect of a change in accounting principles. The cumulative effect

of a change in accounting principles is generally one time in

nature and not expected to occur as part of our normal business

on a regular basis.

Certain Significant Items

Adjusted income is calculated prior to considering certain significant

items. Certain significant items represent substantive, unusual

items that are evaluated on an individual basis. Such evaluation

considers both the quantitative and the qualitative aspect of their

unusual nature. Unusual, in this context, may represent items that

are not part of our ongoing business; items that, either as a result

of their nature or size, we would not expect to occur as part of our

normal business on a regular basis; items that would be non-

recurring; or items that relate to products we no longer sell. While

not all-inclusive, examples of items that could be included as

certain significant items would be a major non-acquisition-related

restructuring charge and associated implementation costs for a

program which is specific in nature with a defined term, such as

those related to our cost-reduction initiatives; charges related to

sales or disposals of products or facilities that do not qualify as

discontinued operations as defined by U.S. GAAP; amounts

associated with transition service agreements in support of

discontinued operations after sale; certain intangible asset

impairments; adjustments related to the resolution of certain tax

positions; the impact of adopting certain significant, event-driven

tax legislation, such as adjustments associated with charges

attributable to the repatriation of foreign earnings in accordance

with the American Jobs Creation Act of 2004; or possible charges

related to legal matters, such as certain of those discussed in Legal

Proceedings in our Form 10-K and in Part II: Other Information; Item

1, Legal Proceedings in our Form 10-Q filings. Normal, ongoing

defense costs of the Company or settlements and accruals on legal

matters made in the normal course of our business would not be

considered certain significant items.