Pfizer 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

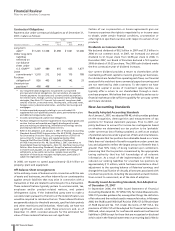

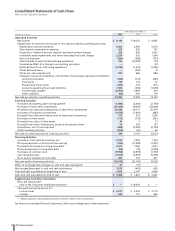

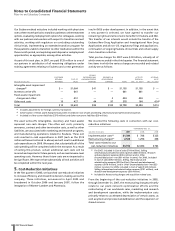

Consolidated Statements of Cash Flows

Pfizer Inc and Subsidiary Companies

YEAR ENDED DECEMBER 31,

________________________________________________________________

(MILLIONS OF DOLLARS) 2007 2006 2005

Operating Activities

Net income $ 8,144 $ 19,337 $ 8,085

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization 5,200 5,293 5,576

Share-based compensation expense 437 655 157

Acquisition-related in-process research and development charges 283 835 1,652

Intangible asset impairments and other associated non-cash charges 2,220 320 1,240

Gains on disposals (326) (280) (172)

(Gains)/losses on sales of discontinued operations 168 (10,243) (77)

Cumulative effect of a change in accounting principles ——40

Deferred taxes from continuing operations (2,788) (1,525) (1,465)

Other deferred taxes —(420) 8

Other non-cash adjustments 815 606 486

Changes in assets and liabilities, net of effect of businesses acquired and divested:

Accounts receivable (320) (172) (803)

Inventories 720 118 72

Prepaid and other assets (647) 314 615

Accounts payable and accrued liabilities 1,509 (450) (1,054)

Income taxes payable (2,002) 2,909 254

Other liabilities (60) 297 119

Net cash provided by operating activities 13,353 17,594 14,733

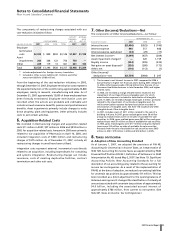

Investing Activities

Purchases of property, plant and equipment (1,880) (2,050) (2,106)

Purchases of short-term investments (25,426) (9,597) (28,040)

Proceeds from sales and redemptions of short-term investments 30,288 20,771 26,779

Purchases of long-term investments (1,635) (1,925) (687)

Proceeds from sales and redemptions of long-term investments 172 233 1,309

Purchases of other assets (111) (153) (431)

Proceeds from sales of other assets 30 312

Proceeds from sales of businesses, products and product lines 24 200 127

Acquisitions, net of cash acquired (464) (2,320) (2,104)

Other investing activities (203) (61) 69

Net cash provided by/(used in) investing activities 795 5,101 (5,072)

Financing Activities

Increase in short-term borrowings, net 3,155 1,040 1,124

Principal payments on short-term borrowings (764) (11,969) (1,427)

Proceeds from issuances of long-term debt 2,573 1,050 1,021

Principal payments on long-term debt (64) (55) (1,039)

Purchases of common stock (9,994) (6,979) (3,797)

Cash dividends paid (7,975) (6,919) (5,555)

Stock option transactions and other 459 732 451

Net cash used in financing activities (12,610) (23,100) (9,222)

Effect of exchange-rate changes on cash and cash equivalents 41 (15) —

Net increase/(decrease) in cash and cash equivalents 1,579 (420) 439

Cash and cash equivalents at beginning of year 1,827 2,247 1,808

Cash and cash equivalents at end of year $ 3,406 $ 1,827 $ 2,247

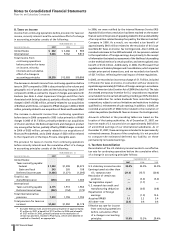

Supplemental Cash Flow Information

Non-cash transactions:

Sale of the Consumer Healthcare business(a) $— $ 16,429 $ —

Cash paid during the period for:

Income taxes $ 5,617 $ 3,443 $ 4,713

Interest 643 715 649

(a) Reflects portion of proceeds received in the form of short-term investments.

See Notes to Consolidated Financial Statements, which are an integral part of these statements.

42 2007 Financial Report