Pfizer 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 2007 Financial Report

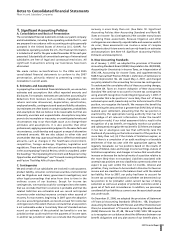

Notes to Consolidated Financial Statements

Pfizer Inc and Subsidiary Companies

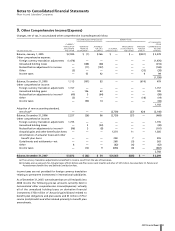

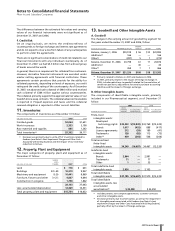

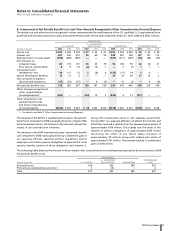

B. Taxes on Income

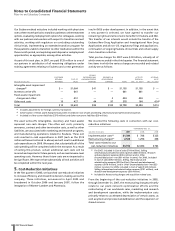

Income from continuing operations before provision for taxes on

income, minority interests and the cumulative effect of a change

in accounting principles consists of the following:

YEAR ENDED DEC. 31,

_____________________________________________________

(MILLIONS OF DOLLARS) 2007 2006 2005

United States $ 242 $ 3,266 $ 985

International 9,036 9,762 9,815

Total income from

continuing operations

before provision for taxes

on income, minority

interests and cumulative

effect of a change in

accounting principles $9,278 $13,028 $10,800

The decrease in domestic income from continuing operations before

taxes in 2007 compared to 2006 is due primarily to the volume and

geographic mix of product sales and restructuring charges in 2007

compared to 2006, as well as the impact of charges associated with

Exubera (see Note 4. Asset Impairment Charges and Other Costs

Associated with Exiting Exubera), partially offset by lower IPR&D

charges in 2007 of $283 million, primarily related to our acquisitions

of BioRexis and Embrex, compared to IPR&D charges in 2006 of $835

million, primarily related to our acquisitions of Rinat and PowderMed.

The increase in domestic income from continuing operations

before taxes in 2006 compared to 2005 is due primarily to IPR&D

charges in 2005 of $1.7 billion, primarily related to our acquisitions

of Vicuron and Idun, the Bextra impairment and changes in product

mix, among other factors, partially offset by IPR&D charges recorded

in 2006 of $835 million, primarily related to our acquisitions of

Rinat and PowderMed, and a 2006 charge of $320 million related

to the impairment of the Depo-Provera intangible asset.

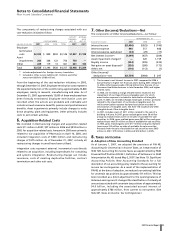

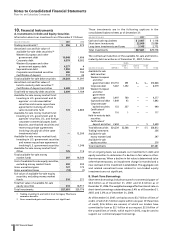

The provision for taxes on income from continuing operations

before minority interests and the cumulative effect of a change

in accounting principles consists of the following:

YEAR ENDED DEC. 31,

_____________________________________________________

(MILLIONS OF DOLLARS) 2007 2006 2005

United States:

Taxes currently payable:

Federal $ 1,393 $1,399 $2,572

State and local 243 205 108

Deferred income taxes (1,986) (1,371) (1,295)

Total U.S. tax

(benefit)/provision (350) 233 1,385

International:

Taxes currently payable 2,175 1,913 1,963

Deferred income taxes (802) (154) (170)

Total international tax

provision 1,373 1,759 1,793

Total provision for taxes on

income(a) $1,023 $1,992 $3,178

(a) Excludes federal, state and international expense of approximately

$1 million in 2007, a benefit of $119 million in 2006 and a benefit

of $127 million in 2005, primarily related to the resolution of

certain tax positions related to Pharmacia, which were debited or

credited to Goodwill, as appropriate.

In 2006, we were notified by the Internal Revenue Service (IRS)

Appeals Division that a resolution had been reached on the matter

that we were in the process of appealing related to the tax deductibility

of an acquisition-related breakup fee paid by the Warner-Lambert

Company in 2000. As a result, we recorded a tax benefit of

approximately $441 million related to the resolution of this issue

(see Note 8E. Taxes on Income: Tax Contingencies). Also in 2006, we

recorded a decrease to the 2005 estimated U.S. tax provision related

to the repatriation of foreign earnings, due primarily to the receipt

of information that raised our assessment of the likelihood of prevailing

on the technical merits of a certain position, and we recognized a tax

benefit of $124 million. Additionally, in 2006, the IRS issued final

regulations on Statutory Mergers and Consolidations, which impacted

certain prior-period transactions, and we recorded a tax benefit

of $217 million, reflecting the total impact of these regulations.

In 2005, we recorded an income tax charge of $1.7 billion, included

in Provision for taxes on income, in connection with our decision to

repatriate approximately $37 billion of foreign earnings in accordance

with the American Jobs Creation Act of 2004 (the Jobs Act). The Jobs

Act created a temporary incentive for U.S. corporations to repatriate

accumulated income earned abroad by providing an 85% dividend-

received deduction for certain dividends from controlled foreign

corporations, subject to various limitations and restrictions including

qualified U.S. reinvestment of such earnings. In addition, in 2005, we

recorded a tax benefit of $586 million related to the resolution of

certain tax positions (see Note 8E. Taxes on Income: Tax Contingencies).

Amounts reflected in the preceding tables are based on the

location of the taxing authorities. As of December 31, 2007, we

have not made a U.S. tax provision on approximately $60 billion

of unremitted earnings of our international subsidiaries. As of

December 31, 2007, these earnings are intended to be permanently

reinvested overseas. Because of the complexity, it is not practical

to compute the estimated deferred tax liability on these

permanently reinvested earnings.

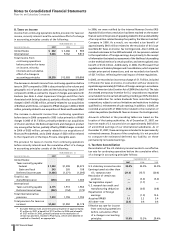

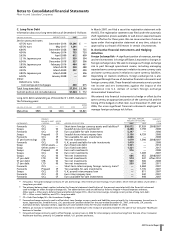

C. Tax Rate Reconciliation

Reconciliation of the U.S. statutory income tax rate to our effective

tax rate for continuing operations before the cumulative effect

of a change in accounting principles follows:

YEAR ENDED DEC. 31,

___________________________________________________

2007 2006 2005

U.S. statutory income tax rate 35.0% 35.0% 35.0%

Earnings taxed at other than

U.S. statutory rate (21.6) (15.7) (20.6)

Resolution of certain tax

positions —(3.4) (5.4)

Tax legislation impact —(1.7) —

U.S. research tax credit and

manufacturing deduction (1.5) (0.5) (0.8)

Repatriation of foreign

earnings —(1.0) 15.4

Acquired IPR&D 1.1 2.2 5.4

All other—net (2.0) 0.4 0.4

Effective tax rate for income

from continuing operations

before cumulative effect

of a change in accounting

principles 11.0% 15.3% 29.4%